Tax technology streamlines compliance, automates tax calculations, and ensures accurate filing, reducing errors and saving time for finance teams. Accounts payable automation focuses on optimizing invoice processing, approval workflows, and payment execution to increase efficiency and control cash flow. Discover how these innovations transform financial operations and enhance business performance.

Why it is important

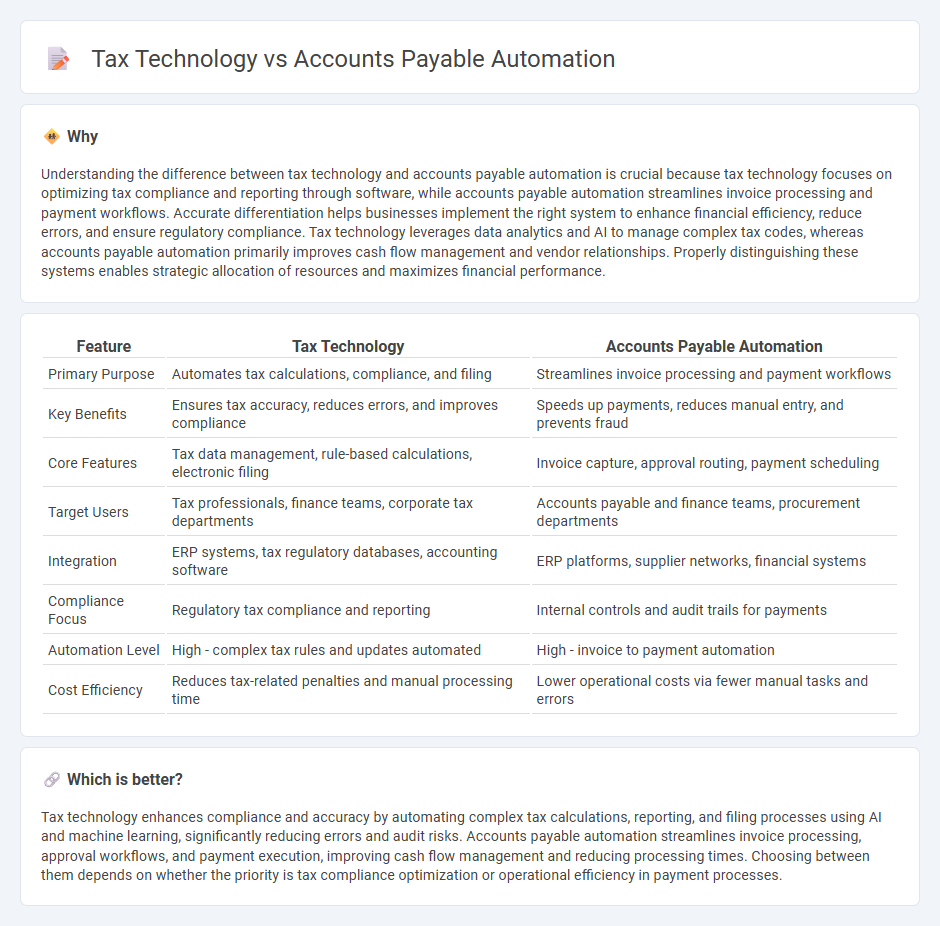

Understanding the difference between tax technology and accounts payable automation is crucial because tax technology focuses on optimizing tax compliance and reporting through software, while accounts payable automation streamlines invoice processing and payment workflows. Accurate differentiation helps businesses implement the right system to enhance financial efficiency, reduce errors, and ensure regulatory compliance. Tax technology leverages data analytics and AI to manage complex tax codes, whereas accounts payable automation primarily improves cash flow management and vendor relationships. Properly distinguishing these systems enables strategic allocation of resources and maximizes financial performance.

Comparison Table

| Feature | Tax Technology | Accounts Payable Automation |

|---|---|---|

| Primary Purpose | Automates tax calculations, compliance, and filing | Streamlines invoice processing and payment workflows |

| Key Benefits | Ensures tax accuracy, reduces errors, and improves compliance | Speeds up payments, reduces manual entry, and prevents fraud |

| Core Features | Tax data management, rule-based calculations, electronic filing | Invoice capture, approval routing, payment scheduling |

| Target Users | Tax professionals, finance teams, corporate tax departments | Accounts payable and finance teams, procurement departments |

| Integration | ERP systems, tax regulatory databases, accounting software | ERP platforms, supplier networks, financial systems |

| Compliance Focus | Regulatory tax compliance and reporting | Internal controls and audit trails for payments |

| Automation Level | High - complex tax rules and updates automated | High - invoice to payment automation |

| Cost Efficiency | Reduces tax-related penalties and manual processing time | Lower operational costs via fewer manual tasks and errors |

Which is better?

Tax technology enhances compliance and accuracy by automating complex tax calculations, reporting, and filing processes using AI and machine learning, significantly reducing errors and audit risks. Accounts payable automation streamlines invoice processing, approval workflows, and payment execution, improving cash flow management and reducing processing times. Choosing between them depends on whether the priority is tax compliance optimization or operational efficiency in payment processes.

Connection

Tax technology integrates advanced software solutions to enhance accuracy and compliance in financial reporting, directly influencing accounts payable automation processes by streamlining invoice processing, tax calculations, and regulatory adherence. Automated accounts payable systems leverage tax technology for real-time tax rate updates and automated tax filing, reducing manual errors and improving efficiency in financial operations. The synergy between tax technology and accounts payable automation drives faster transaction processing, better audit trails, and optimized cash flow management in corporate finance.

Key Terms

Invoice Processing

Accounts payable automation streamlines invoice processing by using AI and OCR technologies to capture, validate, and approve invoices quickly, reducing manual errors and accelerating payment cycles. Tax technology enhances compliance by integrating tax calculations and reporting within the invoice workflow, ensuring accurate tax data capture and real-time regulatory adherence. Discover how combining accounts payable automation with tax technology can optimize your invoice processing and tax compliance.

Compliance

Accounts payable automation enhances compliance by streamlining invoice processing, reducing errors, and ensuring timely payments that meet regulatory standards. Tax technology focuses on maintaining compliance through accurate tax calculations, real-time reporting, and integration with tax authorities to minimize audit risks. Explore how integrating both solutions can optimize your organization's compliance strategy and operational efficiency.

Workflow Integration

Accounts payable automation streamlines invoice processing by integrating with ERP systems to reduce manual data entry and accelerate payment cycles, while tax technology enhances compliance through real-time tax calculations and reporting within financial workflows. Workflow integration in accounts payable focuses on optimizing invoice approvals and payment accuracy, whereas tax technology emphasizes seamless tax data extraction and regulatory updates within existing processes. Explore how advanced workflow integration can bridge accounts payable automation and tax technology for comprehensive financial management solutions.

Source and External Links

What Is AP Automation and How Does it Work? - AP automation technology automates routine tasks such as receiving invoices, coding, routing for approval, payment, and reconciliation, improving efficiency and accuracy.

AP Automation: Benefits to the Accounts Payable Process - AP automation boosts cost-effectiveness, improves payment accuracy, enhances visibility and control, and improves compliance and security in accounts payable management.

What is AP Automation? - AP automation digitizes accounts payable processes, allowing businesses to receive invoices, manage approvals, and process payments automatically via a single platform.

dowidth.com

dowidth.com