Real-time expense management enables businesses to track and control employee spending instantly, improving budgeting accuracy and reducing delays. Expense claim reimbursement processes involve employees submitting expenses after purchases, leading to potential delays and less control over cash flow. Discover how integrating real-time solutions can streamline your financial operations and enhance expense visibility.

Why it is important

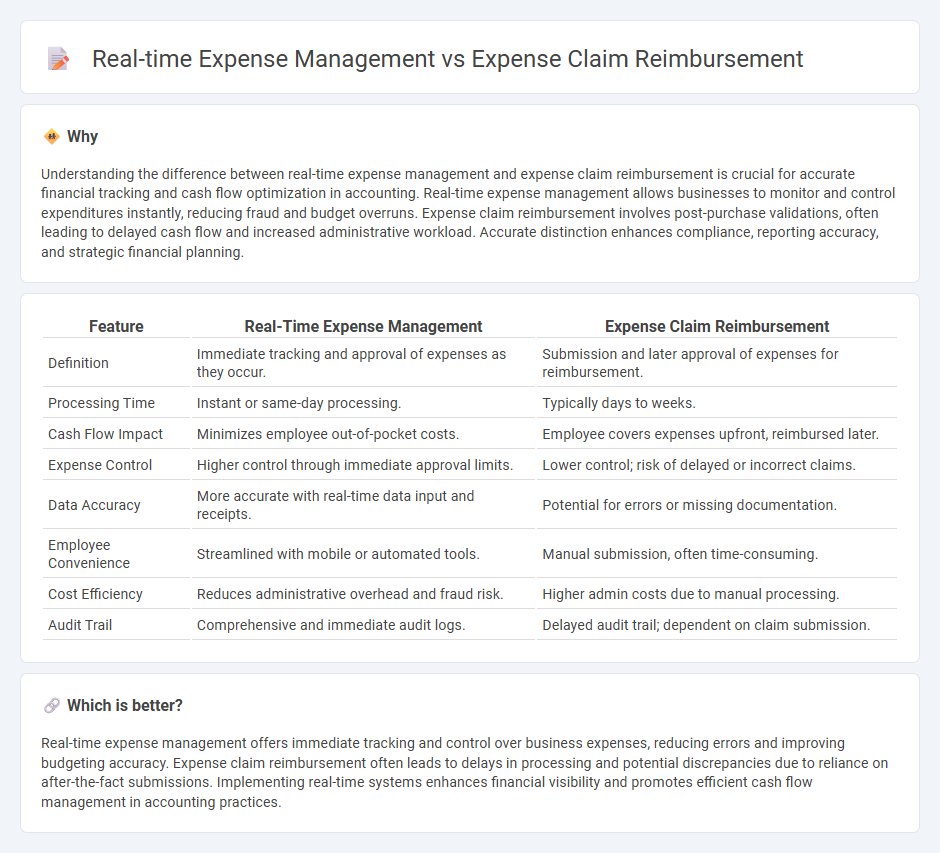

Understanding the difference between real-time expense management and expense claim reimbursement is crucial for accurate financial tracking and cash flow optimization in accounting. Real-time expense management allows businesses to monitor and control expenditures instantly, reducing fraud and budget overruns. Expense claim reimbursement involves post-purchase validations, often leading to delayed cash flow and increased administrative workload. Accurate distinction enhances compliance, reporting accuracy, and strategic financial planning.

Comparison Table

| Feature | Real-Time Expense Management | Expense Claim Reimbursement |

|---|---|---|

| Definition | Immediate tracking and approval of expenses as they occur. | Submission and later approval of expenses for reimbursement. |

| Processing Time | Instant or same-day processing. | Typically days to weeks. |

| Cash Flow Impact | Minimizes employee out-of-pocket costs. | Employee covers expenses upfront, reimbursed later. |

| Expense Control | Higher control through immediate approval limits. | Lower control; risk of delayed or incorrect claims. |

| Data Accuracy | More accurate with real-time data input and receipts. | Potential for errors or missing documentation. |

| Employee Convenience | Streamlined with mobile or automated tools. | Manual submission, often time-consuming. |

| Cost Efficiency | Reduces administrative overhead and fraud risk. | Higher admin costs due to manual processing. |

| Audit Trail | Comprehensive and immediate audit logs. | Delayed audit trail; dependent on claim submission. |

Which is better?

Real-time expense management offers immediate tracking and control over business expenses, reducing errors and improving budgeting accuracy. Expense claim reimbursement often leads to delays in processing and potential discrepancies due to reliance on after-the-fact submissions. Implementing real-time systems enhances financial visibility and promotes efficient cash flow management in accounting practices.

Connection

Real-time expense management streamlines the tracking and approval of employee expenditures, ensuring immediate visibility into spending patterns and budget compliance. This continuous monitoring reduces errors and fraud, expediting the accuracy and speed of expense claim reimbursement. Efficient integration of both processes enhances financial control and employee satisfaction by minimizing delays in reimbursement cycles.

Key Terms

Expense Report

Expense report submission in expense claim reimbursement involves manual entry and delayed processing, often causing slower reimbursement cycles and increased administrative workload. Real-time expense management streamlines data capture and approval workflows through automated digital platforms, enhancing accuracy and accelerating reimbursement timelines. Explore how integrating real-time expense management solutions can optimize your expense reporting processes and improve financial control.

Real-Time Tracking

Real-time expense management leverages advanced tracking technologies such as GPS and mobile app integration to provide instant visibility into expenditures, improving accuracy and control compared to traditional expense claim reimbursement processes. This approach minimizes delays, reduces errors, and enhances compliance by automatically capturing and categorizing expenses as they occur. Explore the benefits of real-time tracking to optimize your organization's financial operations and streamline expense management.

Policy Compliance

Expense claim reimbursement often delays policy compliance verification, resulting in potential overspending and non-compliance risks. Real-time expense management leverages automated controls and instant policy checking to ensure every expenditure aligns with company guidelines immediately. Discover how cutting-edge real-time solutions transform compliance and financial accuracy.

Source and External Links

What is an expense claim, its types and how to manage it? - Volopay - This webpage provides an overview of expense claims, their types, and how they are managed within organizations, emphasizing the need for business-related expenses.

What is Expense Claim? - Navan - This resource explains the purpose and process of submitting an expense claim to ensure employees are reimbursed for out-of-pocket business expenses.

The Employer's Guide to Employee Expense Reimbursement | Brex - This guide outlines the process of expense reimbursement, helping companies manage employee expenses efficiently and maintain accurate financial records.

dowidth.com

dowidth.com