Revenue recognition automation streamlines the process of recording income by automatically matching transactions with delivery and contract terms, ensuring compliance with ASC 606 standards. Accrual accounting automation enhances financial accuracy by systematically capturing expenses and revenues when they are incurred, regardless of cash flow timing, aligning with GAAP principles. Explore how integrating these automation tools can optimize your financial reporting and compliance.

Why it is important

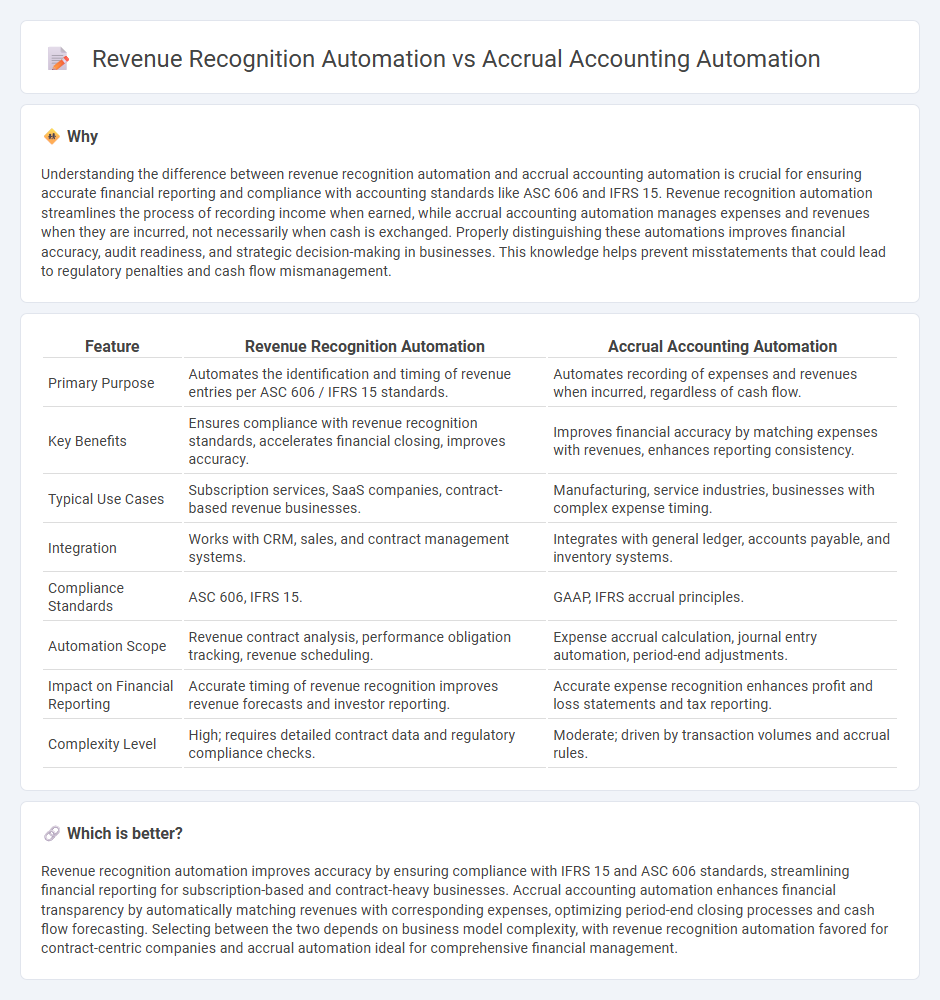

Understanding the difference between revenue recognition automation and accrual accounting automation is crucial for ensuring accurate financial reporting and compliance with accounting standards like ASC 606 and IFRS 15. Revenue recognition automation streamlines the process of recording income when earned, while accrual accounting automation manages expenses and revenues when they are incurred, not necessarily when cash is exchanged. Properly distinguishing these automations improves financial accuracy, audit readiness, and strategic decision-making in businesses. This knowledge helps prevent misstatements that could lead to regulatory penalties and cash flow mismanagement.

