Fair value measurement reflects the current market price of an asset or liability, offering a more accurate and timely valuation compared to book value, which records historical costs less depreciation. This approach enhances financial statement transparency and aligns asset values with real-time market conditions. Explore how fair value and book value impact financial reporting and decision-making.

Why it is important

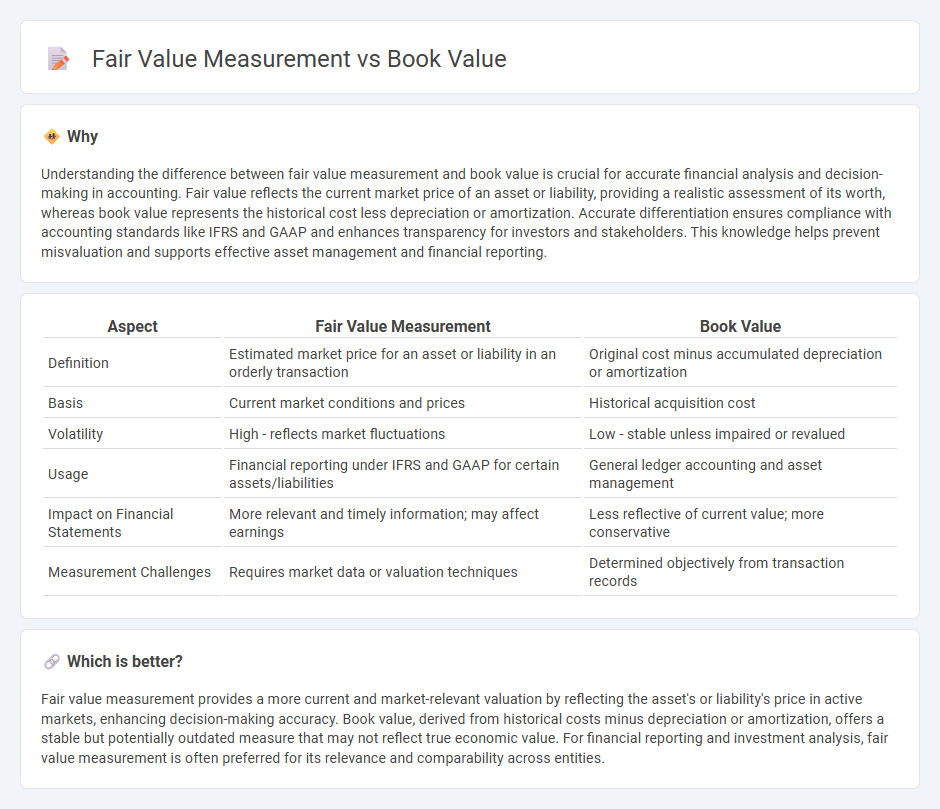

Understanding the difference between fair value measurement and book value is crucial for accurate financial analysis and decision-making in accounting. Fair value reflects the current market price of an asset or liability, providing a realistic assessment of its worth, whereas book value represents the historical cost less depreciation or amortization. Accurate differentiation ensures compliance with accounting standards like IFRS and GAAP and enhances transparency for investors and stakeholders. This knowledge helps prevent misvaluation and supports effective asset management and financial reporting.

Comparison Table

| Aspect | Fair Value Measurement | Book Value |

|---|---|---|

| Definition | Estimated market price for an asset or liability in an orderly transaction | Original cost minus accumulated depreciation or amortization |

| Basis | Current market conditions and prices | Historical acquisition cost |

| Volatility | High - reflects market fluctuations | Low - stable unless impaired or revalued |

| Usage | Financial reporting under IFRS and GAAP for certain assets/liabilities | General ledger accounting and asset management |

| Impact on Financial Statements | More relevant and timely information; may affect earnings | Less reflective of current value; more conservative |

| Measurement Challenges | Requires market data or valuation techniques | Determined objectively from transaction records |

Which is better?

Fair value measurement provides a more current and market-relevant valuation by reflecting the asset's or liability's price in active markets, enhancing decision-making accuracy. Book value, derived from historical costs minus depreciation or amortization, offers a stable but potentially outdated measure that may not reflect true economic value. For financial reporting and investment analysis, fair value measurement is often preferred for its relevance and comparability across entities.

Connection

Fair value measurement and book value are interrelated accounting concepts used to assess an asset's worth. Fair value represents the estimated market price in an orderly transaction between market participants, while book value reflects the asset's recorded cost minus accumulated depreciation or impairment. Understanding their connection helps in accurate financial reporting and asset valuation, impacting investment decisions and compliance with accounting standards like IFRS and GAAP.

Key Terms

Historical Cost

Book value measurement relies on historical cost, recording assets and liabilities at their original purchase price minus depreciation or amortization. Fair value measurement, however, estimates current market prices reflecting present economic conditions, often leading to fluctuating asset valuations. Explore the differences and implications of these valuation methods to understand their impact on financial reporting.

Market Value

Book value represents an asset's value recorded on the balance sheet, reflecting its original cost minus depreciation, while fair value measurement aims to estimate the asset's current market value based on market conditions and comparable transactions. Market value, a critical component of fair value, denotes the price an asset would fetch in an open and competitive market between willing buyers and sellers. Explore further to understand how market value impacts financial reporting and investment decisions.

Impairment

Book value represents the original cost of an asset minus accumulated depreciation or impairment losses, reflecting its carrying amount on the balance sheet. Fair value measurement estimates an asset's current market price, providing a more accurate basis for assessing impairment by comparing recoverable amounts to book value. Explore in-depth analysis and examples to understand how impairment impacts financial reporting and asset valuation.

Source and External Links

Book Value - Definition, Importance, Issue - Book value is a company's equity value as reported in its financial statements, calculated by subtracting liabilities from total assets, and is crucial for investors seeking to find stocks trading below book value for potential gains.

What is Book Value? (Formula & Why Investors Care) - Book value represents a company's net value of assets, calculated as total assets minus total liabilities, reflecting the net worth if the business liquidates its assets and pays off debts.

Book value - Book value is the value of an asset or equity based on its balance sheet amount (assets minus liabilities), often expressed per share, and is used as a valuation metric especially in the price/book financial ratio to indicate a stock's floor price.

dowidth.com

dowidth.com