Digital asset taxation encompasses a broad range of intangible assets including digital tokens, NFTs, and cryptocurrencies, each subject to specific regulatory frameworks and tax treatments. Cryptocurrency taxation focuses specifically on the classification, reporting, and capital gains associated with transactions involving Bitcoin, Ethereum, and other virtual currencies. Explore the nuances between these tax categories to optimize compliance and financial strategy.

Why it is important

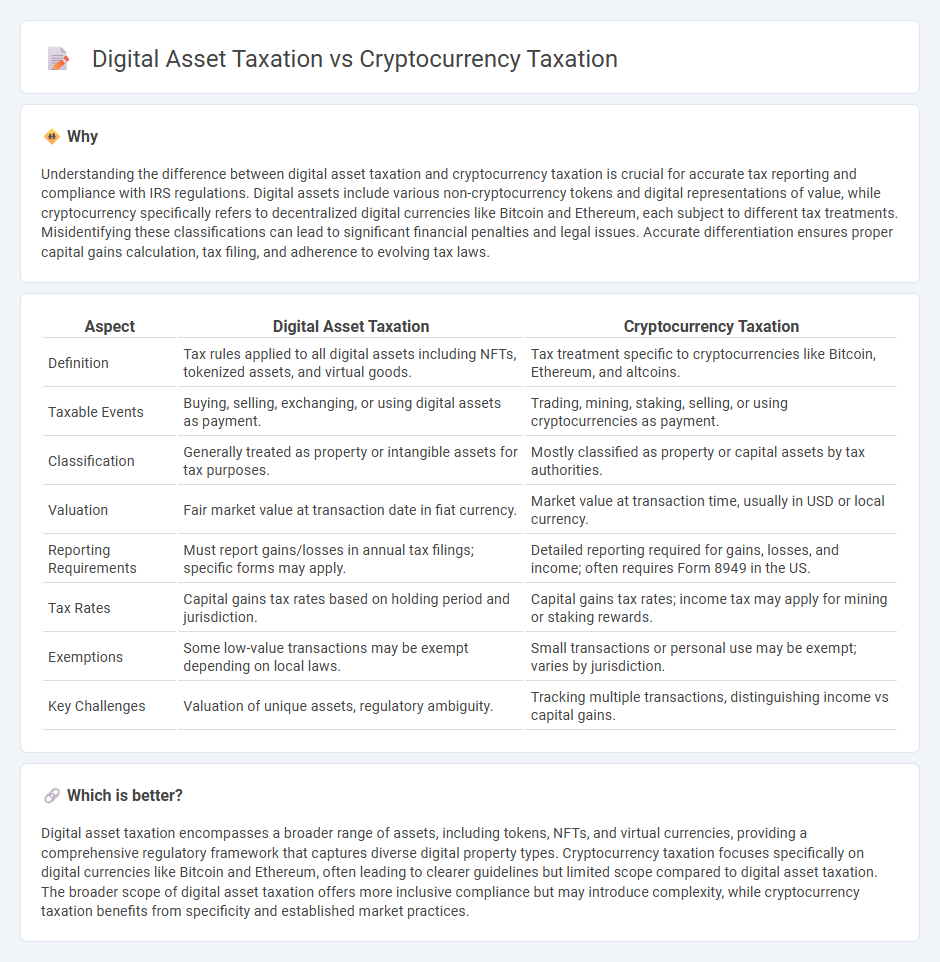

Understanding the difference between digital asset taxation and cryptocurrency taxation is crucial for accurate tax reporting and compliance with IRS regulations. Digital assets include various non-cryptocurrency tokens and digital representations of value, while cryptocurrency specifically refers to decentralized digital currencies like Bitcoin and Ethereum, each subject to different tax treatments. Misidentifying these classifications can lead to significant financial penalties and legal issues. Accurate differentiation ensures proper capital gains calculation, tax filing, and adherence to evolving tax laws.

