Forensic analytics involves examining financial data to detect fraud, errors, and irregularities, using advanced analytical techniques and data mining. Cash flow analysis focuses on evaluating the inflow and outflow of cash to assess an organization's liquidity, solvency, and financial health. Explore the key differences and applications of forensic analytics and cash flow analysis to enhance your accounting expertise.

Why it is important

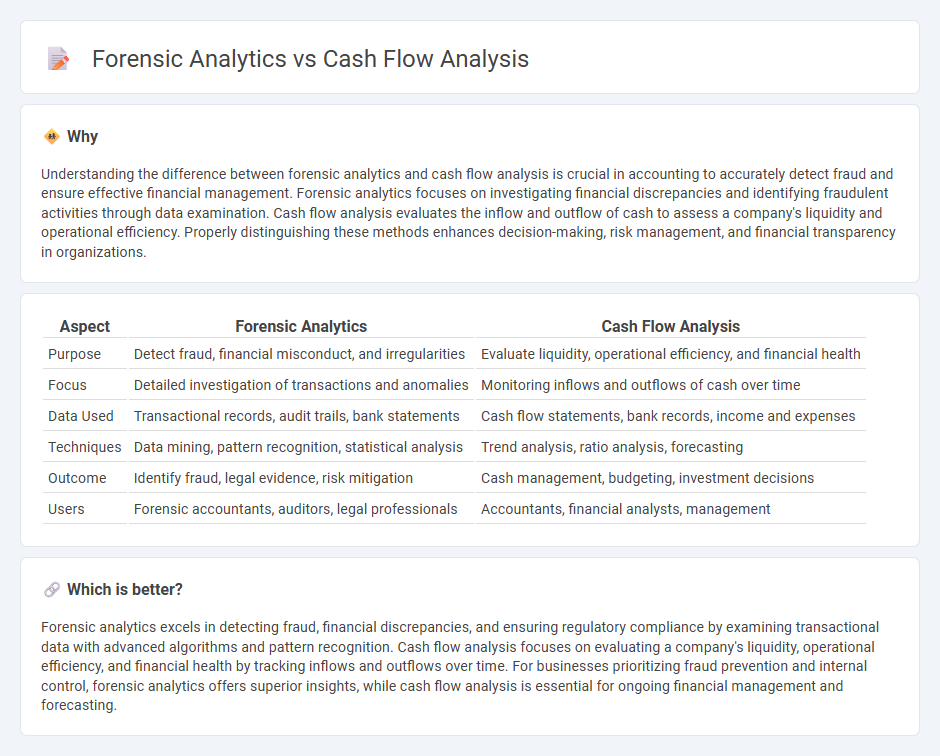

Understanding the difference between forensic analytics and cash flow analysis is crucial in accounting to accurately detect fraud and ensure effective financial management. Forensic analytics focuses on investigating financial discrepancies and identifying fraudulent activities through data examination. Cash flow analysis evaluates the inflow and outflow of cash to assess a company's liquidity and operational efficiency. Properly distinguishing these methods enhances decision-making, risk management, and financial transparency in organizations.

Comparison Table

| Aspect | Forensic Analytics | Cash Flow Analysis |

|---|---|---|

| Purpose | Detect fraud, financial misconduct, and irregularities | Evaluate liquidity, operational efficiency, and financial health |

| Focus | Detailed investigation of transactions and anomalies | Monitoring inflows and outflows of cash over time |

| Data Used | Transactional records, audit trails, bank statements | Cash flow statements, bank records, income and expenses |

| Techniques | Data mining, pattern recognition, statistical analysis | Trend analysis, ratio analysis, forecasting |

| Outcome | Identify fraud, legal evidence, risk mitigation | Cash management, budgeting, investment decisions |

| Users | Forensic accountants, auditors, legal professionals | Accountants, financial analysts, management |

Which is better?

Forensic analytics excels in detecting fraud, financial discrepancies, and ensuring regulatory compliance by examining transactional data with advanced algorithms and pattern recognition. Cash flow analysis focuses on evaluating a company's liquidity, operational efficiency, and financial health by tracking inflows and outflows over time. For businesses prioritizing fraud prevention and internal control, forensic analytics offers superior insights, while cash flow analysis is essential for ongoing financial management and forecasting.

Connection

Forensic analytics enhances cash flow analysis by identifying anomalies and fraudulent activities within financial transactions, ensuring accuracy in cash flow reporting. Detailed examination of cash inflows and outflows using forensic techniques uncovers hidden patterns and irregularities that traditional accounting methods may overlook. Integrating forensic analytics into cash flow analysis strengthens financial integrity and supports compliance with accounting standards.

Key Terms

Cash Flow Analysis:

Cash flow analysis examines the inflow and outflow of cash within a business to assess liquidity, operational efficiency, and financial stability. It focuses on key metrics such as operating cash flow, free cash flow, and cash flow from financing to provide insights into the company's ability to meet short-term obligations. Explore our detailed guide to understand how cash flow analysis can enhance your financial decision-making.

Operating Activities

Cash flow analysis evaluates the cash inflows and outflows related to operating activities, highlighting a company's ability to generate cash from core business functions. Forensic analytics in operating activities delves deeper, identifying irregular patterns or anomalies that could indicate fraud or financial misstatement. Explore detailed techniques to enhance accuracy in diagnosing operational cash flow integrity.

Free Cash Flow

Free Cash Flow (FCF) serves as a crucial metric in cash flow analysis, highlighting the actual cash generated by a company after accounting for capital expenditures, which indicates operational efficiency and financial health. Forensic analytics utilizes detailed examination of Free Cash Flow patterns to detect anomalies, potential fraud, or misstatements in financial reporting by closely scrutinizing inflows and outflows over time. Explore deeper insights into Free Cash Flow applications and forensic techniques to strengthen your financial analysis strategy.

Source and External Links

What Is Cash Flow Analysis? How to Do One (+ Examples) - Shopify - Cash flow analysis is the process of reviewing all the money coming into and going out of a business, helping to assess financial health and identify trends in liquidity over specific time periods.

Cash Flow Analysis: Basics, Benefits and How to Do It | NetSuite - Analyzing cash flow involves evaluating operating, investing, and financing activities to gauge a company's ability to cover obligations, invest in growth, and sustain operations, often using ratios like operating cash flow margin and free cash flow.

Understanding Cash Flow Analysis | Ag Decision Maker - A cash flow statement records actual cash movements in and out of a business, while a cash flow budget projects future flows, both essential for understanding liquidity and planning for sufficient working capital.

dowidth.com

dowidth.com