Digital twin accounting creates a precise virtual replica of financial systems for real-time monitoring and simulation, enhancing accuracy in forecasting and decision-making. AI-powered accounting automates data processing and analysis using machine learning algorithms to optimize transaction management and detect anomalies efficiently. Discover how these cutting-edge technologies revolutionize financial operations and transform accounting practices.

Why it is important

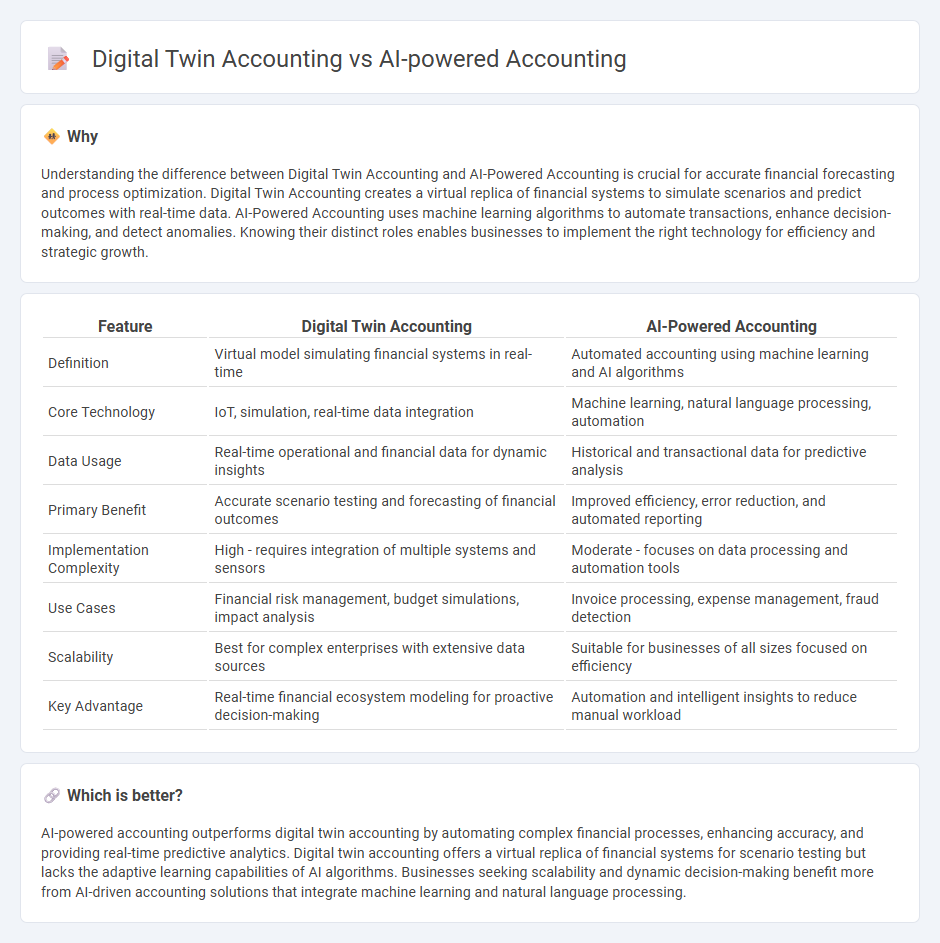

Understanding the difference between Digital Twin Accounting and AI-Powered Accounting is crucial for accurate financial forecasting and process optimization. Digital Twin Accounting creates a virtual replica of financial systems to simulate scenarios and predict outcomes with real-time data. AI-Powered Accounting uses machine learning algorithms to automate transactions, enhance decision-making, and detect anomalies. Knowing their distinct roles enables businesses to implement the right technology for efficiency and strategic growth.

Comparison Table

| Feature | Digital Twin Accounting | AI-Powered Accounting |

|---|---|---|

| Definition | Virtual model simulating financial systems in real-time | Automated accounting using machine learning and AI algorithms |

| Core Technology | IoT, simulation, real-time data integration | Machine learning, natural language processing, automation |

| Data Usage | Real-time operational and financial data for dynamic insights | Historical and transactional data for predictive analysis |

| Primary Benefit | Accurate scenario testing and forecasting of financial outcomes | Improved efficiency, error reduction, and automated reporting |

| Implementation Complexity | High - requires integration of multiple systems and sensors | Moderate - focuses on data processing and automation tools |

| Use Cases | Financial risk management, budget simulations, impact analysis | Invoice processing, expense management, fraud detection |

| Scalability | Best for complex enterprises with extensive data sources | Suitable for businesses of all sizes focused on efficiency |

| Key Advantage | Real-time financial ecosystem modeling for proactive decision-making | Automation and intelligent insights to reduce manual workload |

Which is better?

AI-powered accounting outperforms digital twin accounting by automating complex financial processes, enhancing accuracy, and providing real-time predictive analytics. Digital twin accounting offers a virtual replica of financial systems for scenario testing but lacks the adaptive learning capabilities of AI algorithms. Businesses seeking scalability and dynamic decision-making benefit more from AI-driven accounting solutions that integrate machine learning and natural language processing.

Connection

Digital twin accounting integrates with AI-powered accounting by creating dynamic virtual representations of financial processes, enabling real-time simulation and analysis of accounting data. AI algorithms enhance accuracy and predictive capabilities by continuously learning from these digital twins, optimizing financial forecasting and risk assessment. This synergy improves decision-making efficiency and automates complex accounting tasks, driving innovation in financial management.

Key Terms

**AI-powered accounting:**

AI-powered accounting leverages machine learning algorithms to automate data entry, detect anomalies, and optimize financial forecasting, significantly reducing human error and enhancing decision-making speed. This approach integrates natural language processing to interpret unstructured financial data, improving accuracy and compliance monitoring. Explore how AI-powered accounting transforms financial operations and drives efficiency in modern businesses.

Machine Learning

AI-powered accounting leverages machine learning algorithms to automate tasks such as invoice processing, fraud detection, and financial forecasting, enhancing accuracy and efficiency. Digital twin accounting integrates machine learning with real-time digital replicas of financial systems, enabling dynamic scenario analysis and predictive insights for more informed decision-making. Explore the benefits and applications of these advanced accounting technologies to transform your financial operations.

Automation

AI-powered accounting leverages machine learning algorithms to automate repetitive tasks such as invoice processing, expense categorization, and fraud detection, significantly increasing accuracy and efficiency. Digital twin accounting creates a virtual replica of financial processes, enabling real-time simulation and scenario analysis to optimize automation workflows and anticipate challenges. Explore how these advanced technologies transform financial operations with precision and innovation.

Source and External Links

Trullion: AI-Powered Accounting Software Solutions - Trullion uses AI and GenAI to automate and streamline critical accounting workflows like lease accounting, audit readiness, and revenue recognition, providing a cloud-based platform for improved accuracy and efficiency in finance teams.

Accounting and AI: How AI & ML Impact Finance Teams | Paylocity - AI in accounting automates repetitive tasks, increases accuracy, enables real-time monitoring, improves fraud detection, supports compliance, and enhances decision-making and productivity for finance professionals.

AI in Accounting | Xero US - AI tools in accounting software simplify data entry, bank and invoice reconciliation, and forecasting, while also improving auditing through anomaly detection and more precise fraud identification.

dowidth.com

dowidth.com