Fair value measurement reflects the price at which an asset could be exchanged between knowledgeable, willing parties in an orderly transaction, focusing on current market conditions and assumptions. Market value represents the actual price at which an asset is bought or sold in the marketplace, influenced by supply and demand dynamics at a specific point in time. Explore further to understand how these valuations impact financial reporting and decision-making.

Why it is important

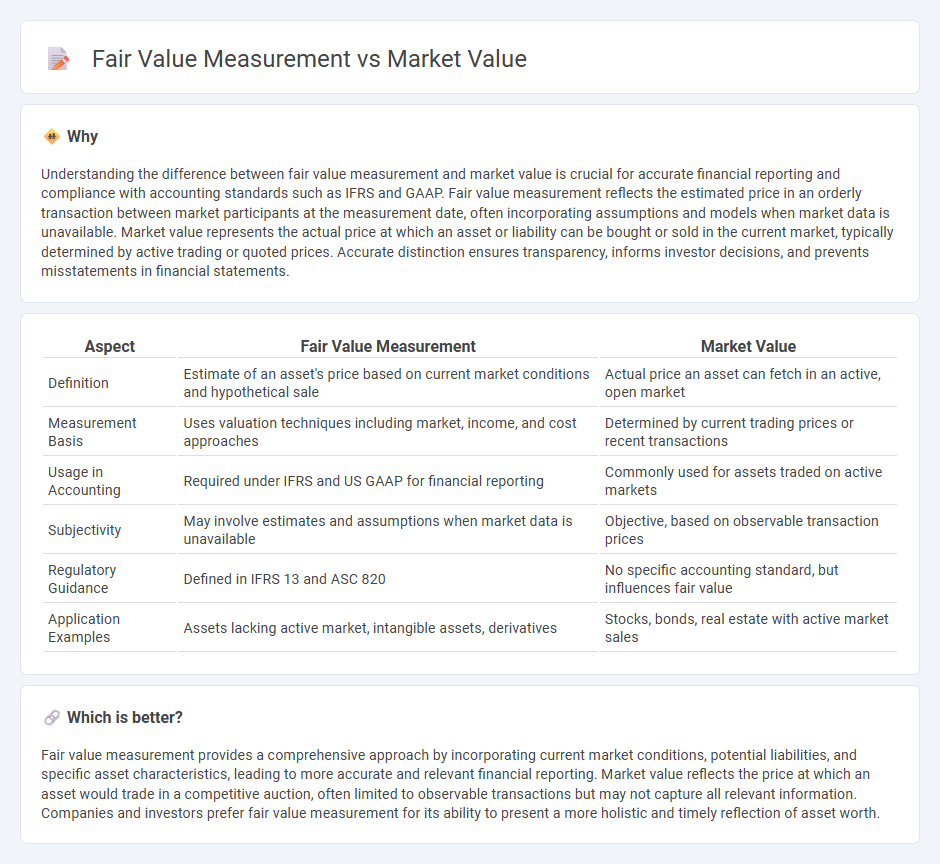

Understanding the difference between fair value measurement and market value is crucial for accurate financial reporting and compliance with accounting standards such as IFRS and GAAP. Fair value measurement reflects the estimated price in an orderly transaction between market participants at the measurement date, often incorporating assumptions and models when market data is unavailable. Market value represents the actual price at which an asset or liability can be bought or sold in the current market, typically determined by active trading or quoted prices. Accurate distinction ensures transparency, informs investor decisions, and prevents misstatements in financial statements.

Comparison Table

| Aspect | Fair Value Measurement | Market Value |

|---|---|---|

| Definition | Estimate of an asset's price based on current market conditions and hypothetical sale | Actual price an asset can fetch in an active, open market |

| Measurement Basis | Uses valuation techniques including market, income, and cost approaches | Determined by current trading prices or recent transactions |

| Usage in Accounting | Required under IFRS and US GAAP for financial reporting | Commonly used for assets traded on active markets |

| Subjectivity | May involve estimates and assumptions when market data is unavailable | Objective, based on observable transaction prices |

| Regulatory Guidance | Defined in IFRS 13 and ASC 820 | No specific accounting standard, but influences fair value |

| Application Examples | Assets lacking active market, intangible assets, derivatives | Stocks, bonds, real estate with active market sales |

Which is better?

Fair value measurement provides a comprehensive approach by incorporating current market conditions, potential liabilities, and specific asset characteristics, leading to more accurate and relevant financial reporting. Market value reflects the price at which an asset would trade in a competitive auction, often limited to observable transactions but may not capture all relevant information. Companies and investors prefer fair value measurement for its ability to present a more holistic and timely reflection of asset worth.

Connection

Fair value measurement determines the price at which an asset or liability could be exchanged in an orderly transaction between market participants at the measurement date. Market value serves as the primary basis for fair value, reflecting the most accurate current price in an active and liquid market. Accurate fair value measurement relies on observable market data to ensure transparency and comparability in financial reporting.

Key Terms

Observable Inputs

Market value measurement relies primarily on observable inputs such as quoted prices in active markets, providing a direct reflection of current market conditions. Fair value measurement incorporates observable inputs but also considers unobservable inputs when active market data is not available, adhering to a hierarchy that prioritizes transparency and relevance. Explore detailed frameworks and applications of observable inputs in valuation methodologies to enhance financial decision-making.

Active Market

Active markets provide reliable data for market value measurement by offering observable prices of identical assets or liabilities traded regularly. Fair value measurement incorporates factors such as market participant assumptions and current market conditions, even in the absence of an active market. Explore in-depth comparisons and methodologies to understand the nuances between market and fair value assessments.

Exit Price

Market value represents the amount at which an asset can be bought or sold in an active market under current conditions, while fair value measurement emphasizes the exit price concept, reflecting the price to sell an asset or transfer a liability in an orderly transaction between market participants. Fair value incorporates factors such as market participant assumptions, market conditions, and transaction costs, providing a more comprehensive and relevant valuation compared to a simple market value. Discover how fair value measurement enhances financial transparency and decision-making by exploring its principles further.

Source and External Links

Market Value - Overview, How To Express, How To Calculate - Market value describes how much an asset or company is worth in a financial market and can be calculated using methods like discounted cash flow, capitalized earnings, asset approach, or comparables among public companies.

Market Value: Definition, Examples and Calculation - SmartAsset - Market value is the price an asset or company would trade for in an open and competitive market, determined by supply and demand, economic conditions, and investor perceptions.

market value | Wex | US Law | LII / Legal Information Institute - Market value is an objective fair price attainable for a good through an arm's-length transaction in the marketplace, often used in property law to determine just compensation.

dowidth.com

dowidth.com