Revenue recognition automation streamlines the process of accurately recording sales income by integrating real-time invoicing and payment data, reducing errors and improving compliance with accounting standards like ASC 606. Consolidation automation focuses on aggregating financial statements from multiple subsidiaries into a unified report, enhancing accuracy and efficiency in multi-entity organizations while ensuring adherence to IFRS or GAAP guidelines. Discover how these automation technologies transform accounting workflows and elevate financial reporting precision.

Why it is important

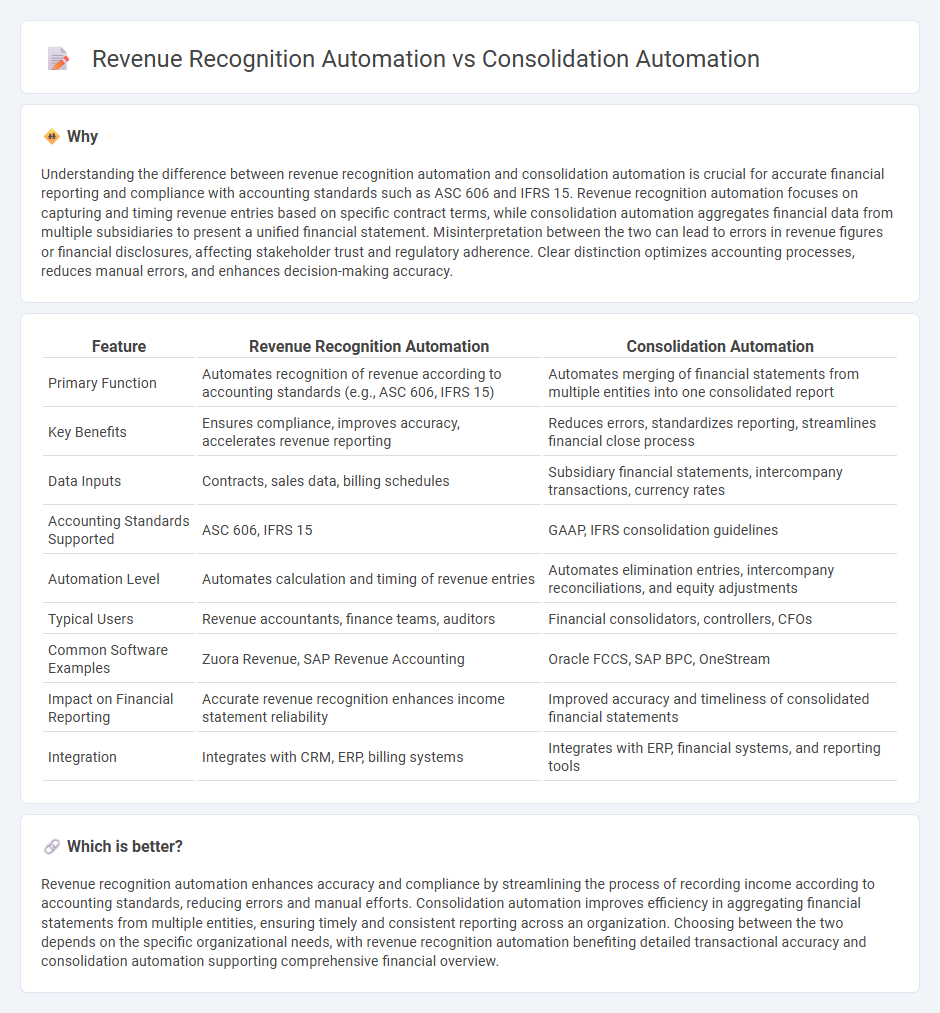

Understanding the difference between revenue recognition automation and consolidation automation is crucial for accurate financial reporting and compliance with accounting standards such as ASC 606 and IFRS 15. Revenue recognition automation focuses on capturing and timing revenue entries based on specific contract terms, while consolidation automation aggregates financial data from multiple subsidiaries to present a unified financial statement. Misinterpretation between the two can lead to errors in revenue figures or financial disclosures, affecting stakeholder trust and regulatory adherence. Clear distinction optimizes accounting processes, reduces manual errors, and enhances decision-making accuracy.

