Real-time expense management leverages advanced software to track and categorize expenses instantly, enhancing financial transparency and control. Policy compliance monitoring ensures all expenditures adhere to organizational guidelines, minimizing risks and preventing fraudulent activities. Explore how integrating both approaches can revolutionize your company's financial oversight.

Why it is important

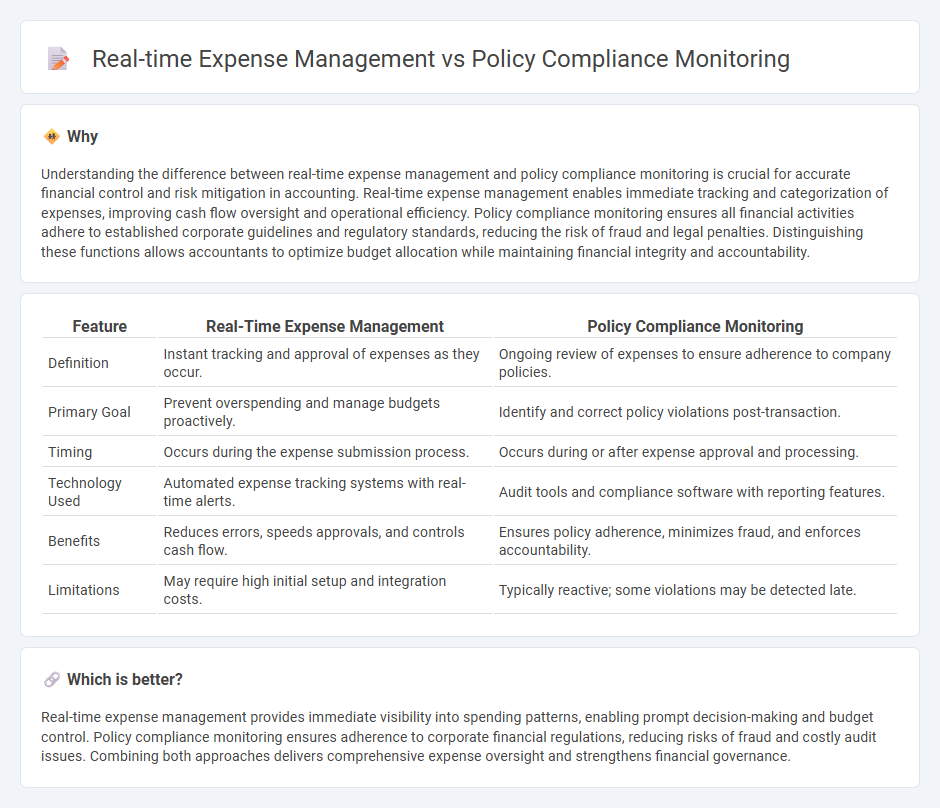

Understanding the difference between real-time expense management and policy compliance monitoring is crucial for accurate financial control and risk mitigation in accounting. Real-time expense management enables immediate tracking and categorization of expenses, improving cash flow oversight and operational efficiency. Policy compliance monitoring ensures all financial activities adhere to established corporate guidelines and regulatory standards, reducing the risk of fraud and legal penalties. Distinguishing these functions allows accountants to optimize budget allocation while maintaining financial integrity and accountability.

Comparison Table

| Feature | Real-Time Expense Management | Policy Compliance Monitoring |

|---|---|---|

| Definition | Instant tracking and approval of expenses as they occur. | Ongoing review of expenses to ensure adherence to company policies. |

| Primary Goal | Prevent overspending and manage budgets proactively. | Identify and correct policy violations post-transaction. |

| Timing | Occurs during the expense submission process. | Occurs during or after expense approval and processing. |

| Technology Used | Automated expense tracking systems with real-time alerts. | Audit tools and compliance software with reporting features. |

| Benefits | Reduces errors, speeds approvals, and controls cash flow. | Ensures policy adherence, minimizes fraud, and enforces accountability. |

| Limitations | May require high initial setup and integration costs. | Typically reactive; some violations may be detected late. |

Which is better?

Real-time expense management provides immediate visibility into spending patterns, enabling prompt decision-making and budget control. Policy compliance monitoring ensures adherence to corporate financial regulations, reducing risks of fraud and costly audit issues. Combining both approaches delivers comprehensive expense oversight and strengthens financial governance.

Connection

Real-time expense management enhances policy compliance monitoring by instantly tracking and categorizing expenditures against predefined company guidelines, enabling immediate detection of violations. This integration ensures accurate financial reporting and reduces the risk of fraud or unauthorized spending. Continuous monitoring facilitates swift corrective actions, maintaining organizational financial integrity and operational efficiency.

Key Terms

Internal Controls

Policy compliance monitoring ensures adherence to company spending rules by reviewing expenses against predefined criteria, helping identify discrepancies and fraud risks. Real-time expense management uses automated tools to track and control expenditures instantly, enhancing the effectiveness of internal controls by preventing violations before they occur. Explore how integrating these approaches can strengthen your organization's financial governance and internal controls.

Expense Reporting

Policy compliance monitoring ensures that all submitted expense reports adhere to company rules and regulatory standards, minimizing risk and preventing fraud. Real-time expense management leverages technology to track expenditures as they occur, providing immediate visibility and control over spending. Discover how integrating these approaches can enhance accuracy and efficiency in expense reporting.

Policy Enforcement

Policy compliance monitoring ensures that all expenses align with company guidelines by regularly reviewing transaction data and flagging violations for corrective action. Real-time expense management enhances policy enforcement by providing instant alerts and automated approvals or rejections during the spending process, significantly reducing unauthorized expenditures. Explore how integrating both approaches optimizes financial control and policy adherence in your organization.

Source and External Links

Policy Compliance - This involves systematically identifying, assessing, controlling, and monitoring activities to align with internal and external standards, utilizing robust governance and compliance frameworks.

Compliance Monitoring - Effective compliance monitoring includes automated tools for tracking adherence, generating reports, and identifying areas for improvement to mitigate risks and maintain integrity.

Compliance Monitoring: A Definitive Guide - This guide outlines the importance of a well-structured compliance monitoring plan to ensure regulatory adherence and foster a culture of accountability through audits and inspections.

dowidth.com

dowidth.com