Comparison Table

| Feature | Revenue Recognition Automation | Accrual Accounting Automation |

|---|---|---|

| Primary Purpose | Automates the identification and timing of revenue entries per ASC 606 / IFRS 15 standards. | Automates recording of expenses and revenues when incurred, regardless of cash flow. |

| Key Benefits | Ensures compliance with revenue recognition standards, accelerates financial closing, improves accuracy. | Improves financial accuracy by matching expenses with revenues, enhances reporting consistency. |

| Typical Use Cases | Subscription services, SaaS companies, contract-based revenue businesses. | Manufacturing, service industries, businesses with complex expense timing. |

| Integration | Works with CRM, sales, and contract management systems. | Integrates with general ledger, accounts payable, and inventory systems. |

| Compliance Standards | ASC 606, IFRS 15. | GAAP, IFRS accrual principles. |

| Automation Scope | Revenue contract analysis, performance obligation tracking, revenue scheduling. | Expense accrual calculation, journal entry automation, period-end adjustments. |

| Impact on Financial Reporting | Accurate timing of revenue recognition improves revenue forecasts and investor reporting. | Accurate expense recognition enhances profit and loss statements and tax reporting. |

| Complexity Level | High; requires detailed contract data and regulatory compliance checks. | Moderate; driven by transaction volumes and accrual rules. |

Which is better?

Revenue recognition automation improves accuracy by ensuring compliance with IFRS 15 and ASC 606 standards, streamlining financial reporting for subscription-based and contract-heavy businesses. Accrual accounting automation enhances financial transparency by automatically matching revenues with corresponding expenses, optimizing period-end closing processes and cash flow forecasting. Selecting between the two depends on business model complexity, with revenue recognition automation favored for contract-centric companies and accrual automation ideal for comprehensive financial management.

Connection

Revenue recognition automation streamlines the process of accurately recording income when it is earned, ensuring compliance with accounting standards like ASC 606 and IFRS 15. Accrual accounting automation complements this by systematically matching revenues with related expenses in the correct accounting periods, enhancing financial accuracy and reporting consistency. Integrating both automations reduces manual errors, accelerates financial close cycles, and improves real-time visibility into financial performance.

Key Terms

**Accrual Accounting Automation:**

Accrual accounting automation streamlines the process of recording revenues and expenses when they are incurred, regardless of cash flow, enhancing accuracy in financial statements and ensuring compliance with GAAP standards. It automates journal entries, matching expenses with revenues in the appropriate accounting periods, reducing manual errors and enabling real-time financial analysis. Explore how accrual accounting automation can improve your organization's financial efficiency and reporting precision.

Expense Matching

Accrual accounting automation streamlines the process of matching expenses to the period in which they are incurred, ensuring accurate financial statements by recognizing liabilities and expenses in the correct accounting period. Revenue recognition automation focuses on identifying when and how revenue should be recorded, often following specific standards like ASC 606, but it does not directly address the expense matching principle critical in accrual accounting. Explore more to understand how these automation tools enhance financial accuracy and compliance.

Accrual Entries

Accrual accounting automation streamlines the process of recording accrual entries by automatically capturing expenses and revenues that have been incurred but not yet recorded, ensuring accurate financial statements. Revenue recognition automation focuses specifically on adhering to accounting standards like ASC 606, optimizing the timing and accuracy of revenue recording. Discover how integrating accrual entries automation enhances financial precision in your organization.

Source and External Links

Accrual Automation: How To Improve Accrual Workflow ['25] - Accrual automation software automatically collects and analyzes financial data from multiple sources to identify and record accruals, streamlining the recognition of unpaid invoices and deferred revenues while providing real-time accrual visibility and reporting functions.

Accrual Accounting Automation - Alteryx - Automation in accrual accounting reduces manual labor by collecting and organizing accrual data from diverse sources, enabling faster, more consistent, and higher-quality financial reporting while facilitating compliance and forecasting.

5 Best Accrual Accounting Software Tools in 2025 - FinOptimal - Leading software such as FinOptimal's Accruer and QuickBooks offer automated accrual calculations, real-time reporting, and integration capabilities, helping businesses streamline accrual accounting with user-friendly interfaces and strong customer support.

dowidth.com

dowidth.com