Carbon accounting quantifies an organization's greenhouse gas emissions to manage environmental impact and comply with sustainability goals. Tax accounting focuses on preparing financial information for tax calculation and compliance with government regulations. Explore deeper insights into how these accounting types influence business strategy and reporting.

Why it is important

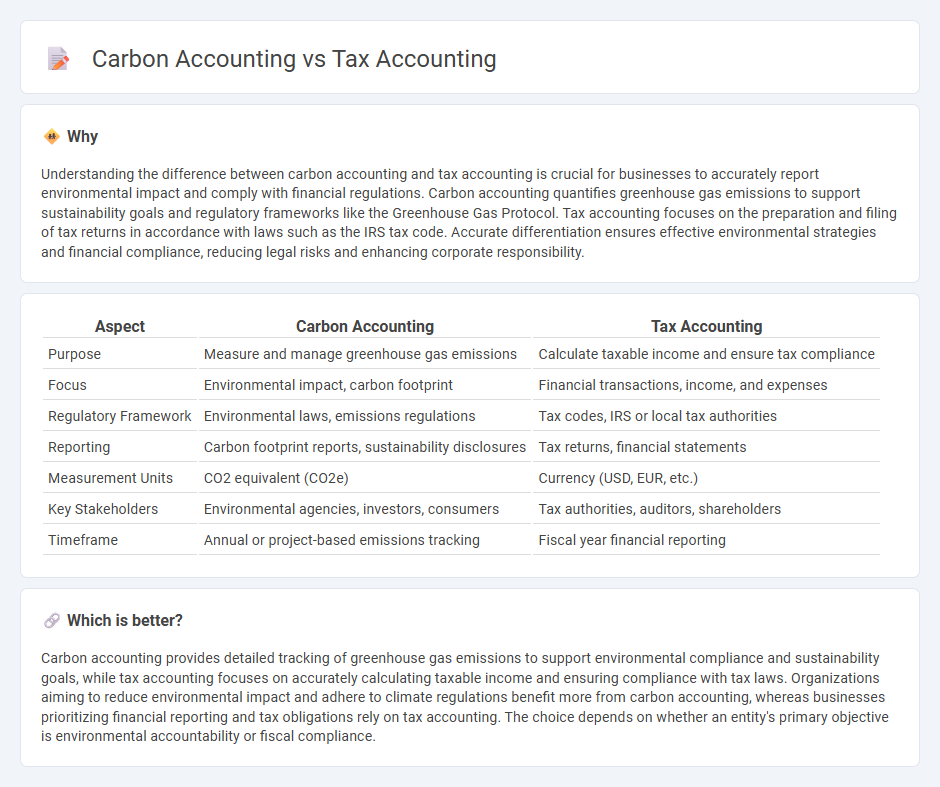

Understanding the difference between carbon accounting and tax accounting is crucial for businesses to accurately report environmental impact and comply with financial regulations. Carbon accounting quantifies greenhouse gas emissions to support sustainability goals and regulatory frameworks like the Greenhouse Gas Protocol. Tax accounting focuses on the preparation and filing of tax returns in accordance with laws such as the IRS tax code. Accurate differentiation ensures effective environmental strategies and financial compliance, reducing legal risks and enhancing corporate responsibility.

Comparison Table

| Aspect | Carbon Accounting | Tax Accounting |

|---|---|---|

| Purpose | Measure and manage greenhouse gas emissions | Calculate taxable income and ensure tax compliance |

| Focus | Environmental impact, carbon footprint | Financial transactions, income, and expenses |

| Regulatory Framework | Environmental laws, emissions regulations | Tax codes, IRS or local tax authorities |

| Reporting | Carbon footprint reports, sustainability disclosures | Tax returns, financial statements |

| Measurement Units | CO2 equivalent (CO2e) | Currency (USD, EUR, etc.) |

| Key Stakeholders | Environmental agencies, investors, consumers | Tax authorities, auditors, shareholders |

| Timeframe | Annual or project-based emissions tracking | Fiscal year financial reporting |

Which is better?

Carbon accounting provides detailed tracking of greenhouse gas emissions to support environmental compliance and sustainability goals, while tax accounting focuses on accurately calculating taxable income and ensuring compliance with tax laws. Organizations aiming to reduce environmental impact and adhere to climate regulations benefit more from carbon accounting, whereas businesses prioritizing financial reporting and tax obligations rely on tax accounting. The choice depends on whether an entity's primary objective is environmental accountability or fiscal compliance.

Connection

Carbon accounting quantifies greenhouse gas emissions to support regulatory compliance and sustainability reporting, while tax accounting incorporates these emissions data to calculate carbon taxes or credits within financial statements. Integrating carbon accounting with tax accounting ensures accurate assessment and reporting of fiscal obligations related to environmental impact. Organizations leveraging this connection optimize tax liabilities and enhance transparency in environmental financial disclosures.

Key Terms

**Tax Accounting:**

Tax accounting involves the systematic recording and analysis of financial transactions to ensure compliance with tax laws and regulations, focusing on accurate calculation of taxable income and tax liability. It requires detailed knowledge of tax codes, deductions, credits, and the preparation of tax returns to optimize tax benefits for individuals and businesses. Explore more to understand how tax accounting strategies can maximize financial efficiency and regulatory adherence.

Taxable Income

Tax accounting centers on calculating taxable income by adhering to government regulations and tax codes to ensure accurate reporting and compliance. Carbon accounting measures greenhouse gas emissions and translates them into carbon credits or liabilities, which generally do not impact taxable income directly but influence sustainability reporting and environmental compliance. Explore the detailed differences and implications of taxable income in both accounting fields for a clearer financial and environmental strategy.

Deferred Tax

Deferred tax in tax accounting reflects temporary differences between the carrying amount of assets or liabilities in financial statements and their tax bases, impacting future taxable income. In carbon accounting, deferred tax considerations arise from timing differences related to carbon credits or liabilities, influencing the recognition of tax effects tied to environmental obligations. Explore further to understand how deferred tax bridges financial reporting and environmental sustainability goals.

Source and External Links

Tax Accounting | Definition, Types & Examples - Study.com - Tax accounting is a specialized field focused on minimizing tax liability and ensuring compliance with tax laws, involving preparation of tax returns and strategic tax planning for individuals and organizations.

What Is Tax Accounting? (With Tips and an Example) | Indeed.com - Tax accounting involves methods to prepare financial statements showing tax assets and liabilities, ensuring companies pay accurate taxes and comply with regulations.

Tax Accountant Careers - Tax accountants prepare tax filings, advise on tax planning, analyze financial data related to taxes, and stay updated on tax law changes to help individuals and businesses manage tax obligations.

dowidth.com

dowidth.com