Forensic analytics involves the detailed examination of financial data to detect fraud, errors, or irregularities, often used in legal investigations and compliance audits. Due diligence focuses on thoroughly assessing financial records and operational performance to evaluate risks and inform business decisions during mergers, acquisitions, or investments. Discover more about the key differences and applications of forensic analytics and due diligence in accounting.

Why it is important

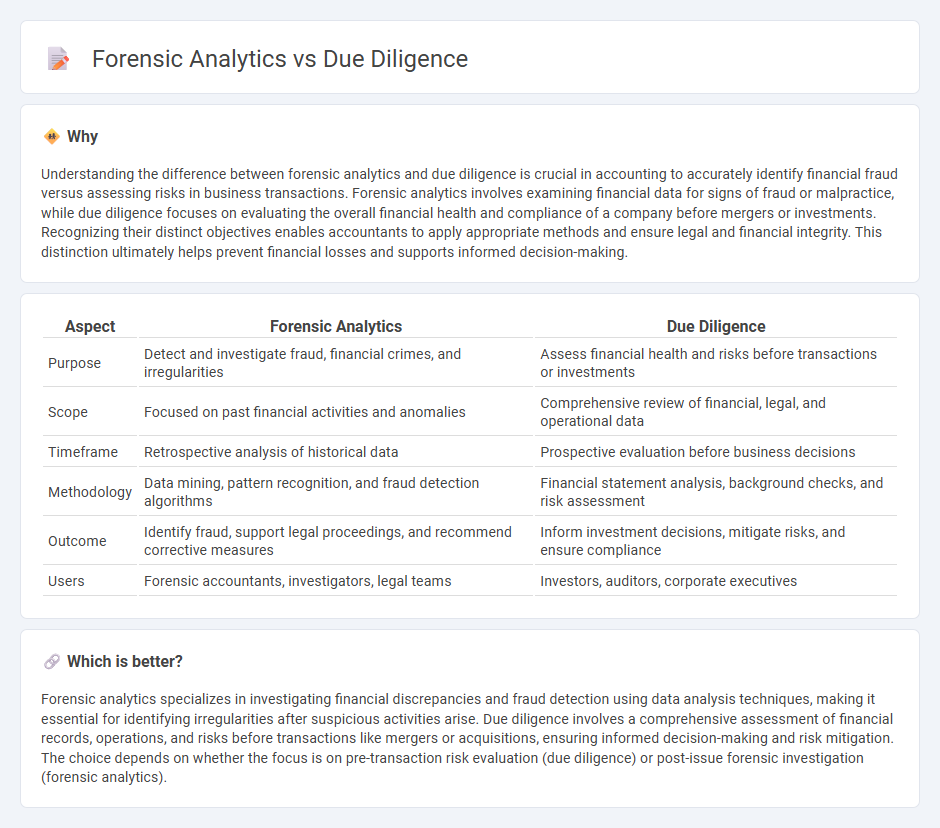

Understanding the difference between forensic analytics and due diligence is crucial in accounting to accurately identify financial fraud versus assessing risks in business transactions. Forensic analytics involves examining financial data for signs of fraud or malpractice, while due diligence focuses on evaluating the overall financial health and compliance of a company before mergers or investments. Recognizing their distinct objectives enables accountants to apply appropriate methods and ensure legal and financial integrity. This distinction ultimately helps prevent financial losses and supports informed decision-making.

Comparison Table

| Aspect | Forensic Analytics | Due Diligence |

|---|---|---|

| Purpose | Detect and investigate fraud, financial crimes, and irregularities | Assess financial health and risks before transactions or investments |

| Scope | Focused on past financial activities and anomalies | Comprehensive review of financial, legal, and operational data |

| Timeframe | Retrospective analysis of historical data | Prospective evaluation before business decisions |

| Methodology | Data mining, pattern recognition, and fraud detection algorithms | Financial statement analysis, background checks, and risk assessment |

| Outcome | Identify fraud, support legal proceedings, and recommend corrective measures | Inform investment decisions, mitigate risks, and ensure compliance |

| Users | Forensic accountants, investigators, legal teams | Investors, auditors, corporate executives |

Which is better?

Forensic analytics specializes in investigating financial discrepancies and fraud detection using data analysis techniques, making it essential for identifying irregularities after suspicious activities arise. Due diligence involves a comprehensive assessment of financial records, operations, and risks before transactions like mergers or acquisitions, ensuring informed decision-making and risk mitigation. The choice depends on whether the focus is on pre-transaction risk evaluation (due diligence) or post-issue forensic investigation (forensic analytics).

Connection

Forensic analytics and due diligence are interconnected through their focus on financial investigation and risk assessment. Forensic analytics uses data analysis techniques to detect fraud, errors, and anomalies in financial records, supporting due diligence by enhancing the verification of a company's financial integrity. This connection strengthens the reliability of financial statements and uncovers potential legal or compliance issues during mergers, acquisitions, or audits.

Key Terms

Verification

Due diligence involves comprehensive verification processes to assess financial integrity and compliance before business transactions, using traditional auditing and background checks. Forensic analytics specializes in detecting fraud and irregularities by analyzing complex data patterns and anomalies post-transaction. Explore how both methodologies enhance decision-making through thorough verification by learning more about their distinct applications.

Fraud detection

Due diligence involves comprehensive evaluations to verify the legitimacy and background of entities before engagement, primarily aimed at risk assessment and compliance. Forensic analytics uses advanced data analysis techniques to investigate financial records and detect anomalies indicative of fraud, focusing on identifying fraudulent activities after suspicious behavior arises. Explore in-depth methods and tools employed in both fields for effective fraud detection.

Financial statements

Due diligence in financial statements involves verifying accuracy, completeness, and compliance to assess investment risks, while forensic analytics detects and investigates fraud, discrepancies, and financial manipulation. Due diligence focuses on routine validation and risk assessment during transactions, whereas forensic analytics applies advanced data analysis to uncover hidden patterns and anomalies. Explore how each approach enhances financial integrity and decision-making.

Source and External Links

Due diligence: Definition, types and examples - Due diligence is the process of investigating and verifying information about a company or investment opportunity, involving clear objectives, cross-functional expertise, structured processes, technology integration, risk assessment, documentation, and ongoing monitoring to enable better decision-making.

Due diligence - Wikipedia - Due diligence is the investigation or exercise of care that a reasonable business or person takes before entering into an agreement, often used to evaluate a target company before a merger or acquisition to ensure informed decision-making.

Overview of Due Diligence in an M&A Transaction - Due diligence is the process of verifying all relevant facts, financial information, and issues related to a deal or investment before closing, reducing risks and providing assurance to buyers and sellers in mergers and acquisitions.

dowidth.com

dowidth.com