Revenue recognition automation streamlines the accurate recording of income based on specific accounting standards, reducing manual errors and ensuring timely financial reporting. Compliance automation focuses on adhering to regulatory requirements, automating audits and controls to maintain transparency and avoid penalties. Explore the key differences and benefits of these automation processes in accounting to enhance operational efficiency and accuracy.

Why it is important

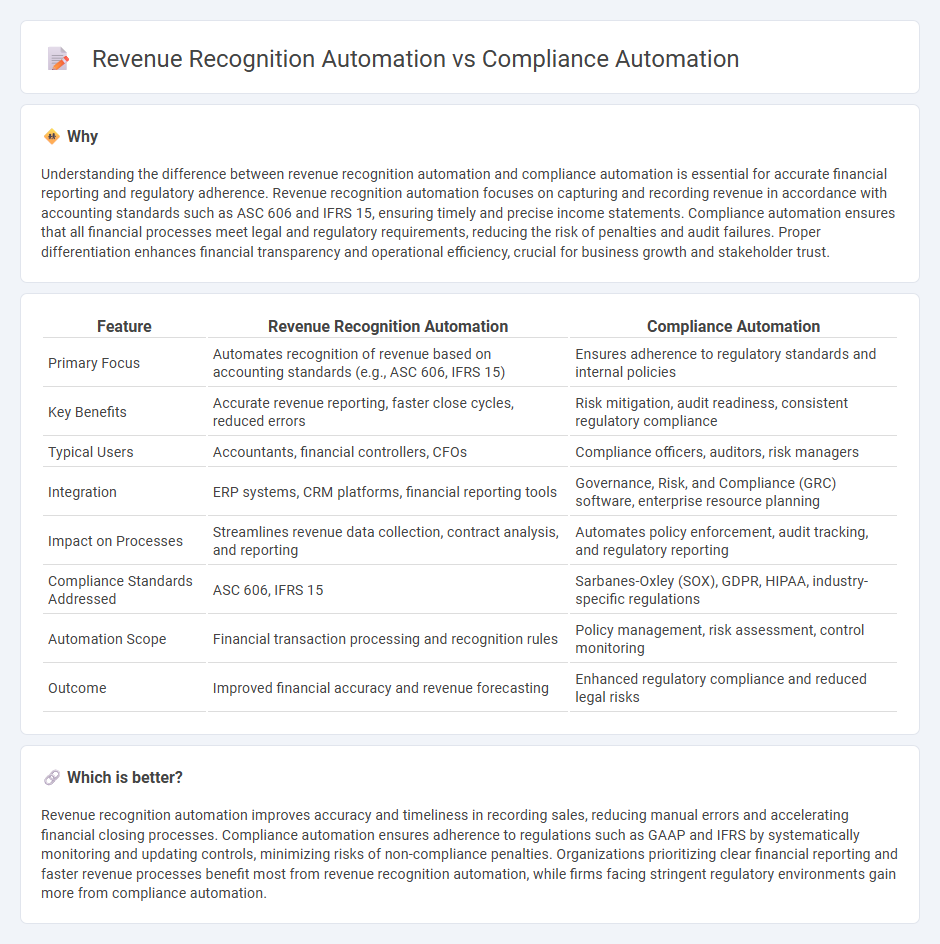

Understanding the difference between revenue recognition automation and compliance automation is essential for accurate financial reporting and regulatory adherence. Revenue recognition automation focuses on capturing and recording revenue in accordance with accounting standards such as ASC 606 and IFRS 15, ensuring timely and precise income statements. Compliance automation ensures that all financial processes meet legal and regulatory requirements, reducing the risk of penalties and audit failures. Proper differentiation enhances financial transparency and operational efficiency, crucial for business growth and stakeholder trust.

Comparison Table

| Feature | Revenue Recognition Automation | Compliance Automation |

|---|---|---|

| Primary Focus | Automates recognition of revenue based on accounting standards (e.g., ASC 606, IFRS 15) | Ensures adherence to regulatory standards and internal policies |

| Key Benefits | Accurate revenue reporting, faster close cycles, reduced errors | Risk mitigation, audit readiness, consistent regulatory compliance |

| Typical Users | Accountants, financial controllers, CFOs | Compliance officers, auditors, risk managers |

| Integration | ERP systems, CRM platforms, financial reporting tools | Governance, Risk, and Compliance (GRC) software, enterprise resource planning |

| Impact on Processes | Streamlines revenue data collection, contract analysis, and reporting | Automates policy enforcement, audit tracking, and regulatory reporting |

| Compliance Standards Addressed | ASC 606, IFRS 15 | Sarbanes-Oxley (SOX), GDPR, HIPAA, industry-specific regulations |

| Automation Scope | Financial transaction processing and recognition rules | Policy management, risk assessment, control monitoring |

| Outcome | Improved financial accuracy and revenue forecasting | Enhanced regulatory compliance and reduced legal risks |

Which is better?

Revenue recognition automation improves accuracy and timeliness in recording sales, reducing manual errors and accelerating financial closing processes. Compliance automation ensures adherence to regulations such as GAAP and IFRS by systematically monitoring and updating controls, minimizing risks of non-compliance penalties. Organizations prioritizing clear financial reporting and faster revenue processes benefit most from revenue recognition automation, while firms facing stringent regulatory environments gain more from compliance automation.

Connection

Revenue recognition automation streamlines the accurate recording of sales in accordance with accounting standards like ASC 606, reducing manual errors and ensuring timely financial reporting. Compliance automation integrates regulatory requirements into accounting processes, enabling continuous monitoring and adherence to financial rules. Together, these technologies enhance the reliability of financial statements by aligning revenue data with compliance protocols, minimizing risks of misstatements and audits.

Key Terms

**Compliance Automation:**

Compliance automation enhances regulatory adherence by streamlining processes such as audit trails, policy enforcement, and risk management through advanced software solutions. It reduces manual errors and improves efficiency by ensuring timely updates to regulatory changes, facilitating consistent data monitoring and reporting. Explore how compliance automation can transform your organization's governance and risk management strategies.

Regulatory Reporting

Compliance automation enhances regulatory reporting by streamlining data collection and ensuring accurate, timely submission of financial disclosures, reducing the risk of penalties. Revenue recognition automation specifically targets the application of accounting standards like ASC 606 or IFRS 15, improving precision in revenue calculations and related disclosures. Explore the nuances between these automation types to optimize your regulatory reporting processes effectively.

Internal Controls

Compliance automation strengthens internal controls by ensuring accurate regulatory reporting, reducing errors, and maintaining audit trails critical for governance. Revenue recognition automation optimizes internal controls by automating revenue timing and calculations according to accounting standards such as ASC 606, thereby improving financial accuracy and consistency. Explore how integrating both automation types can enhance internal control frameworks and drive organizational efficiency.

Source and External Links

Compliance Automation: How It Works and How to... - This article discusses how compliance automation uses software to streamline compliance procedures, leveraging AI and data analytics to enhance regulatory adherence.

What is Compliance Automation? - This blog post explains how compliance automation utilizes technology, particularly AI, to simplify compliance workflows and ensure regulatory conformity by automating manual tasks.

Join the Compliance Automation Revolution - The Cloud Security Alliance's initiative aims to automate compliance, reduce manual work, and enhance security through AI-powered analysis and automated controls testing.

dowidth.com

dowidth.com