Embedded finance reporting integrates financial data directly within operational platforms, enhancing real-time transparency and decision-making efficiency. Internal audit reports systematically evaluate an organization's internal controls and compliance, identifying risks and ensuring accuracy in financial statements. Explore how these distinct reporting methods improve corporate accountability and financial management.

Why it is important

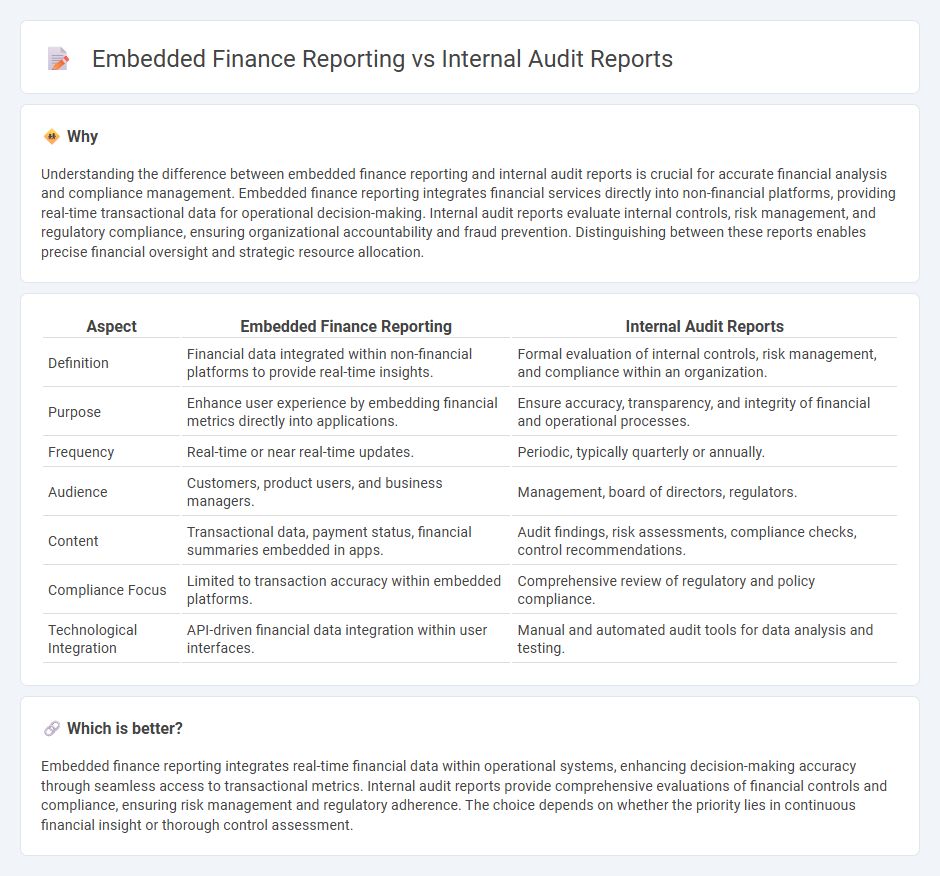

Understanding the difference between embedded finance reporting and internal audit reports is crucial for accurate financial analysis and compliance management. Embedded finance reporting integrates financial services directly into non-financial platforms, providing real-time transactional data for operational decision-making. Internal audit reports evaluate internal controls, risk management, and regulatory compliance, ensuring organizational accountability and fraud prevention. Distinguishing between these reports enables precise financial oversight and strategic resource allocation.

Comparison Table

| Aspect | Embedded Finance Reporting | Internal Audit Reports |

|---|---|---|

| Definition | Financial data integrated within non-financial platforms to provide real-time insights. | Formal evaluation of internal controls, risk management, and compliance within an organization. |

| Purpose | Enhance user experience by embedding financial metrics directly into applications. | Ensure accuracy, transparency, and integrity of financial and operational processes. |

| Frequency | Real-time or near real-time updates. | Periodic, typically quarterly or annually. |

| Audience | Customers, product users, and business managers. | Management, board of directors, regulators. |

| Content | Transactional data, payment status, financial summaries embedded in apps. | Audit findings, risk assessments, compliance checks, control recommendations. |

| Compliance Focus | Limited to transaction accuracy within embedded platforms. | Comprehensive review of regulatory and policy compliance. |

| Technological Integration | API-driven financial data integration within user interfaces. | Manual and automated audit tools for data analysis and testing. |

Which is better?

Embedded finance reporting integrates real-time financial data within operational systems, enhancing decision-making accuracy through seamless access to transactional metrics. Internal audit reports provide comprehensive evaluations of financial controls and compliance, ensuring risk management and regulatory adherence. The choice depends on whether the priority lies in continuous financial insight or thorough control assessment.

Connection

Embedded finance reporting integrates financial services directly within business operations, enhancing real-time transaction tracking and financial transparency. Internal audit reports utilize this integrated data to assess risk management, compliance, and operational efficiency more accurately. Together, they streamline financial oversight by providing comprehensive, data-driven insights that improve decision-making and internal controls.

Key Terms

Compliance

Internal audit reports primarily assess organizational compliance with regulatory standards and internal controls, ensuring risks are mitigated effectively. Embedded finance reporting centers on real-time transaction data, monitoring compliance with financial regulations and third-party partnerships in integrated fintech environments. Explore detailed comparisons to optimize compliance strategies across these auditing frameworks.

Risk assessment

Internal audit reports provide a comprehensive evaluation of an organization's risk management, internal controls, and governance processes to ensure compliance and operational efficiency. Embedded finance reporting emphasizes real-time risk assessment within financial services integrated into non-financial platforms, focusing on transaction security, fraud detection, and regulatory adherence. Discover how these distinct reporting frameworks optimize risk assessment in their respective domains.

Transaction transparency

Internal audit reports emphasize transaction transparency by systematically reviewing financial records to detect discrepancies, fraud, or compliance issues. Embedded finance reporting integrates financial services within non-financial platforms, providing real-time transaction data that enhances visibility and operational efficiency. Explore further to understand how these reporting methods impact financial accuracy and trust.

Source and External Links

Compiling a Useful Audit Report: Best Practices - This article outlines the essential components of an audit report, including scope, objectives, findings, and recommendations, based on IIA auditing standards.

Audit Report Writing Toolkit - This toolkit provides guidance on typical contents of an audit report, including executive summaries, objectives, scope, and conclusions.

Audit Reports: The Definitive Guide to Compliance - This guide covers the preparation of internal audit reports, emphasizing the importance of executive summaries, audit plans, findings, and actionable recommendations.

dowidth.com

dowidth.com