Comparison Table

| Feature | Revenue Recognition Automation | Consolidation Automation |

|---|---|---|

| Primary Function | Automates recognition of revenue according to accounting standards (e.g., ASC 606, IFRS 15) | Automates merging of financial statements from multiple entities into one consolidated report |

| Key Benefits | Ensures compliance, improves accuracy, accelerates revenue reporting | Reduces errors, standardizes reporting, streamlines financial close process |

| Data Inputs | Contracts, sales data, billing schedules | Subsidiary financial statements, intercompany transactions, currency rates |

| Accounting Standards Supported | ASC 606, IFRS 15 | GAAP, IFRS consolidation guidelines |

| Automation Level | Automates calculation and timing of revenue entries | Automates elimination entries, intercompany reconciliations, and equity adjustments |

| Typical Users | Revenue accountants, finance teams, auditors | Financial consolidators, controllers, CFOs |

| Common Software Examples | Zuora Revenue, SAP Revenue Accounting | Oracle FCCS, SAP BPC, OneStream |

| Impact on Financial Reporting | Accurate revenue recognition enhances income statement reliability | Improved accuracy and timeliness of consolidated financial statements |

| Integration | Integrates with CRM, ERP, billing systems | Integrates with ERP, financial systems, and reporting tools |

Which is better?

Revenue recognition automation enhances accuracy and compliance by streamlining the process of recording income according to accounting standards, reducing errors and manual efforts. Consolidation automation improves efficiency in aggregating financial statements from multiple entities, ensuring timely and consistent reporting across an organization. Choosing between the two depends on the specific organizational needs, with revenue recognition automation benefiting detailed transactional accuracy and consolidation automation supporting comprehensive financial overview.

Connection

Revenue recognition automation streamlines the tracking and recording of sales income by applying standardized rules and real-time data integration, while consolidation automation aggregates financial data from multiple subsidiaries to produce unified financial statements. Both processes rely on accurate, timely data inputs and consistent application of accounting policies, enabling seamless integration of revenue figures into consolidated reports. This connection reduces errors, accelerates financial close cycles, and enhances compliance with accounting standards such as IFRS 15 and ASC 606.

Key Terms

**Consolidation Automation:**

Consolidation automation streamlines financial data aggregation from multiple subsidiaries, ensuring accuracy and compliance with accounting standards like IFRS and GAAP. It reduces manual errors and accelerates the closing process by automating tasks such as intercompany eliminations and currency translations. Discover how consolidation automation can transform your financial reporting efficiency.

Intercompany Eliminations

Consolidation automation streamlines the process of aggregating financial data from multiple entities, emphasizing accurate intercompany eliminations to prevent double counting of transactions and balances. Revenue recognition automation ensures compliance with accounting standards by systematically capturing revenue events, yet it must also address intercompany sales to avoid inflating group revenue figures. Explore how integrated solutions can enhance the accuracy and efficiency of intercompany eliminations across both consolidation and revenue recognition processes.

Financial Close

Consolidation automation streamlines the process of aggregating financial data from multiple subsidiaries, ensuring accuracy and compliance during the financial close. Revenue recognition automation focuses on applying consistent revenue recognition standards per ASC 606 or IFRS 15, reducing errors and accelerating close cycles. Explore how integrating both automation solutions can optimize your financial close efficiency and accuracy.

Source and External Links

CCH Tagetik Financial Consolidation - AI-powered automation handles intercompany eliminations, currency conversions, and compliance for complex global groups, delivering faster, more accurate consolidation than manual processes.

Top 20 Financial Consolidation Tools For 2025 - Automated systems like BlackLine and Trintech enable real-time consolidated reporting, multi-GAAP/IFRS compliance, and end-to-end close process automation with robust audit trails.

Planful Financial Consolidation Software - Automates data load, validation, eliminations, and recurring entries to streamline the close cycle, reduce risk, and deliver consolidated reports in hours instead of days.

dowidth.com

dowidth.com