On-demand accruals represent expenses recognized as they occur, even if payment is postponed, enhancing financial accuracy and cash flow management. Accrued liabilities, however, are obligations recorded on the balance sheet for expenses incurred but not yet paid, ensuring compliance with accounting principles like GAAP. Explore the nuances of on-demand accruals versus accrued liabilities to optimize your accounting practices.

Why it is important

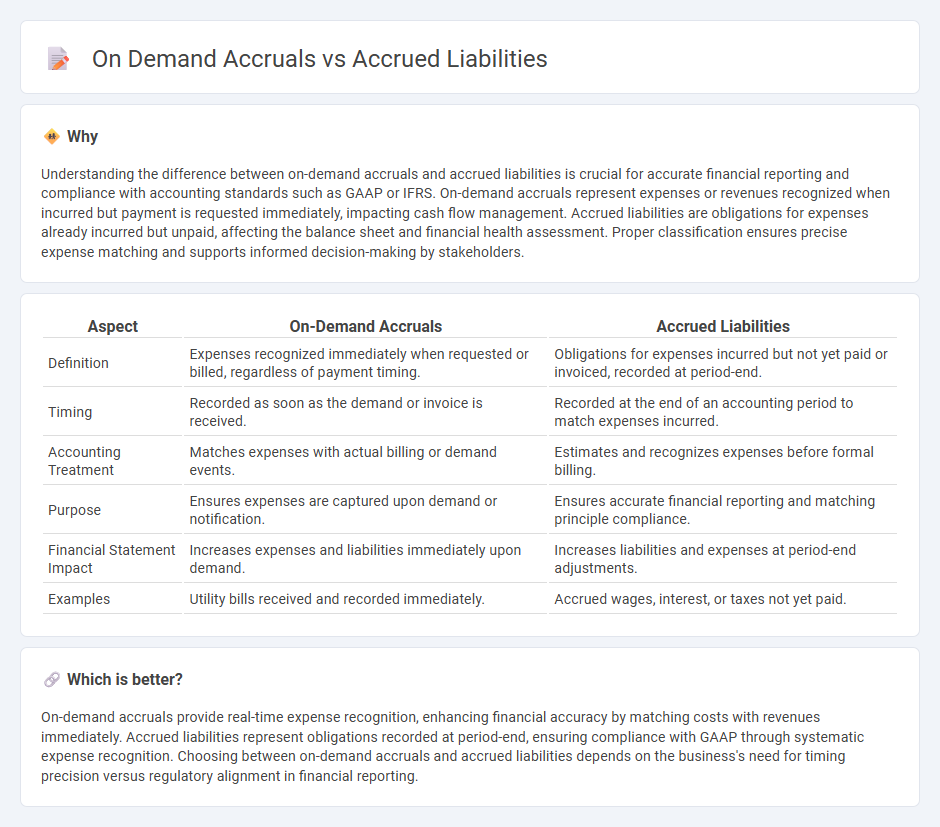

Understanding the difference between on-demand accruals and accrued liabilities is crucial for accurate financial reporting and compliance with accounting standards such as GAAP or IFRS. On-demand accruals represent expenses or revenues recognized when incurred but payment is requested immediately, impacting cash flow management. Accrued liabilities are obligations for expenses already incurred but unpaid, affecting the balance sheet and financial health assessment. Proper classification ensures precise expense matching and supports informed decision-making by stakeholders.

Comparison Table

| Aspect | On-Demand Accruals | Accrued Liabilities |

|---|---|---|

| Definition | Expenses recognized immediately when requested or billed, regardless of payment timing. | Obligations for expenses incurred but not yet paid or invoiced, recorded at period-end. |

| Timing | Recorded as soon as the demand or invoice is received. | Recorded at the end of an accounting period to match expenses incurred. |

| Accounting Treatment | Matches expenses with actual billing or demand events. | Estimates and recognizes expenses before formal billing. |

| Purpose | Ensures expenses are captured upon demand or notification. | Ensures accurate financial reporting and matching principle compliance. |

| Financial Statement Impact | Increases expenses and liabilities immediately upon demand. | Increases liabilities and expenses at period-end adjustments. |

| Examples | Utility bills received and recorded immediately. | Accrued wages, interest, or taxes not yet paid. |

Which is better?

On-demand accruals provide real-time expense recognition, enhancing financial accuracy by matching costs with revenues immediately. Accrued liabilities represent obligations recorded at period-end, ensuring compliance with GAAP through systematic expense recognition. Choosing between on-demand accruals and accrued liabilities depends on the business's need for timing precision versus regulatory alignment in financial reporting.

Connection

On-demand accruals represent expenses recorded when incurred but paid later, aligning closely with accrued liabilities, which are obligations owed by a company for services or goods received yet unpaid. Both concepts ensure accurate financial reporting by matching expenses to the period they relate to, enhancing the reliability of financial statements. Proper management of these accounts supports compliance with accounting principles like GAAP and IFRS.

Key Terms

Timing of Recognition

Accrued liabilities are expenses recognized in the accounting period they are incurred, regardless of payment timing, ensuring accurate matching of costs and revenues; on demand accruals represent obligations recognized only when a payment request or demand is made, reflecting a more uncertain timing of liability recognition. The difference in recognition timing impacts financial reporting accuracy and cash flow management, with accrued liabilities providing a proactive approach versus the reactive nature of on demand accruals. Explore more to understand how these timing differences affect financial statements and decision-making processes.

Payment Obligation Trigger

Accrued liabilities are expenses recognized when goods or services have been received but payment is pending, triggered by the receipt or consumption of those goods or services. On demand accruals arise when payment obligations are triggered by specific contractual conditions or requests, rather than by the delivery of goods or services. Explore detailed differences in payment obligation triggers to optimize financial reporting and compliance.

Financial Statement Presentation

Accrued liabilities represent expenses incurred but not yet paid, listed as current liabilities on the balance sheet, reflecting obligations recognized under the matching principle. On demand accruals are specific accrued expenses that the company must settle immediately upon request, often classified within current liabilities but requiring clear disclosure due to their immediate payment demand. Explore our detailed analysis of how proper financial statement presentation affects transparency and compliance.

Source and External Links

What Are Accrued Liabilities? (With Definition and Examples) - Indeed - Accrued liabilities are expenses a company has incurred during an accounting period but has yet to pay, and they are recorded under current liabilities to provide an accurate financial picture through accrual accounting.

Accrued Liability - Definition, Types, Example - Accrued liabilities are expenses incurred but not yet billed or paid, recorded under the matching principle in accrual accounting; they are shown as current liabilities on the balance sheet and include recurring items like wages and non-recurring items like one-off supplier purchases.

What Are Accrued Liabilities? - GoCardless - Accrued liabilities (or accrued expenses) are costs a business has incurred but not yet billed for, classified as current liabilities, including routine expenses such as wages and infrequent ones like one-time purchases, reflecting liabilities before cash payment occurs.

dowidth.com

dowidth.com