Real-time expense recognition records expenses as they occur, providing an accurate financial position by matching costs with revenues immediately. Prepaid expenses, on the other hand, involve payments made in advance that are allocated over time to reflect the expense in the appropriate accounting periods. Explore more to understand how these methods impact financial reporting and business decision-making.

Why it is important

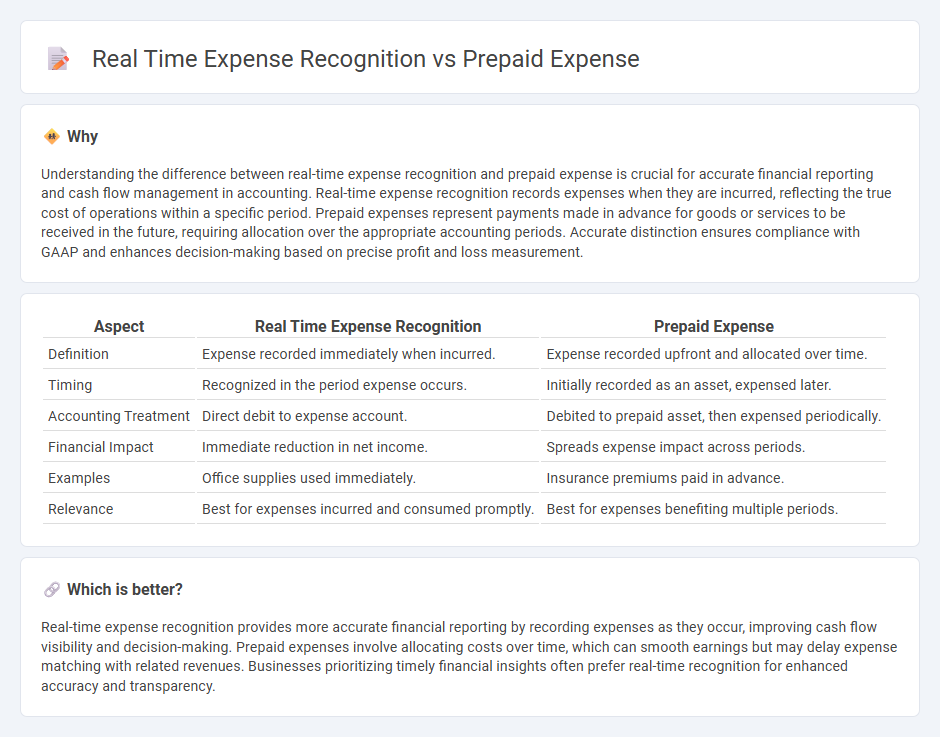

Understanding the difference between real-time expense recognition and prepaid expense is crucial for accurate financial reporting and cash flow management in accounting. Real-time expense recognition records expenses when they are incurred, reflecting the true cost of operations within a specific period. Prepaid expenses represent payments made in advance for goods or services to be received in the future, requiring allocation over the appropriate accounting periods. Accurate distinction ensures compliance with GAAP and enhances decision-making based on precise profit and loss measurement.

Comparison Table

| Aspect | Real Time Expense Recognition | Prepaid Expense |

|---|---|---|

| Definition | Expense recorded immediately when incurred. | Expense recorded upfront and allocated over time. |

| Timing | Recognized in the period expense occurs. | Initially recorded as an asset, expensed later. |

| Accounting Treatment | Direct debit to expense account. | Debited to prepaid asset, then expensed periodically. |

| Financial Impact | Immediate reduction in net income. | Spreads expense impact across periods. |

| Examples | Office supplies used immediately. | Insurance premiums paid in advance. |

| Relevance | Best for expenses incurred and consumed promptly. | Best for expenses benefiting multiple periods. |

Which is better?

Real-time expense recognition provides more accurate financial reporting by recording expenses as they occur, improving cash flow visibility and decision-making. Prepaid expenses involve allocating costs over time, which can smooth earnings but may delay expense matching with related revenues. Businesses prioritizing timely financial insights often prefer real-time recognition for enhanced accuracy and transparency.

Connection

Real-time expense recognition ensures that expenses are recorded immediately when incurred, enhancing financial accuracy and timeliness. Prepaid expenses involve payments made in advance for goods or services, which are initially recorded as assets and then expensed over the relevant period using real-time recognition. This connection enables businesses to match expenses with revenue accurately, maintaining compliance with the matching principle in accounting.

Key Terms

Accrual Basis

Prepaid expenses represent payments made in advance for goods or services to be received in the future, recognized as assets initially and expensed over time under accrual accounting. Real-time expense recognition records expenses as they are incurred, matching costs with revenues within the same accounting period to provide accurate financial reporting. Explore more about accrual basis principles to optimize your expense tracking and financial clarity.

Matching Principle

Prepaid expenses are recorded as assets and recognized gradually as expenses over the matching period, ensuring costs align with the related revenue. Real-time expense recognition reflects costs instantly when incurred, which may not always conform to the matching principle that aims to match expenses with revenues in the same accounting period. Explore more to understand how different expense recognition methods impact financial statements and compliance with accounting standards.

Asset Recognition

Prepaid expenses are recorded as assets on the balance sheet because they represent payments made for goods or services to be received in the future, reflecting future economic benefits. Real-time expense recognition requires expenses to be recorded immediately as incurred, impacting current period profit and loss without creating an asset. Explore the nuances of asset recognition in different expense recognition methods to optimize financial reporting.

Source and External Links

What are Prepaid Expenses? | F&A Glossary - BlackLine - A prepaid expense is an expense paid in advance for goods or services to be received in the future, recorded as a current asset that is gradually expensed over the periods benefited, like prepaid rent or insurance.

Prepaid Expenses: Definition, Examples & How to Record - Rippling - Prepaid expenses are payments made upfront for future goods or services and are initially recorded as assets, then systematically recognized as expenses over time as the benefits are realized.

Everything You Need to Know About Prepaid Expenses - Kolleno - Prepaid expenses refer to payments made in advance for assets or services to be used within a year, recognized as current assets in the balance sheet and expensed gradually according to GAAP when incurred.

dowidth.com

dowidth.com