Microtransaction accounting involves tracking small, frequent financial transactions typically found in digital platforms and gaming economies, requiring precise record-keeping to manage high volumes of low-value sales. Revenue recognition focuses on the timing and criteria for reporting income in financial statements, ensuring compliance with accounting standards like IFRS 15 or ASC 606. Explore detailed insights into how these accounting practices impact financial transparency and business decision-making.

Why it is important

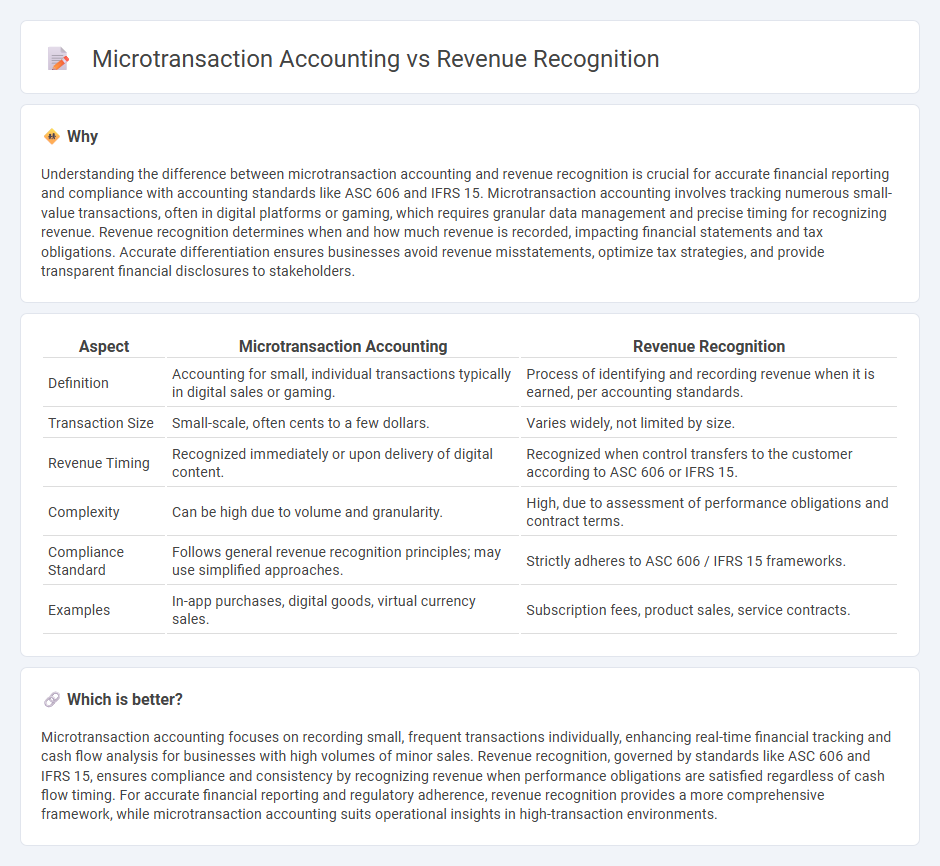

Understanding the difference between microtransaction accounting and revenue recognition is crucial for accurate financial reporting and compliance with accounting standards like ASC 606 and IFRS 15. Microtransaction accounting involves tracking numerous small-value transactions, often in digital platforms or gaming, which requires granular data management and precise timing for recognizing revenue. Revenue recognition determines when and how much revenue is recorded, impacting financial statements and tax obligations. Accurate differentiation ensures businesses avoid revenue misstatements, optimize tax strategies, and provide transparent financial disclosures to stakeholders.

Comparison Table

| Aspect | Microtransaction Accounting | Revenue Recognition |

|---|---|---|

| Definition | Accounting for small, individual transactions typically in digital sales or gaming. | Process of identifying and recording revenue when it is earned, per accounting standards. |

| Transaction Size | Small-scale, often cents to a few dollars. | Varies widely, not limited by size. |

| Revenue Timing | Recognized immediately or upon delivery of digital content. | Recognized when control transfers to the customer according to ASC 606 or IFRS 15. |

| Complexity | Can be high due to volume and granularity. | High, due to assessment of performance obligations and contract terms. |

| Compliance Standard | Follows general revenue recognition principles; may use simplified approaches. | Strictly adheres to ASC 606 / IFRS 15 frameworks. |

| Examples | In-app purchases, digital goods, virtual currency sales. | Subscription fees, product sales, service contracts. |

Which is better?

Microtransaction accounting focuses on recording small, frequent transactions individually, enhancing real-time financial tracking and cash flow analysis for businesses with high volumes of minor sales. Revenue recognition, governed by standards like ASC 606 and IFRS 15, ensures compliance and consistency by recognizing revenue when performance obligations are satisfied regardless of cash flow timing. For accurate financial reporting and regulatory adherence, revenue recognition provides a more comprehensive framework, while microtransaction accounting suits operational insights in high-transaction environments.

Connection

Microtransaction accounting requires precise tracking of small-value transactions to ensure accurate financial reporting. Revenue recognition principles dictate when and how these microtransactions are recorded as income, often involving real-time data processing due to their volume and frequency. Proper integration of microtransaction accounting with revenue recognition standards ensures compliance with accounting frameworks like IFRS 15 or ASC 606, enhancing transparency and financial accuracy.

Key Terms

Performance Obligations

Revenue recognition under ASC 606 focuses on identifying and satisfying performance obligations as distinct promises within a contract, recognizing revenue when control transfers to the customer. Microtransaction accounting requires detailed tracking of numerous small transactions, often involving virtual goods or services, where each microtransaction represents a separate performance obligation. Explore our in-depth analysis to understand how these concepts impact financial reporting and compliance.

Deferred Revenue

Deferred revenue arises when businesses receive payments before delivering goods or services and is a key concept in revenue recognition. In microtransaction accounting, deferred revenue represents funds from small, often digital purchases that are recorded as liabilities until the related content or service is provided. Explore how accurately managing deferred revenue in microtransactions ensures compliance with accounting standards and maintains financial transparency.

Virtual Goods

Revenue recognition for virtual goods typically follows the ASC 606 standard, which requires identifying performance obligations and recognizing revenue as those obligations are satisfied, ensuring accuracy in timing and amount. Microtransaction accounting involves handling numerous small-value sales in real time, requiring robust systems to track and record revenue efficiently, often involving deferred revenue recognition until delivery or consumption of the virtual good. Explore deeper insights into how companies optimize revenue frameworks and regulatory compliance for virtual goods through microtransaction models.

Source and External Links

Revenue Recognition: Principles and 5-Step Model - NetSuite - Revenue recognition is an accounting principle stating revenue must be recognized as earned, following a five-step model: identify the contract, identify performance obligations, determine transaction price, allocate price to obligations, and recognize revenue when obligations are satisfied.

Revenue recognition principles & best practices - Stripe - Revenue recognition is governed by GAAP and IFRS standards (ASC 606 and IFRS 15) which dictate that revenue is recognized when earned, not when payment is received, enhancing consistency and transparency across industries worldwide.

Revenue recognition - Wikipedia - Revenue is recognized when it is realized or realizable, not upon receipt of cash; advance payments are recorded as deferred revenue (a liability) until the related goods or services are delivered or rendered.

dowidth.com

dowidth.com