Tax technology integrates advanced software and AI to streamline tax filings, enhance accuracy, and ensure compliance with evolving regulations. Financial reporting automation focuses on generating precise financial statements through automated data collection and analysis, reducing manual errors and saving time. Explore how these innovations redefine accounting efficiency and accuracy.

Why it is important

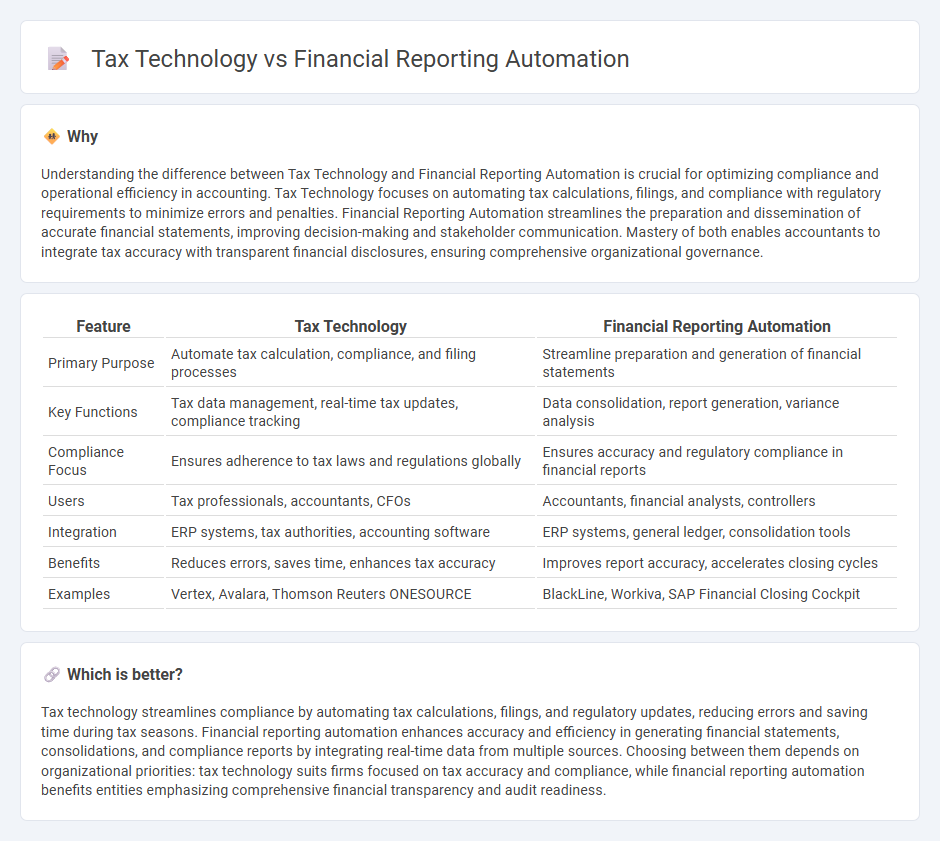

Understanding the difference between Tax Technology and Financial Reporting Automation is crucial for optimizing compliance and operational efficiency in accounting. Tax Technology focuses on automating tax calculations, filings, and compliance with regulatory requirements to minimize errors and penalties. Financial Reporting Automation streamlines the preparation and dissemination of accurate financial statements, improving decision-making and stakeholder communication. Mastery of both enables accountants to integrate tax accuracy with transparent financial disclosures, ensuring comprehensive organizational governance.

Comparison Table

| Feature | Tax Technology | Financial Reporting Automation |

|---|---|---|

| Primary Purpose | Automate tax calculation, compliance, and filing processes | Streamline preparation and generation of financial statements |

| Key Functions | Tax data management, real-time tax updates, compliance tracking | Data consolidation, report generation, variance analysis |

| Compliance Focus | Ensures adherence to tax laws and regulations globally | Ensures accuracy and regulatory compliance in financial reports |

| Users | Tax professionals, accountants, CFOs | Accountants, financial analysts, controllers |

| Integration | ERP systems, tax authorities, accounting software | ERP systems, general ledger, consolidation tools |

| Benefits | Reduces errors, saves time, enhances tax accuracy | Improves report accuracy, accelerates closing cycles |

| Examples | Vertex, Avalara, Thomson Reuters ONESOURCE | BlackLine, Workiva, SAP Financial Closing Cockpit |

Which is better?

Tax technology streamlines compliance by automating tax calculations, filings, and regulatory updates, reducing errors and saving time during tax seasons. Financial reporting automation enhances accuracy and efficiency in generating financial statements, consolidations, and compliance reports by integrating real-time data from multiple sources. Choosing between them depends on organizational priorities: tax technology suits firms focused on tax accuracy and compliance, while financial reporting automation benefits entities emphasizing comprehensive financial transparency and audit readiness.

Connection

Tax technology and financial reporting automation are interconnected through their ability to streamline data collection, enhance accuracy, and ensure compliance with regulatory standards. Automated financial reporting tools integrate tax data seamlessly, reducing manual errors and accelerating the tax filing process. This synergy improves decision-making by providing real-time insights into tax liabilities and financial performance.

Key Terms

**Financial reporting automation:**

Financial reporting automation streamlines the preparation, consolidation, and analysis of financial statements by leveraging AI-driven tools and cloud-based platforms, enhancing accuracy and reducing manual errors. It enables real-time data integration from multiple sources, improving compliance with regulatory standards such as GAAP and IFRS. Explore more about how financial reporting automation transforms accounting efficiency and decision-making.

Consolidation

Financial reporting automation streamlines data aggregation, reconciliation, and consolidation processes to produce accurate and timely financial statements, leveraging AI and cloud-based platforms for enhanced efficiency. Tax technology focuses on integrating tax compliance and planning within consolidation workflows, utilizing specialized software to ensure regulatory adherence and optimize tax outcomes across jurisdictions. Explore how advancements in consolidation tools are revolutionizing financial transparency and tax accuracy in corporate environments.

Data Integration

Financial reporting automation streamlines the aggregation and standardization of financial data across multiple systems to ensure accuracy and compliance. Tax technology emphasizes seamless data integration to facilitate real-time tax calculations and regulatory reporting, enhancing precision and reducing manual errors. Explore how advanced data integration solutions transform both financial reporting and tax technology workflows for improved efficiency.

Source and External Links

Automated Financial Reporting: Benefits & Best Practices - This article highlights how financial reporting automation can save time and money by automating tasks like revenue tracking and compliance reports, enhancing accuracy and compliance adherence.

Benefits of Financial Reporting Automation (+Best Practices) - Discusses the benefits of financial reporting automation, including quick approvals, higher efficiency, reduced errors, more transparency, and fraud prevention.

4 Benefits of Financial Reporting Automation - Outlines how automated financial reporting empowers finance teams to focus on strategic work by addressing challenges from outdated processes and technology.

dowidth.com

dowidth.com