Continuous close in accounting involves real-time transaction recording and ongoing financial updates, enhancing accuracy and timeliness in financial reporting. Rolling close refers to a systematic process where financial statements are prepared on a recurring basis, often overlapping fiscal periods to reduce closing cycle time. Discover how these modern closing methods improve financial efficiency and decision-making.

Why it is important

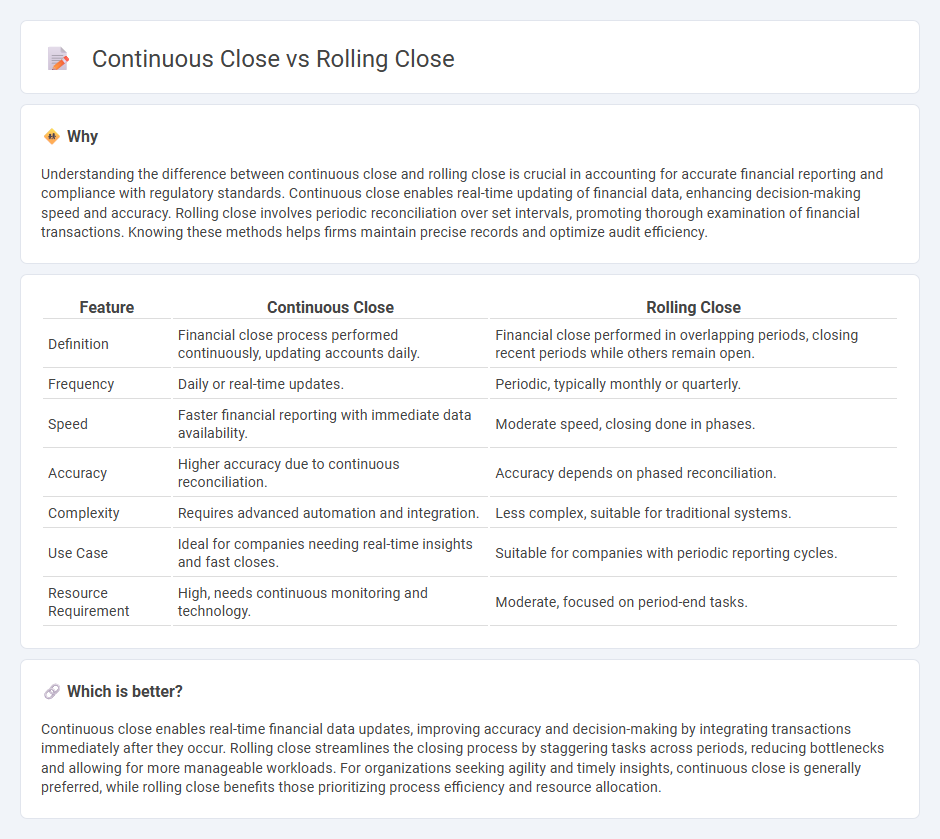

Understanding the difference between continuous close and rolling close is crucial in accounting for accurate financial reporting and compliance with regulatory standards. Continuous close enables real-time updating of financial data, enhancing decision-making speed and accuracy. Rolling close involves periodic reconciliation over set intervals, promoting thorough examination of financial transactions. Knowing these methods helps firms maintain precise records and optimize audit efficiency.

Comparison Table

| Feature | Continuous Close | Rolling Close |

|---|---|---|

| Definition | Financial close process performed continuously, updating accounts daily. | Financial close performed in overlapping periods, closing recent periods while others remain open. |

| Frequency | Daily or real-time updates. | Periodic, typically monthly or quarterly. |

| Speed | Faster financial reporting with immediate data availability. | Moderate speed, closing done in phases. |

| Accuracy | Higher accuracy due to continuous reconciliation. | Accuracy depends on phased reconciliation. |

| Complexity | Requires advanced automation and integration. | Less complex, suitable for traditional systems. |

| Use Case | Ideal for companies needing real-time insights and fast closes. | Suitable for companies with periodic reporting cycles. |

| Resource Requirement | High, needs continuous monitoring and technology. | Moderate, focused on period-end tasks. |

Which is better?

Continuous close enables real-time financial data updates, improving accuracy and decision-making by integrating transactions immediately after they occur. Rolling close streamlines the closing process by staggering tasks across periods, reducing bottlenecks and allowing for more manageable workloads. For organizations seeking agility and timely insights, continuous close is generally preferred, while rolling close benefits those prioritizing process efficiency and resource allocation.

Connection

Continuous close and rolling close are interconnected accounting processes designed to enhance financial reporting efficiency and accuracy. Continuous close involves the ongoing reconciliation and validation of accounting data throughout the period, while rolling close extends this by overlapping reporting periods to provide real-time financial insights. Both methods reduce the time between period-end and financial statement finalization, enabling faster decision-making and improved compliance.

Key Terms

Period-End Processing

Rolling close accelerates period-end processing by continuously updating financial data throughout the accounting cycle, reducing bottlenecks at month-end. Continuous close extends this approach by integrating real-time data validation and automation across departments, leading to enhanced accuracy and faster reporting. Explore how implementing rolling and continuous close strategies can streamline your financial close process and improve overall efficiency.

Real-Time Data Entry

Rolling close enables businesses to finalize financial data progressively throughout the accounting period, enhancing accuracy in real-time data entry by minimizing delays and manual adjustments. Continuous close integrates real-time data entry with automated workflows, ensuring up-to-date financial reporting without waiting for period-end closings. Explore how these advanced closing methods optimize financial processes and improve decision-making accuracy.

Automation

Rolling close automates financial reporting by sequentially closing accounts over several days, improving accuracy and reducing manual errors. Continuous close leverages real-time data integration and automation to maintain up-to-date financial statements daily, enhancing decision-making speed. Explore more to understand how these automation techniques can transform your financial close processes.

Source and External Links

What is a Rolling Close? - A Rolling Close is a disbursement of funds from escrow to the issuer before the offering deadline, allowing the company to receive funds in stages and investors to withdraw before each closing.

Rolling Close - A rolling close means an offering has multiple closing dates, enabling a company to accept funds as soon as the first investor is ready, accommodating different investors' timing.

What does Rolling Close mean | Startup Fundraising ... - A rolling close is a fundraising strategy where startups close funding rounds in stages, securing capital as they meet milestones throughout the process.

dowidth.com

dowidth.com