Tax technology leverages automation and artificial intelligence to streamline tax compliance, improve accuracy, and enhance data management for businesses. Budgeting and forecasting tools utilize predictive analytics and real-time financial data to optimize financial planning and resource allocation. Explore these technologies to understand how they transform accounting processes and drive strategic decision-making.

Why it is important

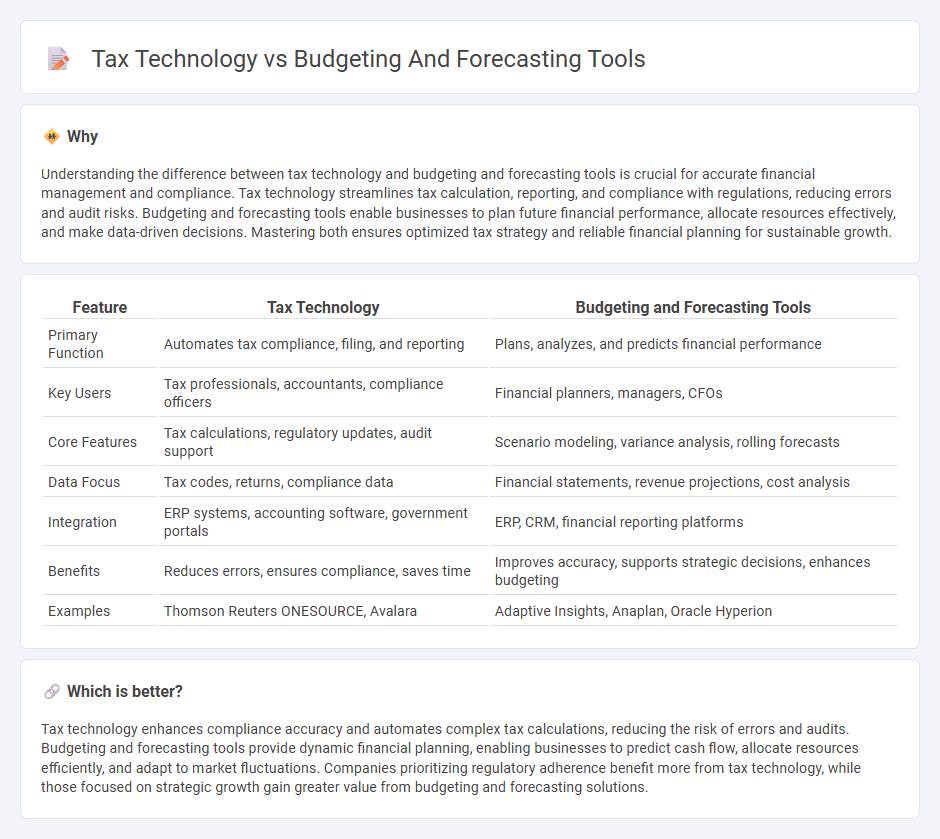

Understanding the difference between tax technology and budgeting and forecasting tools is crucial for accurate financial management and compliance. Tax technology streamlines tax calculation, reporting, and compliance with regulations, reducing errors and audit risks. Budgeting and forecasting tools enable businesses to plan future financial performance, allocate resources effectively, and make data-driven decisions. Mastering both ensures optimized tax strategy and reliable financial planning for sustainable growth.

Comparison Table

| Feature | Tax Technology | Budgeting and Forecasting Tools |

|---|---|---|

| Primary Function | Automates tax compliance, filing, and reporting | Plans, analyzes, and predicts financial performance |

| Key Users | Tax professionals, accountants, compliance officers | Financial planners, managers, CFOs |

| Core Features | Tax calculations, regulatory updates, audit support | Scenario modeling, variance analysis, rolling forecasts |

| Data Focus | Tax codes, returns, compliance data | Financial statements, revenue projections, cost analysis |

| Integration | ERP systems, accounting software, government portals | ERP, CRM, financial reporting platforms |

| Benefits | Reduces errors, ensures compliance, saves time | Improves accuracy, supports strategic decisions, enhances budgeting |

| Examples | Thomson Reuters ONESOURCE, Avalara | Adaptive Insights, Anaplan, Oracle Hyperion |

Which is better?

Tax technology enhances compliance accuracy and automates complex tax calculations, reducing the risk of errors and audits. Budgeting and forecasting tools provide dynamic financial planning, enabling businesses to predict cash flow, allocate resources efficiently, and adapt to market fluctuations. Companies prioritizing regulatory adherence benefit more from tax technology, while those focused on strategic growth gain greater value from budgeting and forecasting solutions.

Connection

Tax technology integrates automated data processing and compliance features that enhance the accuracy and efficiency of budgeting and forecasting tools by providing real-time tax data and analytics. These interconnected systems enable accountants to incorporate tax implications directly into financial projections, improving the precision of cash flow forecasts and expense management. Leveraging tax technology within budgeting software reduces risks of errors and ensures regulatory adherence, optimizing overall financial planning and decision-making processes.

Key Terms

**Budgeting and forecasting tools:**

Budgeting and forecasting tools leverage advanced algorithms and real-time data integration to enhance financial planning accuracy and operational efficiency across industries. These platforms often include features like predictive analytics, scenario modeling, and automated reporting, enabling businesses to optimize resource allocation and anticipate market changes. Explore more to understand how leveraging these tools can significantly improve your organization's financial strategy.

Variance Analysis

Budgeting and forecasting tools integrate variance analysis to compare projected financial outcomes with actual results, enabling organizations to identify deviations and adjust strategies effectively. Tax technology focuses on variance analysis by pinpointing discrepancies in tax computations, ensuring compliance and optimizing tax liabilities. Explore how advanced variance analysis enhances financial precision in both budgeting and tax management.

Rolling Forecast

Rolling forecast tools enhance budgeting accuracy by continuously updating financial projections based on real-time data, enabling agile decision-making in dynamic markets. Tax technology primarily automates compliance and reporting processes, reducing errors and ensuring adherence to regulatory requirements without directly influencing forecast adjustments. Explore how integrating rolling forecast capabilities within budgeting solutions can improve financial planning efficiency and strategic agility.

Source and External Links

5 Best Budget Forecasting Tools Ranked and Reviewed - This article reviews top budget forecasting tools, including Martus, Prophix, Vena, Anaplan, and IBM Planning Analytics, highlighting their features and suitability for businesses.

Budgeting & Forecasting Tools for Businesses - Pigment - Pigment offers advanced budgeting and forecasting tools with real-time data updates, scenario analysis, and collaboration features to enhance financial planning.

Planning, Budgeting and Forecasting (PB&F) Software - Anaplan - Anaplan provides AI-infused planning, budgeting, and forecasting solutions to support financial planning transformation with speed, consistency, and accuracy.

dowidth.com

dowidth.com