Sustainability reporting focuses on disclosing environmental, social, and governance (ESG) performance to stakeholders, emphasizing transparency and compliance with global standards like GRI and SASB. Triple bottom line reporting evaluates organizational success across three dimensions: economic, social, and environmental impacts, integrating financial results with social equity and ecological stewardship. Explore the essential differences and benefits between these reporting frameworks to enhance corporate accountability and sustainable growth.

Why it is important

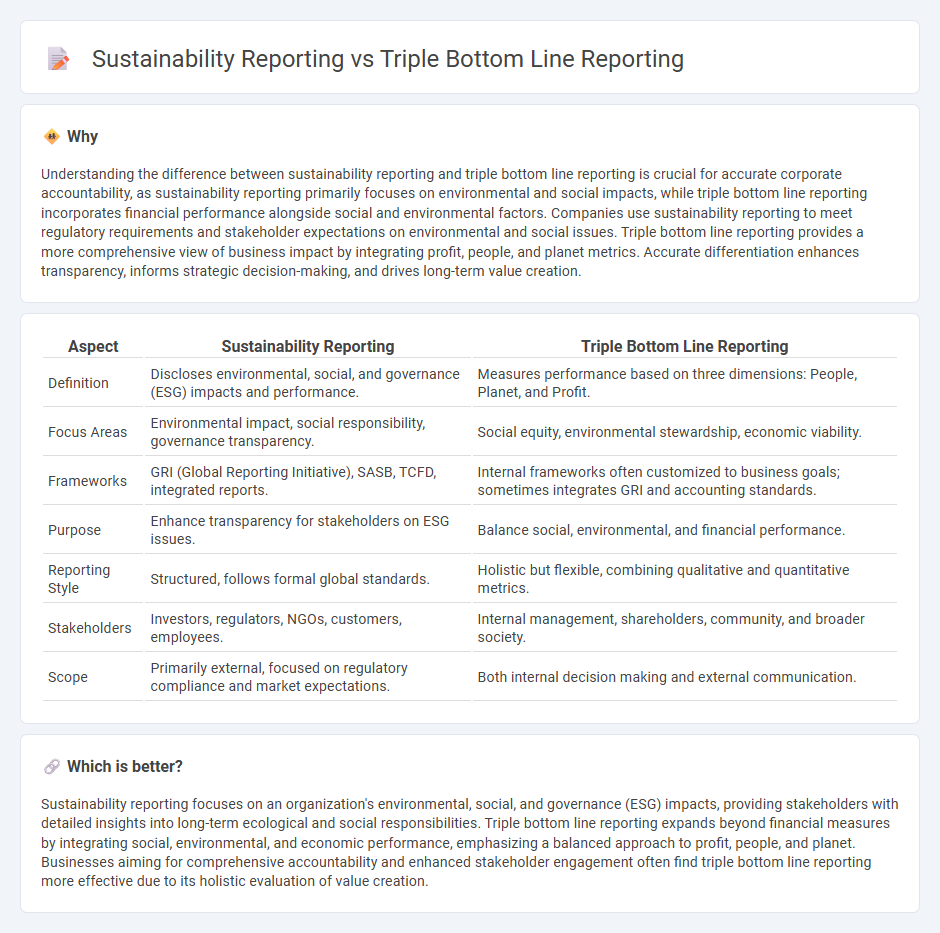

Understanding the difference between sustainability reporting and triple bottom line reporting is crucial for accurate corporate accountability, as sustainability reporting primarily focuses on environmental and social impacts, while triple bottom line reporting incorporates financial performance alongside social and environmental factors. Companies use sustainability reporting to meet regulatory requirements and stakeholder expectations on environmental and social issues. Triple bottom line reporting provides a more comprehensive view of business impact by integrating profit, people, and planet metrics. Accurate differentiation enhances transparency, informs strategic decision-making, and drives long-term value creation.

Comparison Table

| Aspect | Sustainability Reporting | Triple Bottom Line Reporting |

|---|---|---|

| Definition | Discloses environmental, social, and governance (ESG) impacts and performance. | Measures performance based on three dimensions: People, Planet, and Profit. |

| Focus Areas | Environmental impact, social responsibility, governance transparency. | Social equity, environmental stewardship, economic viability. |

| Frameworks | GRI (Global Reporting Initiative), SASB, TCFD, integrated reports. | Internal frameworks often customized to business goals; sometimes integrates GRI and accounting standards. |

| Purpose | Enhance transparency for stakeholders on ESG issues. | Balance social, environmental, and financial performance. |

| Reporting Style | Structured, follows formal global standards. | Holistic but flexible, combining qualitative and quantitative metrics. |

| Stakeholders | Investors, regulators, NGOs, customers, employees. | Internal management, shareholders, community, and broader society. |

| Scope | Primarily external, focused on regulatory compliance and market expectations. | Both internal decision making and external communication. |

Which is better?

Sustainability reporting focuses on an organization's environmental, social, and governance (ESG) impacts, providing stakeholders with detailed insights into long-term ecological and social responsibilities. Triple bottom line reporting expands beyond financial measures by integrating social, environmental, and economic performance, emphasizing a balanced approach to profit, people, and planet. Businesses aiming for comprehensive accountability and enhanced stakeholder engagement often find triple bottom line reporting more effective due to its holistic evaluation of value creation.

Connection

Sustainability reporting and triple bottom line reporting both emphasize measuring an organization's performance across environmental, social, and economic dimensions, integrating these factors into financial assessments. These reporting frameworks provide stakeholders with comprehensive insights into long-term value creation by highlighting impacts on natural resources, social equity, and corporate profitability. Incorporating sustainability and triple bottom line metrics enhances transparency and accountability in accounting practices, aligning business strategies with global sustainability goals.

Key Terms

Economic Profit

Triple bottom line reporting evaluates performance based on three pillars: economic profit, social impact, and environmental stewardship, emphasizing how economic profit integrates with broader sustainability goals. Sustainability reporting primarily focuses on environmental and social factors but increasingly incorporates economic profit to demonstrate long-term viability and value creation. Explore deeper insights into how economic profit drives comprehensive sustainability practices and reporting frameworks.

Environmental Impact

Triple bottom line reporting evaluates environmental impact alongside social and economic factors, offering a comprehensive framework for sustainability performance. Sustainability reporting primarily emphasizes environmental metrics such as carbon emissions, resource use, and ecological footprint, targeting eco-friendly practices and compliance. Explore more about how these reporting methods enhance corporate responsibility and environmental stewardship.

Social Responsibility

Triple bottom line reporting emphasizes the integration of social responsibility, environmental stewardship, and economic performance, highlighting how organizations impact communities and labor practices. Sustainability reporting primarily focuses on environmental and economic metrics but increasingly incorporates social responsibility elements such as human rights, diversity, and community engagement. Explore how these reporting frameworks uniquely address social responsibility to enhance corporate transparency and stakeholder trust.

Source and External Links

The Triple Bottom Line: What Is It and How Does It Work? - This article discusses the Triple Bottom Line as an accounting framework that includes social, environmental, and financial dimensions for measuring sustainability.

What is the triple bottom line and why is it important to your business - The triple bottom line is a framework emphasizing the importance of social, environmental, and financial concerns in business operations.

Sustainability management system: The Triple Bottom Line - This resource explores how the Triple Bottom Line method helps businesses measure their environmental, social, and economic impacts through a comprehensive sustainability framework.

dowidth.com

dowidth.com