Continuous audit employs automated tools and real-time data analysis to monitor financial transactions and controls constantly, ensuring immediate detection of anomalies and compliance issues. Periodic audit, on the other hand, involves scheduled, retrospective examination of financial records at specific intervals, which may delay the identification of errors or fraud. Explore deeper insights on how continuous and periodic audits impact financial accuracy and risk management.

Why it is important

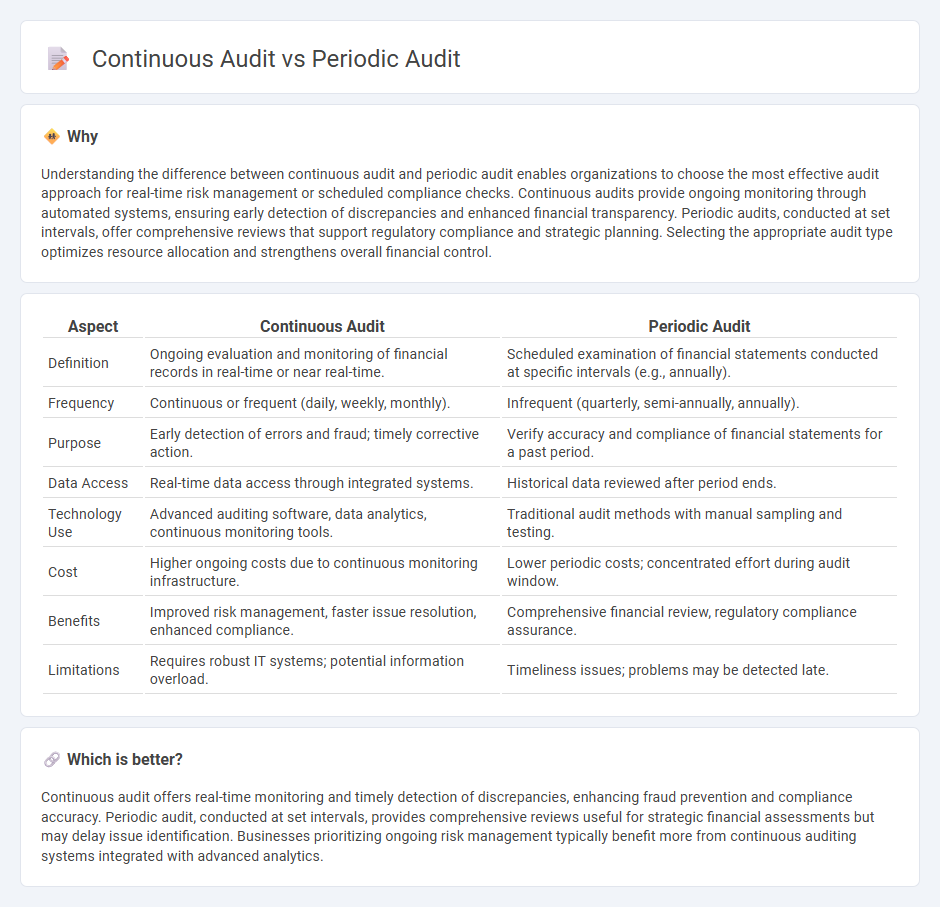

Understanding the difference between continuous audit and periodic audit enables organizations to choose the most effective audit approach for real-time risk management or scheduled compliance checks. Continuous audits provide ongoing monitoring through automated systems, ensuring early detection of discrepancies and enhanced financial transparency. Periodic audits, conducted at set intervals, offer comprehensive reviews that support regulatory compliance and strategic planning. Selecting the appropriate audit type optimizes resource allocation and strengthens overall financial control.

Comparison Table

| Aspect | Continuous Audit | Periodic Audit |

|---|---|---|

| Definition | Ongoing evaluation and monitoring of financial records in real-time or near real-time. | Scheduled examination of financial statements conducted at specific intervals (e.g., annually). |

| Frequency | Continuous or frequent (daily, weekly, monthly). | Infrequent (quarterly, semi-annually, annually). |

| Purpose | Early detection of errors and fraud; timely corrective action. | Verify accuracy and compliance of financial statements for a past period. |

| Data Access | Real-time data access through integrated systems. | Historical data reviewed after period ends. |

| Technology Use | Advanced auditing software, data analytics, continuous monitoring tools. | Traditional audit methods with manual sampling and testing. |

| Cost | Higher ongoing costs due to continuous monitoring infrastructure. | Lower periodic costs; concentrated effort during audit window. |

| Benefits | Improved risk management, faster issue resolution, enhanced compliance. | Comprehensive financial review, regulatory compliance assurance. |

| Limitations | Requires robust IT systems; potential information overload. | Timeliness issues; problems may be detected late. |

Which is better?

Continuous audit offers real-time monitoring and timely detection of discrepancies, enhancing fraud prevention and compliance accuracy. Periodic audit, conducted at set intervals, provides comprehensive reviews useful for strategic financial assessments but may delay issue identification. Businesses prioritizing ongoing risk management typically benefit more from continuous auditing systems integrated with advanced analytics.

Connection

Continuous audit leverages real-time data analysis and automated controls to provide ongoing assurance of financial transactions, while periodic audit evaluates cumulative financial records at set intervals to verify accuracy and compliance. Both audit types complement each other by enhancing risk detection and improving financial reporting reliability through integrated data review and testing processes. Implementing a hybrid audit approach optimizes internal controls and strengthens overall corporate governance.

Key Terms

Frequency

Periodic audits occur at fixed intervals, such as quarterly or annually, providing a comprehensive snapshot of financial or operational status at specific points in time. Continuous audits utilize automated tools and real-time data analysis to monitor and evaluate activities on an ongoing basis, enabling faster identification of discrepancies and risks. Explore detailed comparisons to understand which audit frequency best suits your organizational needs.

Scope

Periodic audit typically examines financial statements or operations over a specific past period, offering a snapshot evaluation with a defined start and end date. Continuous audit involves ongoing monitoring and assessment, providing real-time or near-real-time insights into the entire scope of processes or controls. Explore detailed comparisons to understand how audit scope influences compliance and risk management strategies.

Timeliness

Periodic audits occur at set intervals, often quarterly or annually, potentially delaying the identification of issues due to their retrospective nature. Continuous audits leverage real-time data analytics and automated processes to provide immediate insights, enabling faster detection and resolution of discrepancies. Explore our in-depth comparison to understand how audit timeliness impacts business risk management and compliance.

Source and External Links

Periodic Audit: Understanding Its Legal Definition and Importance - A periodic audit is an evaluation conducted at regular intervals to ensure an organization manages its federal awards in compliance with terms and conditions, focusing on overall compliance rather than individual awards.

What is periodic audit? Simple Definition & Meaning - LSD.Law - A periodic audit is a regular examination of financial records, compliance, and overall condition of an individual or organization, helping identify issues early and ensuring proper order.

Connecting the Dots: Periodic Audit Requirement - Financial Data - Periodic audits are mandated for managed care plans to assess accuracy and completeness of financial and encounter data, often required at least every three years as part of regulatory compliance.

dowidth.com

dowidth.com