Real-time audit leverages continuous monitoring and data analytics to identify discrepancies and fraud as transactions occur, enhancing transparency and reducing financial risks immediately. Post-transaction review analyzes financial records after transactions are completed, focusing on accuracy and compliance but potentially delaying issue detection. Explore how integrating both methods can optimize financial oversight and maintain robust accounting controls.

Why it is important

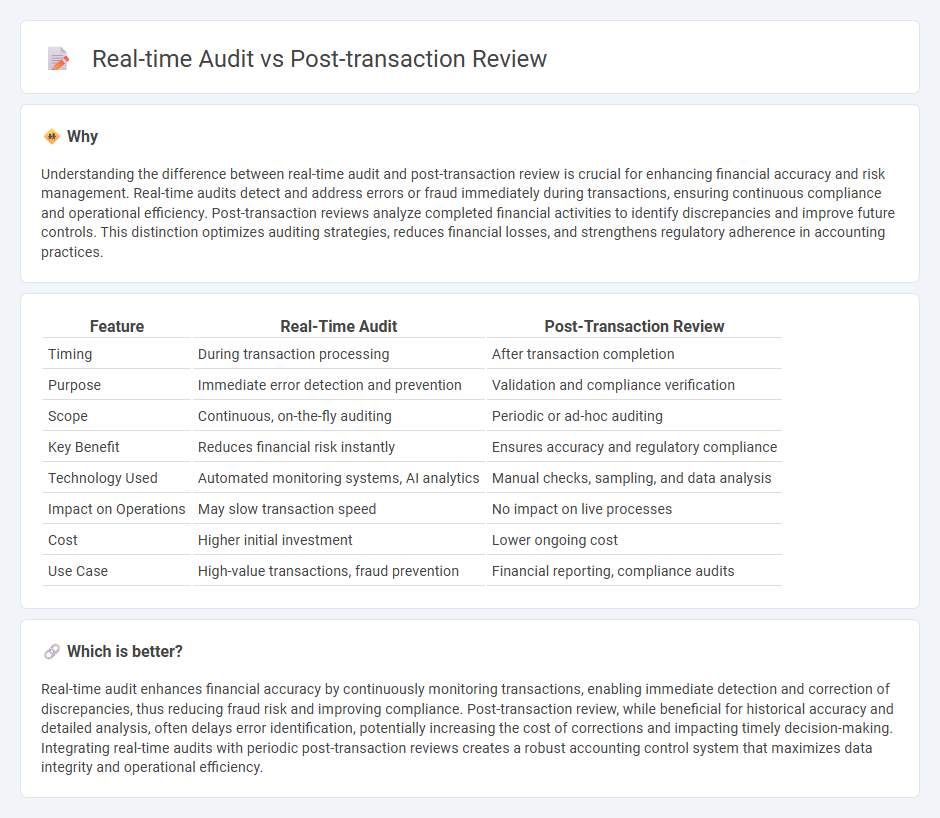

Understanding the difference between real-time audit and post-transaction review is crucial for enhancing financial accuracy and risk management. Real-time audits detect and address errors or fraud immediately during transactions, ensuring continuous compliance and operational efficiency. Post-transaction reviews analyze completed financial activities to identify discrepancies and improve future controls. This distinction optimizes auditing strategies, reduces financial losses, and strengthens regulatory adherence in accounting practices.

Comparison Table

| Feature | Real-Time Audit | Post-Transaction Review |

|---|---|---|

| Timing | During transaction processing | After transaction completion |

| Purpose | Immediate error detection and prevention | Validation and compliance verification |

| Scope | Continuous, on-the-fly auditing | Periodic or ad-hoc auditing |

| Key Benefit | Reduces financial risk instantly | Ensures accuracy and regulatory compliance |

| Technology Used | Automated monitoring systems, AI analytics | Manual checks, sampling, and data analysis |

| Impact on Operations | May slow transaction speed | No impact on live processes |

| Cost | Higher initial investment | Lower ongoing cost |

| Use Case | High-value transactions, fraud prevention | Financial reporting, compliance audits |

Which is better?

Real-time audit enhances financial accuracy by continuously monitoring transactions, enabling immediate detection and correction of discrepancies, thus reducing fraud risk and improving compliance. Post-transaction review, while beneficial for historical accuracy and detailed analysis, often delays error identification, potentially increasing the cost of corrections and impacting timely decision-making. Integrating real-time audits with periodic post-transaction reviews creates a robust accounting control system that maximizes data integrity and operational efficiency.

Connection

Real-time audit enhances accounting accuracy by continuously monitoring transactions as they occur, allowing immediate detection of discrepancies and potential fraud. Post-transaction review complements this process by providing a comprehensive analysis of recorded data to ensure regulatory compliance and financial integrity. Together, these methods create a robust audit framework that improves risk management and decision-making in accounting.

Key Terms

Timing

Post-transaction review analyzes completed transactions to identify errors or fraudulent activities, providing insights for future process improvements. Real-time audit monitors transactions as they occur, enabling immediate detection and prevention of potential issues, enhancing operational security. Discover more about how timing impacts audit effectiveness and business risk management.

Controls

Post-transaction reviews analyze control effectiveness after transactions finalize, identifying compliance gaps and anomalies. Real-time audits monitor controls simultaneously with transaction processing, enabling immediate detection and mitigation of risks. Explore in-depth comparisons to enhance your control strategies effectively.

Exception Reporting

Exception reporting is a crucial component in both post-transaction review and real-time audit processes, serving to identify anomalies or deviations from standard operating procedures. In post-transaction reviews, exception reports analyze completed transactions to detect errors or fraud after the event, while real-time audits use exception reporting to flag issues instantaneously for immediate resolution. Explore how integrating advanced exception reporting technologies enhances accuracy and reduces risk in auditing workflows.

Source and External Links

Why Post-Monitoring Matters for AML & Fraud - Post-transaction review is essential for identifying suspicious patterns and improving risk management practices in financial transactions.

Pre- vs Post-Transaction Monitoring and Detection Rules - Post-transaction monitoring involves generating reports to analyze customer transaction patterns and detect potential fraud.

Marketplace Post Transaction: How to Manage Reviews & ... - In marketplace settings, post-transaction review includes managing reviews and handling disputes to maintain user trust and satisfaction.

dowidth.com

dowidth.com