Fractional CFOs provide ongoing strategic financial leadership tailored for growing companies needing consistent expertise without full-time commitment. Project-based CFOs focus on specific financial initiatives like fundraising, restructuring, or system implementation, offering targeted solutions for short-term needs. Explore the distinctions between these CFO roles to determine the best financial strategy for your business.

Why it is important

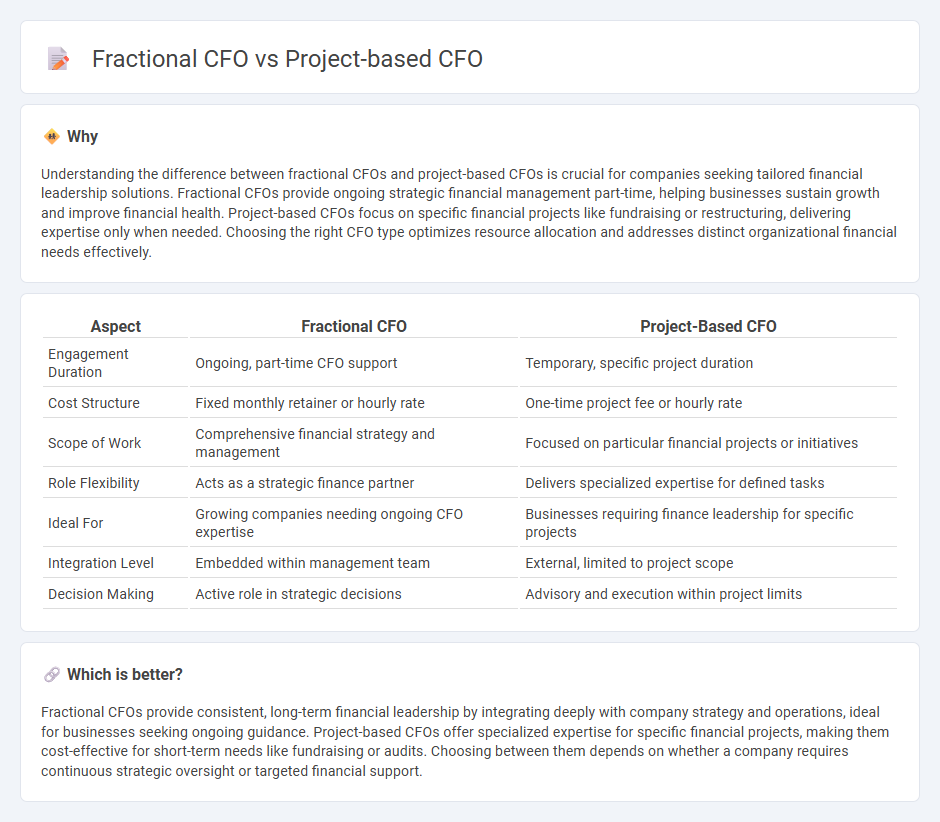

Understanding the difference between fractional CFOs and project-based CFOs is crucial for companies seeking tailored financial leadership solutions. Fractional CFOs provide ongoing strategic financial management part-time, helping businesses sustain growth and improve financial health. Project-based CFOs focus on specific financial projects like fundraising or restructuring, delivering expertise only when needed. Choosing the right CFO type optimizes resource allocation and addresses distinct organizational financial needs effectively.

Comparison Table

| Aspect | Fractional CFO | Project-Based CFO |

|---|---|---|

| Engagement Duration | Ongoing, part-time CFO support | Temporary, specific project duration |

| Cost Structure | Fixed monthly retainer or hourly rate | One-time project fee or hourly rate |

| Scope of Work | Comprehensive financial strategy and management | Focused on particular financial projects or initiatives |

| Role Flexibility | Acts as a strategic finance partner | Delivers specialized expertise for defined tasks |

| Ideal For | Growing companies needing ongoing CFO expertise | Businesses requiring finance leadership for specific projects |

| Integration Level | Embedded within management team | External, limited to project scope |

| Decision Making | Active role in strategic decisions | Advisory and execution within project limits |

Which is better?

Fractional CFOs provide consistent, long-term financial leadership by integrating deeply with company strategy and operations, ideal for businesses seeking ongoing guidance. Project-based CFOs offer specialized expertise for specific financial projects, making them cost-effective for short-term needs like fundraising or audits. Choosing between them depends on whether a company requires continuous strategic oversight or targeted financial support.

Connection

Fractional CFOs provide part-time executive financial leadership tailored to the strategic needs of growing businesses, while project-based CFOs focus on specific financial initiatives or challenges within a defined timeframe. Both roles offer flexible, cost-effective solutions by delivering expert financial guidance without the commitment of a full-time position, optimizing resource allocation for companies. Their connection lies in addressing distinct financial management demands through scalable and specialized expertise, enhancing overall corporate financial health.

Key Terms

Scope of Engagement

A project-based CFO typically engages with a company for a defined initiative such as financial system implementation, capital raising, or M&A, offering specialized expertise limited to the project's duration. In contrast, a fractional CFO provides ongoing, part-time financial leadership, managing diverse responsibilities including cash flow management, strategic planning, and financial reporting over an extended period. Explore further to understand which CFO model best aligns with your business goals and financial needs.

Time Commitment

Project-based CFOs engage with companies for specific, finite projects, offering targeted financial leadership during critical periods, often lasting a few months. Fractional CFOs provide ongoing, part-time executive financial management, dedicating consistent hours monthly to support business growth and strategic planning. Explore deeper insights into how time commitment shapes financial leadership effectiveness by learning more.

Cost Structure

Project-based CFO services offer targeted financial leadership during specific initiatives, often resulting in variable costs aligned with project scope and duration. Fractional CFOs provide ongoing strategic financial management at a fraction of the cost of a full-time CFO, delivering predictable monthly expenses and enhanced budgeting control. Explore detailed cost comparisons and benefits to determine the best financial leadership model for your business needs.

Source and External Links

Virtual CFO Services - Offers project-based CFO services for small businesses evaluating financial decisions, such as hiring new employees or launching new initiatives.

Project-Based, Part Time CFO Services - Provides project-based CFO services to address unique financial challenges, including financial strategy and cost control for small to medium-sized companies.

The Ultimate Guide To Fractional CFO Services - Explains how a fractional CFO delivers part-time or project-based financial management services, including forecasting and cash flow management.

dowidth.com

dowidth.com