Neobank reconciliation involves matching digital transaction records with bank statements to ensure accuracy in cash flow and reduce discrepancies. Prepaid expenses reconciliation focuses on verifying the correct allocation and recognition of expenses over time to maintain accurate financial reporting. Explore detailed processes and best practices for both reconciliation methods to enhance your accounting accuracy.

Why it is important

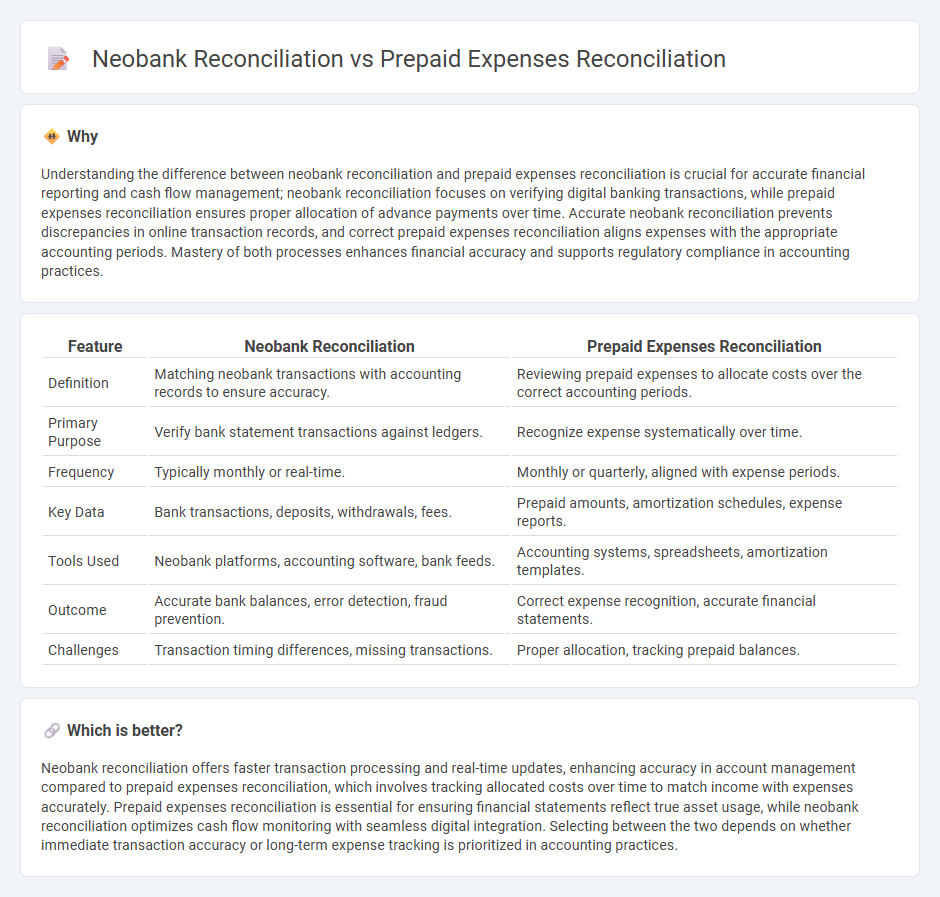

Understanding the difference between neobank reconciliation and prepaid expenses reconciliation is crucial for accurate financial reporting and cash flow management; neobank reconciliation focuses on verifying digital banking transactions, while prepaid expenses reconciliation ensures proper allocation of advance payments over time. Accurate neobank reconciliation prevents discrepancies in online transaction records, and correct prepaid expenses reconciliation aligns expenses with the appropriate accounting periods. Mastery of both processes enhances financial accuracy and supports regulatory compliance in accounting practices.

Comparison Table

| Feature | Neobank Reconciliation | Prepaid Expenses Reconciliation |

|---|---|---|

| Definition | Matching neobank transactions with accounting records to ensure accuracy. | Reviewing prepaid expenses to allocate costs over the correct accounting periods. |

| Primary Purpose | Verify bank statement transactions against ledgers. | Recognize expense systematically over time. |

| Frequency | Typically monthly or real-time. | Monthly or quarterly, aligned with expense periods. |

| Key Data | Bank transactions, deposits, withdrawals, fees. | Prepaid amounts, amortization schedules, expense reports. |

| Tools Used | Neobank platforms, accounting software, bank feeds. | Accounting systems, spreadsheets, amortization templates. |

| Outcome | Accurate bank balances, error detection, fraud prevention. | Correct expense recognition, accurate financial statements. |

| Challenges | Transaction timing differences, missing transactions. | Proper allocation, tracking prepaid balances. |

Which is better?

Neobank reconciliation offers faster transaction processing and real-time updates, enhancing accuracy in account management compared to prepaid expenses reconciliation, which involves tracking allocated costs over time to match income with expenses accurately. Prepaid expenses reconciliation is essential for ensuring financial statements reflect true asset usage, while neobank reconciliation optimizes cash flow monitoring with seamless digital integration. Selecting between the two depends on whether immediate transaction accuracy or long-term expense tracking is prioritized in accounting practices.

Connection

Neobank reconciliation and prepaid expenses reconciliation are interconnected through the need for accurate financial tracking and reporting in digital banking environments. Neobank reconciliation involves verifying transactions and balances in digital accounts, ensuring that records align with bank statements, while prepaid expenses reconciliation focuses on matching prepaid asset accounts with the corresponding expense recognition over time. Together, these processes enhance financial accuracy by preventing discrepancies and ensuring that digital banking transactions and prepaid costs are correctly recorded in accounting systems.

Key Terms

Accruals

Prepaid expenses reconciliation involves matching prepaid costs to their corresponding expense periods to ensure accurate accrual accounting, while neobank reconciliation centers on verifying digital transactions and balances for precise financial records. Accrual-focused reconciliation requires monitoring timing differences between cash flows and expense recognition in both processes, highlighting the importance of aligning expense recognition with incurred periods. Explore detailed methods and best practices to optimize accrual accuracy in prepaid and neobank reconciliations.

Transaction Matching

Prepaid expenses reconciliation involves matching advance payments recorded as assets with actual expense recognition over time, ensuring accurate expense allocation and financial reporting. Neobank reconciliation centers on transaction matching between bank statements and internal records, emphasizing real-time categorization and error detection for seamless cash flow management. Explore detailed methods to enhance transaction matching accuracy in both prepaid expenses and neobank reconciliations.

Cut-off Dates

Prepaid expenses reconciliation ensures accurate allocation of expenses within the correct accounting periods by matching payments to the cut-off dates of service delivery or benefits received. Neobank reconciliation involves verifying transactions against cut-off dates to capture all banking activities accurately, preventing discrepancies in account balances and financial reports. Explore more about how precise cut-off date management enhances both prepaid expenses and neobank reconciliations.

Source and External Links

What is Prepaid Reconciliation? - FinFloh - Prepaid reconciliation is the process of verifying, matching, and adjusting prepaid expenses in financial statements, involving identifying prepaid expenses, recording initial transactions, amortizing expenses over time, comparing ledger balances with documents, and adjusting discrepancies.

Prepaid Reconciliation | HighRadius(tm) | A/R Management Software - Prepaid reconciliation verifies and reconciles prepaid expenses recorded with actual expenses incurred, ensuring accurate financial statements by identifying and correcting discrepancies.

Prepaid expenses accounting - AccountingTools - It involves recording expenditures as assets when prepaid, amortizing over relevant periods through adjusting entries, and reconciling the prepaid expense account balance to the amortization schedule to maintain accuracy.

dowidth.com

dowidth.com