Comparison Table

| Aspect | Digital Asset Taxation | Cryptocurrency Taxation |

|---|---|---|

| Definition | Tax rules applied to all digital assets including NFTs, tokenized assets, and virtual goods. | Tax treatment specific to cryptocurrencies like Bitcoin, Ethereum, and altcoins. |

| Taxable Events | Buying, selling, exchanging, or using digital assets as payment. | Trading, mining, staking, selling, or using cryptocurrencies as payment. |

| Classification | Generally treated as property or intangible assets for tax purposes. | Mostly classified as property or capital assets by tax authorities. |

| Valuation | Fair market value at transaction date in fiat currency. | Market value at transaction time, usually in USD or local currency. |

| Reporting Requirements | Must report gains/losses in annual tax filings; specific forms may apply. | Detailed reporting required for gains, losses, and income; often requires Form 8949 in the US. |

| Tax Rates | Capital gains tax rates based on holding period and jurisdiction. | Capital gains tax rates; income tax may apply for mining or staking rewards. |

| Exemptions | Some low-value transactions may be exempt depending on local laws. | Small transactions or personal use may be exempt; varies by jurisdiction. |

| Key Challenges | Valuation of unique assets, regulatory ambiguity. | Tracking multiple transactions, distinguishing income vs capital gains. |

Which is better?

Digital asset taxation encompasses a broader range of assets, including tokens, NFTs, and virtual currencies, providing a comprehensive regulatory framework that captures diverse digital property types. Cryptocurrency taxation focuses specifically on digital currencies like Bitcoin and Ethereum, often leading to clearer guidelines but limited scope compared to digital asset taxation. The broader scope of digital asset taxation offers more inclusive compliance but may introduce complexity, while cryptocurrency taxation benefits from specificity and established market practices.

Connection

Digital asset taxation and cryptocurrency taxation are interconnected frameworks addressing tax obligations on digital financial instruments, with cryptocurrencies being a primary type of digital asset. Both require precise reporting of gains, losses, and transactions to tax authorities, ensuring compliance with evolving tax regulations. The tax treatment hinges on classification criteria, valuation methods, and jurisdiction-specific laws applied to digital assets and cryptocurrencies.

Key Terms

Capital Gains

Cryptocurrency taxation primarily treats digital currencies as property, subject to capital gains tax when assets are sold or exchanged, often requiring precise record-keeping of purchase prices and transaction dates. Digital asset taxation, encompassing a broader range of assets like NFTs and tokenized securities, applies similar capital gains principles but varies based on asset classification and regulatory guidelines. Explore detailed comparisons to understand nuanced tax implications and reporting requirements for each asset type.

Fair Market Value

Cryptocurrency taxation often relies on the Fair Market Value (FMV) at the time of each transaction, treating digital coins as property for tax purposes, while digital asset taxation may encompass a broader range of assets, including NFTs and tokens, each with distinct valuation challenges. The FMV is crucial in calculating gains or losses, ensuring accurate tax reporting based on current market prices derived from exchanges or recognized marketplaces. Explore detailed guidelines and compliance strategies to optimize your tax responsibilities related to digital assets and cryptocurrencies.

Taxable Event

Cryptocurrency taxation primarily hinges on events such as selling, exchanging, or using crypto for purchases, which trigger taxable events recognized by tax authorities. Digital asset taxation extends beyond cryptocurrencies to include NFTs, tokens, and other blockchain-based assets, with taxable events often occurring upon transfers, sales, or converting assets back to fiat currency. Explore the detailed tax implications and reporting requirements for both to optimize compliance and financial outcomes.

Source and External Links

Crypto Taxes: How They Work, 2025 Rates and Rules - Cryptocurrency is taxed as property, with short-term gains (held one year or less) taxed at ordinary income rates (10-37%) and long-term gains (held over one year) taxed at lower capital gains rates (0-20%), depending on your taxable income.

Your Crypto Tax Guide - TurboTax - The IRS treats cryptocurrency like property, requiring gains and losses to be reported on Schedule D and Form 8949, with tax rates determined by holding period (short-term or long-term) and your regular income tax bracket.

Cryptocurrency | Department of Revenue - Taxation - Colorado allows taxpayers to pay state taxes using cryptocurrency through PayPal's Cryptocurrencies Hub, converting crypto to USD with a service fee of $1 plus 1.83% of the payment, though refunds are not issued in crypto.

dowidth.com

dowidth.com