Neobank reconciliation focuses on aligning digital transaction records with bank statements to ensure accuracy within modern financial platforms, while trial balance reconciliation involves verifying that the sum of debits equals credits across all general ledger accounts. Both methods are essential in maintaining precise financial reporting and detecting discrepancies in accounting processes. Explore further to understand how each reconciliation approach enhances financial integrity in different banking environments.

Why it is important

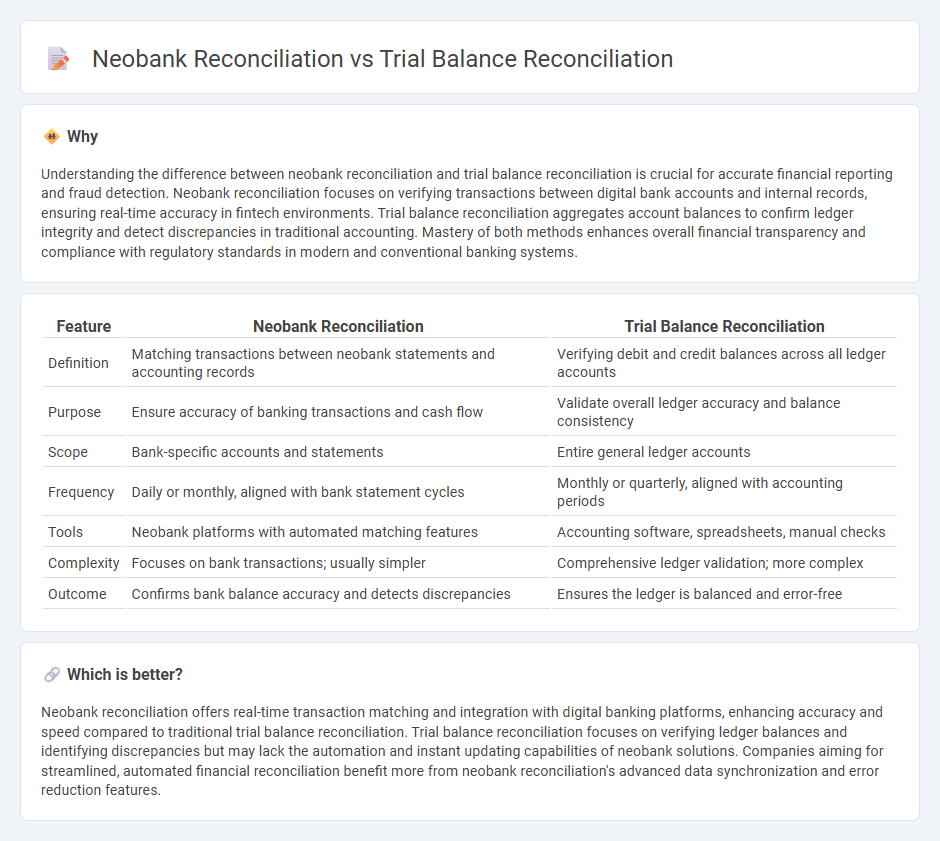

Understanding the difference between neobank reconciliation and trial balance reconciliation is crucial for accurate financial reporting and fraud detection. Neobank reconciliation focuses on verifying transactions between digital bank accounts and internal records, ensuring real-time accuracy in fintech environments. Trial balance reconciliation aggregates account balances to confirm ledger integrity and detect discrepancies in traditional accounting. Mastery of both methods enhances overall financial transparency and compliance with regulatory standards in modern and conventional banking systems.

Comparison Table

| Feature | Neobank Reconciliation | Trial Balance Reconciliation |

|---|---|---|

| Definition | Matching transactions between neobank statements and accounting records | Verifying debit and credit balances across all ledger accounts |

| Purpose | Ensure accuracy of banking transactions and cash flow | Validate overall ledger accuracy and balance consistency |

| Scope | Bank-specific accounts and statements | Entire general ledger accounts |

| Frequency | Daily or monthly, aligned with bank statement cycles | Monthly or quarterly, aligned with accounting periods |

| Tools | Neobank platforms with automated matching features | Accounting software, spreadsheets, manual checks |

| Complexity | Focuses on bank transactions; usually simpler | Comprehensive ledger validation; more complex |

| Outcome | Confirms bank balance accuracy and detects discrepancies | Ensures the ledger is balanced and error-free |

Which is better?

Neobank reconciliation offers real-time transaction matching and integration with digital banking platforms, enhancing accuracy and speed compared to traditional trial balance reconciliation. Trial balance reconciliation focuses on verifying ledger balances and identifying discrepancies but may lack the automation and instant updating capabilities of neobank solutions. Companies aiming for streamlined, automated financial reconciliation benefit more from neobank reconciliation's advanced data synchronization and error reduction features.

Connection

Neobank reconciliation involves matching digital transaction records with bank statements to ensure accuracy in financial data, directly impacting the trial balance reconciliation process. Trial balance reconciliation aggregates these verified transactions to confirm that total debits and credits are balanced, reflecting true financial health. Efficient neobank reconciliation reduces discrepancies, streamlining the preparation of an accurate trial balance in accounting systems.

Key Terms

**Trial Balance Reconciliation:**

Trial balance reconciliation involves verifying that the general ledger accounts accurately reflect all financial transactions to ensure the accounting books are balanced and error-free. It focuses on identifying discrepancies between the trial balance and subsidiary records, such as bank statements or invoices, to maintain financial accuracy and compliance. Explore more to understand the critical processes and tools used in trial balance reconciliation for improved financial management.

Ledger Balances

Trial balance reconciliation ensures accuracy of ledger balances by verifying that total debits equal total credits, highlighting discrepancies within accounting records. Neobank reconciliation involves comparing ledger balances with neobank transaction statements to identify mismatches caused by fees, delays, or unauthorized transactions. Explore more to understand the specific processes optimizing ledger balance accuracy in both contexts.

Debit-Credit Equality

Trial balance reconciliation ensures the accuracy of accounting records by verifying that total debits equal total credits across ledger accounts, a fundamental principle in double-entry bookkeeping. Neobank reconciliation involves matching digital transaction records with bank statements to detect discrepancies and maintain accurate cash flow tracking in a digital banking environment. Explore detailed methodologies and benefits of both reconciliations to optimize financial accuracy and reporting.

Source and External Links

Why Use Trial Balance Reconciliation? Auditor's Guide - This guide explains the importance of trial balance reconciliation in ensuring accurate financial reporting by matching debit and credit balances in a company's ledger.

A Detailed Guide on Trial Balance in Accounting - This article provides a step-by-step approach to analyzing a trial balance, including mathematical checks and account verification to identify discrepancies.

A Complete Guide to the Balance Sheet Reconciliation - This comprehensive guide covers the process of balance sheet reconciliation, highlighting key accounts, gathering documents, and comparing ledger entries with supporting documents.

dowidth.com

dowidth.com