Cryptocurrency auditing focuses on verifying blockchain transactions, wallet holdings, and smart contract compliance, ensuring accuracy and fraud prevention within decentralized finance systems. Process auditing evaluates internal controls, workflows, and operational procedures to optimize efficiency and regulatory adherence in traditional financial environments. Explore further to understand how these auditing approaches impact organizational transparency and risk management.

Why it is important

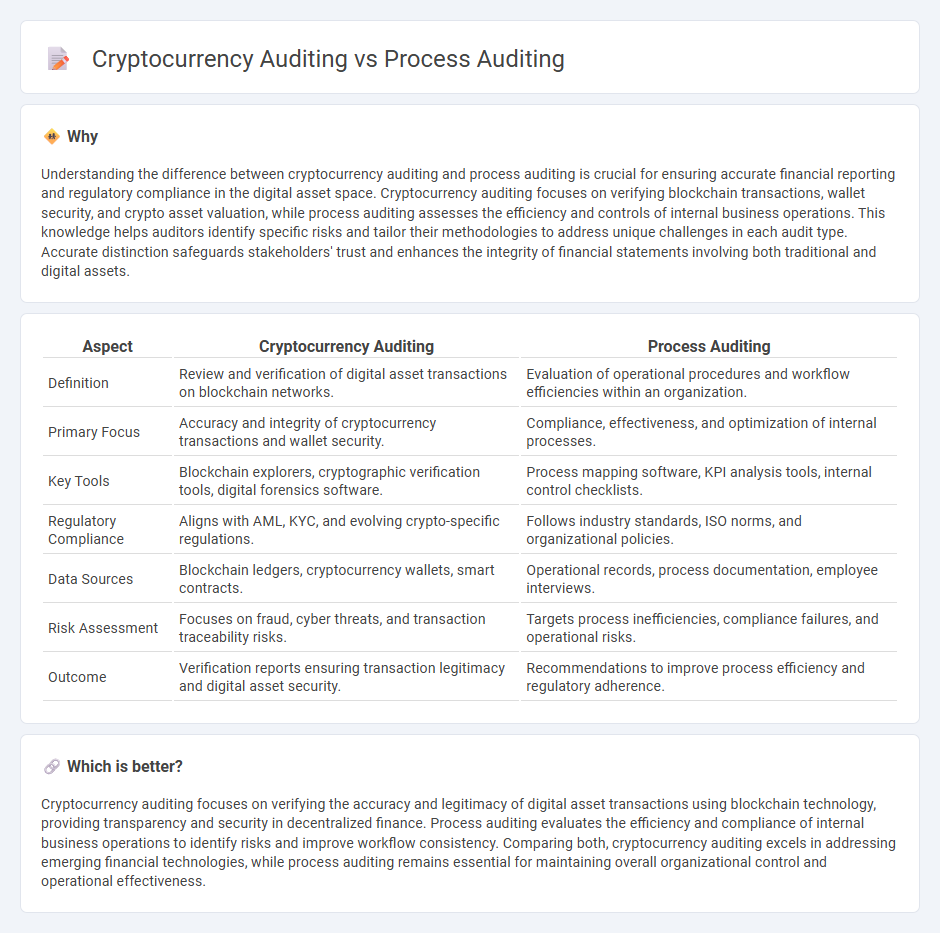

Understanding the difference between cryptocurrency auditing and process auditing is crucial for ensuring accurate financial reporting and regulatory compliance in the digital asset space. Cryptocurrency auditing focuses on verifying blockchain transactions, wallet security, and crypto asset valuation, while process auditing assesses the efficiency and controls of internal business operations. This knowledge helps auditors identify specific risks and tailor their methodologies to address unique challenges in each audit type. Accurate distinction safeguards stakeholders' trust and enhances the integrity of financial statements involving both traditional and digital assets.

Comparison Table

| Aspect | Cryptocurrency Auditing | Process Auditing |

|---|---|---|

| Definition | Review and verification of digital asset transactions on blockchain networks. | Evaluation of operational procedures and workflow efficiencies within an organization. |

| Primary Focus | Accuracy and integrity of cryptocurrency transactions and wallet security. | Compliance, effectiveness, and optimization of internal processes. |

| Key Tools | Blockchain explorers, cryptographic verification tools, digital forensics software. | Process mapping software, KPI analysis tools, internal control checklists. |

| Regulatory Compliance | Aligns with AML, KYC, and evolving crypto-specific regulations. | Follows industry standards, ISO norms, and organizational policies. |

| Data Sources | Blockchain ledgers, cryptocurrency wallets, smart contracts. | Operational records, process documentation, employee interviews. |

| Risk Assessment | Focuses on fraud, cyber threats, and transaction traceability risks. | Targets process inefficiencies, compliance failures, and operational risks. |

| Outcome | Verification reports ensuring transaction legitimacy and digital asset security. | Recommendations to improve process efficiency and regulatory adherence. |

Which is better?

Cryptocurrency auditing focuses on verifying the accuracy and legitimacy of digital asset transactions using blockchain technology, providing transparency and security in decentralized finance. Process auditing evaluates the efficiency and compliance of internal business operations to identify risks and improve workflow consistency. Comparing both, cryptocurrency auditing excels in addressing emerging financial technologies, while process auditing remains essential for maintaining overall organizational control and operational effectiveness.

Connection

Cryptocurrency auditing involves verifying digital asset transactions and wallet security to ensure compliance with financial regulations, while process auditing evaluates the effectiveness and efficiency of organizational procedures. The connection lies in process auditing providing a framework to assess and improve the internal controls specific to cryptocurrency transactions, enhancing accuracy and fraud prevention. Integrating process audits into cryptocurrency auditing strengthens risk management and financial reporting integrity within blockchain-based accounting systems.

Key Terms

Process Auditing:

Process auditing systematically evaluates business workflows to ensure compliance, efficiency, and effectiveness in achieving organizational goals. It identifies process deviations, control weaknesses, and opportunities for improvement through detailed examination of documentation and operational practices. Explore how process auditing enhances operational integrity and supports continuous improvement.

Internal Controls

Process auditing emphasizes evaluating internal controls to ensure operational efficiency, compliance, and risk management across business processes. Cryptocurrency auditing focuses on verifying digital asset transactions, blockchain integrity, and security protocols that protect against fraud and cyber threats. Explore detailed insights into how internal controls differ in traditional process auditing versus cryptocurrency auditing.

Compliance

Process auditing in compliance focuses on evaluating internal controls, operational procedures, and adherence to regulatory standards to ensure organizational efficiency and risk management. Cryptocurrency auditing emphasizes verifying digital asset transactions, wallet security, and compliance with blockchain regulations and anti-money laundering (AML) laws. Explore detailed insights into both auditing approaches to enhance your compliance strategy.

Source and External Links

The Definitive Guide to Process Auditing: Benefits and Best ... - A process audit evaluates the effectiveness, efficiency, and compliance of an organization's processes through documentation review, observation, performance analysis, interviews, and control testing to identify opportunities for improvement and ensure adherence to standards.

Business Process Audit: What & Why it is important? - A process audit is a structured review of organizational processes to identify inefficiencies, gaps, and improvement areas, helping businesses streamline operations, maintain quality, and achieve goals by documenting and analyzing how tasks are performed.

6 Steps Of A Successful Business Process Audit - A business process audit systematically examines workflows, procedures, and resource use to uncover inefficiencies and bottlenecks, aiming to optimize operations, reduce costs, and ensure regulatory compliance.

dowidth.com

dowidth.com