Environmental Social Governance (ESG) accounting focuses on measuring a company's impact on environmental sustainability, social responsibility, and ethical governance practices, emphasizing non-financial metrics. Governmental accounting, in contrast, centers on managing and reporting public funds, ensuring transparency, accountability, and compliance with regulations in the public sector. Explore further to understand how these accounting approaches shape decision-making and reporting in different organizational contexts.

Why it is important

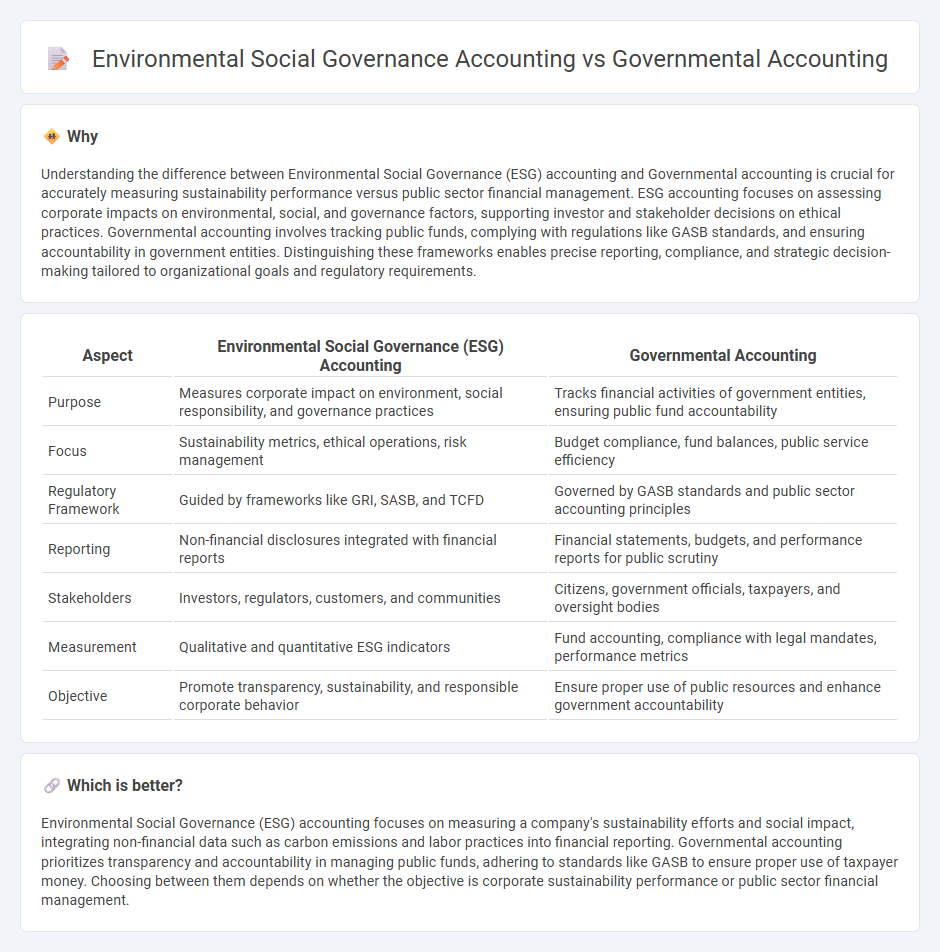

Understanding the difference between Environmental Social Governance (ESG) accounting and Governmental accounting is crucial for accurately measuring sustainability performance versus public sector financial management. ESG accounting focuses on assessing corporate impacts on environmental, social, and governance factors, supporting investor and stakeholder decisions on ethical practices. Governmental accounting involves tracking public funds, complying with regulations like GASB standards, and ensuring accountability in government entities. Distinguishing these frameworks enables precise reporting, compliance, and strategic decision-making tailored to organizational goals and regulatory requirements.

Comparison Table

| Aspect | Environmental Social Governance (ESG) Accounting | Governmental Accounting |

|---|---|---|

| Purpose | Measures corporate impact on environment, social responsibility, and governance practices | Tracks financial activities of government entities, ensuring public fund accountability |

| Focus | Sustainability metrics, ethical operations, risk management | Budget compliance, fund balances, public service efficiency |

| Regulatory Framework | Guided by frameworks like GRI, SASB, and TCFD | Governed by GASB standards and public sector accounting principles |

| Reporting | Non-financial disclosures integrated with financial reports | Financial statements, budgets, and performance reports for public scrutiny |

| Stakeholders | Investors, regulators, customers, and communities | Citizens, government officials, taxpayers, and oversight bodies |

| Measurement | Qualitative and quantitative ESG indicators | Fund accounting, compliance with legal mandates, performance metrics |

| Objective | Promote transparency, sustainability, and responsible corporate behavior | Ensure proper use of public resources and enhance government accountability |

Which is better?

Environmental Social Governance (ESG) accounting focuses on measuring a company's sustainability efforts and social impact, integrating non-financial data such as carbon emissions and labor practices into financial reporting. Governmental accounting prioritizes transparency and accountability in managing public funds, adhering to standards like GASB to ensure proper use of taxpayer money. Choosing between them depends on whether the objective is corporate sustainability performance or public sector financial management.

Connection

Environmental Social Governance (ESG) accounting integrates sustainability metrics into financial reporting, aligning with Governmental accounting's focus on transparency and regulatory compliance. Both frameworks emphasize accountability in resource allocation, with ESG accounting driving investment decisions that support environmental and social goals, while Governmental accounting ensures public funds are managed efficiently. The convergence of these practices fosters comprehensive reporting that addresses financial performance and societal impact within public and private sectors.

Key Terms

**Governmental accounting:**

Governmental accounting centers on managing public funds, ensuring compliance with regulations, and promoting transparency in financial reporting for government entities. It includes budgeting, fund accounting, and financial statement preparation to support public accountability. Explore more to understand how governmental accounting enhances fiscal responsibility and public trust.

Fund accounting

Governmental accounting prioritizes fund accounting to ensure transparency and accountability in public sector financial management, tracking resources according to specific purposes and legal restrictions. Environmental Social Governance (ESG) accounting, while not traditionally focused on fund accounting, integrates sustainability metrics and social impact data to assess corporate responsibility and long-term value creation. Discover how these accounting approaches intersect and diverge in addressing public accountability and sustainability goals.

Budgetary control

Governmental accounting emphasizes budgetary control by closely monitoring public funds to ensure compliance with legislative appropriations and fiscal responsibility. Environmental Social Governance (ESG) accounting integrates budgetary controls with sustainability metrics to align financial planning with environmental and social goals, promoting transparency and long-term value creation. Explore detailed comparisons to understand how these accounting practices shape fiscal accountability and sustainable decision-making.

Source and External Links

Governmental Accounting - Wikipedia - This webpage provides an overview of governmental accounting, discussing its unique focus on financial resource management and the use of fund accounting.

Governmental Accounting Standards Board: What is GASB? - This webpage explains the role of GASB in setting accounting standards for U.S. state and local governments, ensuring transparency and accountability in financial reporting.

What Is Government Accounting? - This webpage describes the duties of government accountants, focusing on accountability, transparency, tax compliance, and fraud detection within public financial management.

dowidth.com

dowidth.com