Environmental Social Governance (ESG) accounting focuses on measuring and reporting a company's sustainability practices, social impact, and ethical governance, integrating non-financial metrics into traditional financial reports. ESG auditing systematically verifies the accuracy and reliability of these sustainability disclosures, ensuring compliance with regulatory standards and stakeholder expectations. Explore further to understand how ESG accounting and auditing drive transparency and long-term value creation.

Why it is important

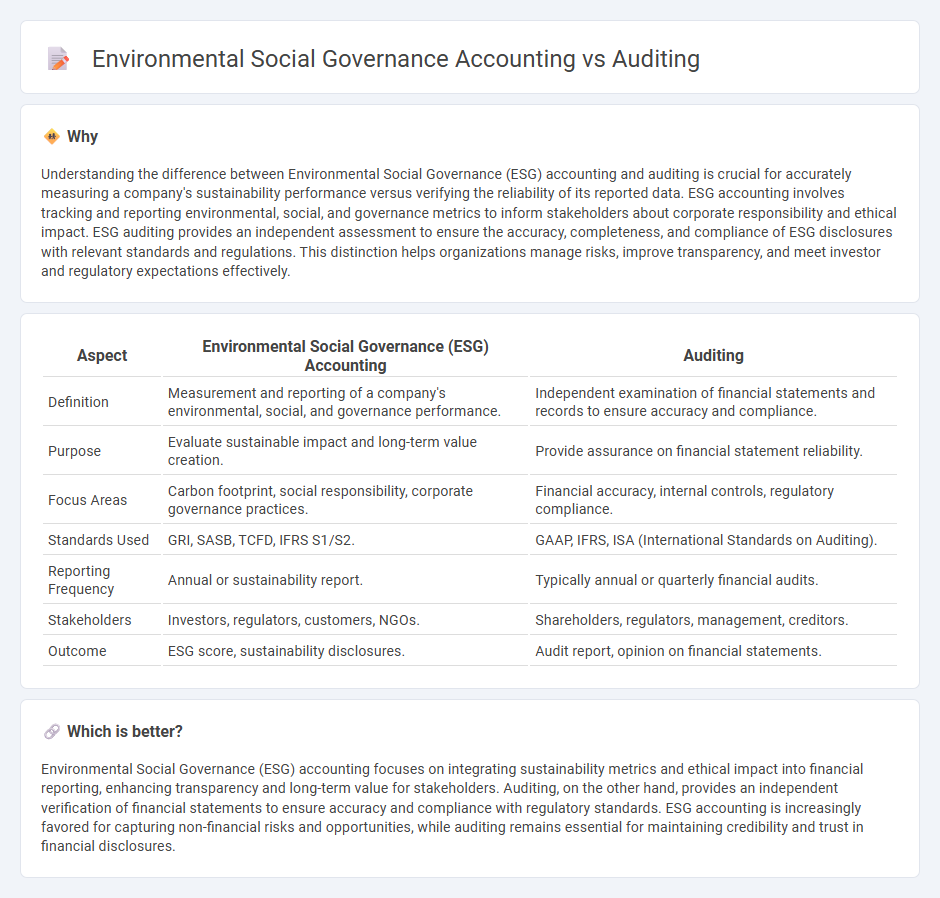

Understanding the difference between Environmental Social Governance (ESG) accounting and auditing is crucial for accurately measuring a company's sustainability performance versus verifying the reliability of its reported data. ESG accounting involves tracking and reporting environmental, social, and governance metrics to inform stakeholders about corporate responsibility and ethical impact. ESG auditing provides an independent assessment to ensure the accuracy, completeness, and compliance of ESG disclosures with relevant standards and regulations. This distinction helps organizations manage risks, improve transparency, and meet investor and regulatory expectations effectively.

Comparison Table

| Aspect | Environmental Social Governance (ESG) Accounting | Auditing |

|---|---|---|

| Definition | Measurement and reporting of a company's environmental, social, and governance performance. | Independent examination of financial statements and records to ensure accuracy and compliance. |

| Purpose | Evaluate sustainable impact and long-term value creation. | Provide assurance on financial statement reliability. |

| Focus Areas | Carbon footprint, social responsibility, corporate governance practices. | Financial accuracy, internal controls, regulatory compliance. |

| Standards Used | GRI, SASB, TCFD, IFRS S1/S2. | GAAP, IFRS, ISA (International Standards on Auditing). |

| Reporting Frequency | Annual or sustainability report. | Typically annual or quarterly financial audits. |

| Stakeholders | Investors, regulators, customers, NGOs. | Shareholders, regulators, management, creditors. |

| Outcome | ESG score, sustainability disclosures. | Audit report, opinion on financial statements. |

Which is better?

Environmental Social Governance (ESG) accounting focuses on integrating sustainability metrics and ethical impact into financial reporting, enhancing transparency and long-term value for stakeholders. Auditing, on the other hand, provides an independent verification of financial statements to ensure accuracy and compliance with regulatory standards. ESG accounting is increasingly favored for capturing non-financial risks and opportunities, while auditing remains essential for maintaining credibility and trust in financial disclosures.

Connection

Environmental, Social, and Governance (ESG) accounting integrates non-financial metrics related to sustainability and ethical practices into traditional financial reporting frameworks. ESG auditing rigorously evaluates the accuracy and reliability of ESG disclosures, ensuring compliance with regulatory standards and investor expectations. This connection enhances transparency, mitigates risks, and supports strategic decision-making aligned with corporate social responsibility and long-term value creation.

Key Terms

**Auditing:**

Auditing involves the systematic examination and verification of financial records to ensure accuracy, compliance, and transparency within an organization. It primarily focuses on financial data, internal controls, and regulatory adherence to detect fraud or errors. To explore how auditing enhances corporate accountability and risk management, learn more about its key methodologies and best practices.

Internal Control

Internal control in auditing ensures accuracy and reliability of financial reporting through systematic procedures and risk assessments. Environmental, Social, and Governance (ESG) accounting emphasizes internal controls that monitor sustainability metrics, compliance with regulatory frameworks, and ethical standards. Explore how integrating ESG considerations into internal control frameworks can enhance overall corporate governance effectiveness.

Materiality

Auditing focuses on verifying the accuracy of financial statements, ensuring that material misstatements due to error or fraud are identified and corrected, while Environmental Social Governance (ESG) accounting emphasizes measuring and reporting on sustainability metrics that impact long-term value. Materiality in auditing is primarily quantitative, centered on financial thresholds, whereas ESG materiality integrates qualitative factors related to environmental impact, social responsibility, and governance practices. Explore in-depth how materiality distinctions influence reporting standards and stakeholder decision-making in ESG and traditional auditing frameworks.

Source and External Links

What Is Auditing? Definition, Types & Importance - Auditing is the systematic examination and verification of a company's financial records by an independent party to ensure accuracy, compliance with accounting standards, internal control effectiveness, and fraud detection, thereby enhancing stakeholder confidence.

Auditing: Definition, Types, and Importance - Auditing is a review of financial records to confirm accuracy and compliance, helping generate stakeholder trust and ensuring regulatory compliance and financial transparency for both individuals and businesses.

Auditing - Overview, Importance, Types, and Accounting - Auditing refers to an objective examination and evaluation of a company's financial statements, often performed by external third parties, to ensure fair and accurate financial representation in line with accounting standards.

dowidth.com

dowidth.com