Carbon accounting quantifies greenhouse gas emissions to track environmental impact, focusing on sustainability and regulatory compliance. Cost accounting analyzes business expenses to optimize financial performance and decision-making processes. Explore more about how these distinct accounting methods contribute to corporate strategy and responsibility.

Why it is important

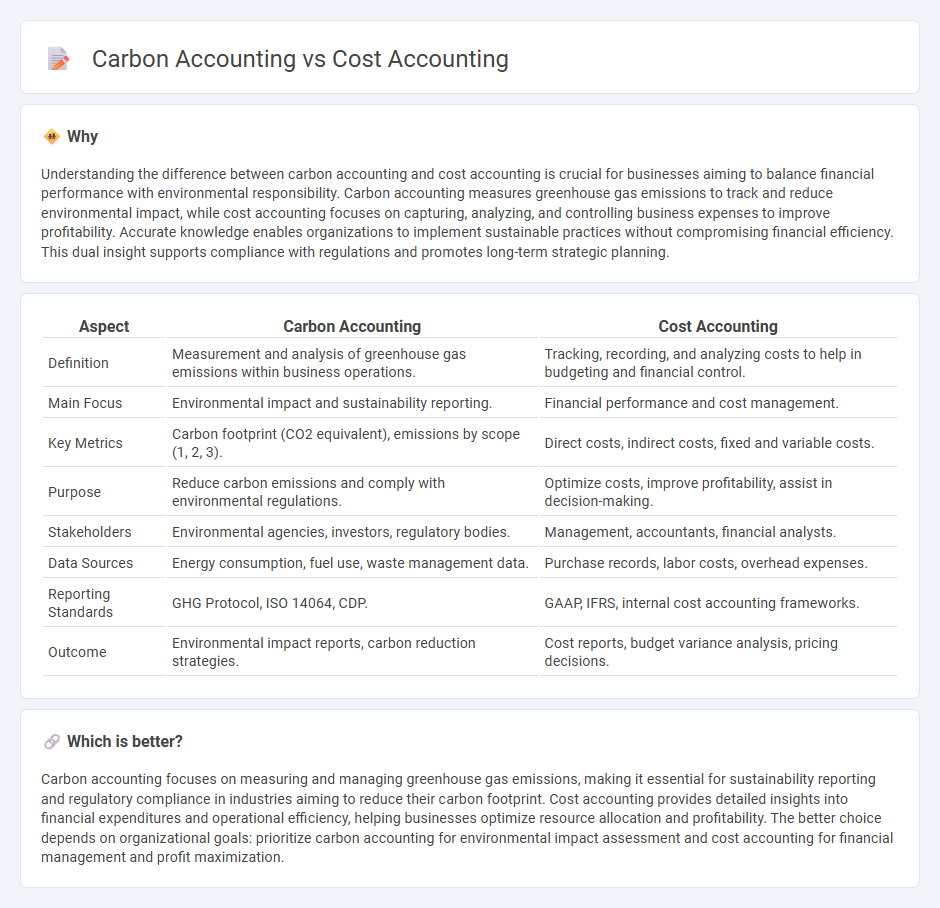

Understanding the difference between carbon accounting and cost accounting is crucial for businesses aiming to balance financial performance with environmental responsibility. Carbon accounting measures greenhouse gas emissions to track and reduce environmental impact, while cost accounting focuses on capturing, analyzing, and controlling business expenses to improve profitability. Accurate knowledge enables organizations to implement sustainable practices without compromising financial efficiency. This dual insight supports compliance with regulations and promotes long-term strategic planning.

Comparison Table

| Aspect | Carbon Accounting | Cost Accounting |

|---|---|---|

| Definition | Measurement and analysis of greenhouse gas emissions within business operations. | Tracking, recording, and analyzing costs to help in budgeting and financial control. |

| Main Focus | Environmental impact and sustainability reporting. | Financial performance and cost management. |

| Key Metrics | Carbon footprint (CO2 equivalent), emissions by scope (1, 2, 3). | Direct costs, indirect costs, fixed and variable costs. |

| Purpose | Reduce carbon emissions and comply with environmental regulations. | Optimize costs, improve profitability, assist in decision-making. |

| Stakeholders | Environmental agencies, investors, regulatory bodies. | Management, accountants, financial analysts. |

| Data Sources | Energy consumption, fuel use, waste management data. | Purchase records, labor costs, overhead expenses. |

| Reporting Standards | GHG Protocol, ISO 14064, CDP. | GAAP, IFRS, internal cost accounting frameworks. |

| Outcome | Environmental impact reports, carbon reduction strategies. | Cost reports, budget variance analysis, pricing decisions. |

Which is better?

Carbon accounting focuses on measuring and managing greenhouse gas emissions, making it essential for sustainability reporting and regulatory compliance in industries aiming to reduce their carbon footprint. Cost accounting provides detailed insights into financial expenditures and operational efficiency, helping businesses optimize resource allocation and profitability. The better choice depends on organizational goals: prioritize carbon accounting for environmental impact assessment and cost accounting for financial management and profit maximization.

Connection

Carbon accounting and cost accounting are connected through the integration of environmental costs into financial decision-making processes. Carbon accounting quantifies greenhouse gas emissions, enabling companies to assign monetary values to their carbon footprint, which cost accounting then incorporates to assess the total expenses of operations. This linkage supports sustainable business strategies by identifying and managing both financial and environmental impacts.

Key Terms

**Cost Accounting:**

Cost accounting systematically tracks, records, and analyzes all expenses related to production processes to determine the cost of goods sold, enabling firms to optimize budgets and improve profitability. It provides detailed insights into direct and indirect costs, labor expenses, and overheads, facilitating better financial decision-making and pricing strategies. Discover how mastering cost accounting can enhance your company's financial health and operational efficiency.

Overheads

Cost accounting allocates overhead costs such as indirect labor, utilities, and depreciation to product or service expenses for accurate financial analysis and pricing decisions. Carbon accounting tracks greenhouse gas emissions associated with overhead activities including energy consumption and waste management to evaluate environmental impact. Explore the differences and applications of overhead accounting methods to enhance both economic efficiency and sustainability efforts.

Cost Allocation

Cost accounting focuses on accurately allocating financial expenses to specific products or departments to determine profitability, using methods like job costing, process costing, and activity-based costing. Carbon accounting allocates greenhouse gas emissions to various organizational units or activities to quantify environmental impact, utilizing standards such as the Greenhouse Gas Protocol. Explore detailed methodologies and best practices in cost versus carbon allocation for strategic decision-making.

Source and External Links

Cost Accounting Defined: What It Is & Why It Matters - This article explains the basics of cost accounting, including its role in tracking input costs and aiding internal management decisions.

Cost Accounting: Everything You Need to Know - This guide provides a comprehensive overview of cost accounting, including its implementation and methods such as job costing.

Guide to Cost Accounting: History, Purpose, and Examples - This blog post covers the history and purpose of cost accounting, highlighting techniques like marginal costing and the benefits of automation.

dowidth.com

dowidth.com