Forensic accounting focuses on investigating financial fraud and disputes by analyzing complex financial data to uncover illegal activities, while auditing primarily aims to evaluate the accuracy and compliance of financial statements according to regulatory standards. Forensic analysis involves in-depth examination suitable for legal proceedings, including detecting embezzlement and financial misconduct, whereas audits serve to assure stakeholders of an entity's financial integrity and operational efficiency. Discover the key distinctions and applications of forensic accounting and auditing techniques to enhance your financial oversight skills.

Why it is important

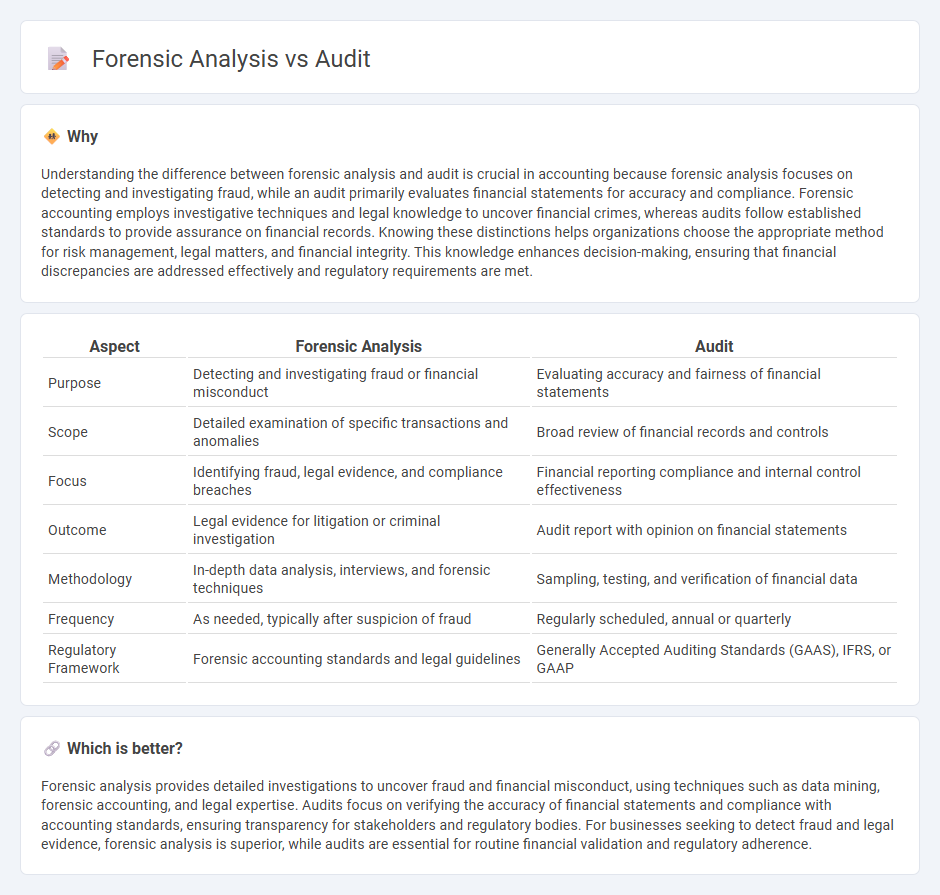

Understanding the difference between forensic analysis and audit is crucial in accounting because forensic analysis focuses on detecting and investigating fraud, while an audit primarily evaluates financial statements for accuracy and compliance. Forensic accounting employs investigative techniques and legal knowledge to uncover financial crimes, whereas audits follow established standards to provide assurance on financial records. Knowing these distinctions helps organizations choose the appropriate method for risk management, legal matters, and financial integrity. This knowledge enhances decision-making, ensuring that financial discrepancies are addressed effectively and regulatory requirements are met.

Comparison Table

| Aspect | Forensic Analysis | Audit |

|---|---|---|

| Purpose | Detecting and investigating fraud or financial misconduct | Evaluating accuracy and fairness of financial statements |

| Scope | Detailed examination of specific transactions and anomalies | Broad review of financial records and controls |

| Focus | Identifying fraud, legal evidence, and compliance breaches | Financial reporting compliance and internal control effectiveness |

| Outcome | Legal evidence for litigation or criminal investigation | Audit report with opinion on financial statements |

| Methodology | In-depth data analysis, interviews, and forensic techniques | Sampling, testing, and verification of financial data |

| Frequency | As needed, typically after suspicion of fraud | Regularly scheduled, annual or quarterly |

| Regulatory Framework | Forensic accounting standards and legal guidelines | Generally Accepted Auditing Standards (GAAS), IFRS, or GAAP |

Which is better?

Forensic analysis provides detailed investigations to uncover fraud and financial misconduct, using techniques such as data mining, forensic accounting, and legal expertise. Audits focus on verifying the accuracy of financial statements and compliance with accounting standards, ensuring transparency for stakeholders and regulatory bodies. For businesses seeking to detect fraud and legal evidence, forensic analysis is superior, while audits are essential for routine financial validation and regulatory adherence.

Connection

Forensic analysis and audit are interconnected through their shared goal of examining financial records to detect discrepancies and prevent fraud. Forensic analysis application within audits enhances the identification of irregular transactions by using specialized investigative techniques and data analytics. This integration strengthens financial transparency and compliance within organizations.

Key Terms

Materiality

Audit emphasizes materiality to determine the significance of financial misstatements affecting users' decisions, applying thresholds aligned with accounting standards. Forensic analysis focuses on identifying material misrepresentations or fraud with detailed evidence gathering, often without predefined materiality limits. Explore more to understand their distinct approaches in ensuring financial accuracy and integrity.

Evidence

Audit processes primarily focus on verifying financial statements and compliance through sample-based evidence, ensuring accuracy and adherence to regulations. Forensic analysis digs deeper into detailed and often digital evidence to investigate fraud, misconduct, or legal disputes with a high level of scrutiny. Explore the differences further to understand how evidence handling varies between audit and forensic investigations.

Fraud detection

Audit primarily examines financial statements to ensure accuracy and compliance with accounting standards, while forensic analysis delves deeper into investigating financial fraud and gathering evidence for legal proceedings. Forensic analysis employs specialized techniques such as data mining, transaction tracing, and interviewing witnesses to uncover hidden fraudulent activities. Explore comprehensive approaches to fraud detection by understanding the distinct roles of audit and forensic analysis.

Source and External Links

What is an audit? - PwC Middle East - An audit is the examination of an organization's financial report by an independent entity to ensure it accurately reflects the organization's financial position.

Audit - Wikipedia - An audit is an independent examination of financial information to express an opinion on its accuracy and compliance with laws.

What is an Audit? - Types of Audits & Auditing Certification - ASQ - Auditing is the on-site verification of processes or quality systems to ensure compliance with set requirements.

dowidth.com

dowidth.com