Workflow automation in accounting streamlines repetitive tasks such as invoicing and data entry, significantly reducing manual errors and increasing efficiency. Artificial Intelligence (AI) enhances these processes by analyzing complex data sets for predictive insights, fraud detection, and financial forecasting. Discover how integrating workflow automation and AI can revolutionize accounting practices and drive smarter business decisions.

Why it is important

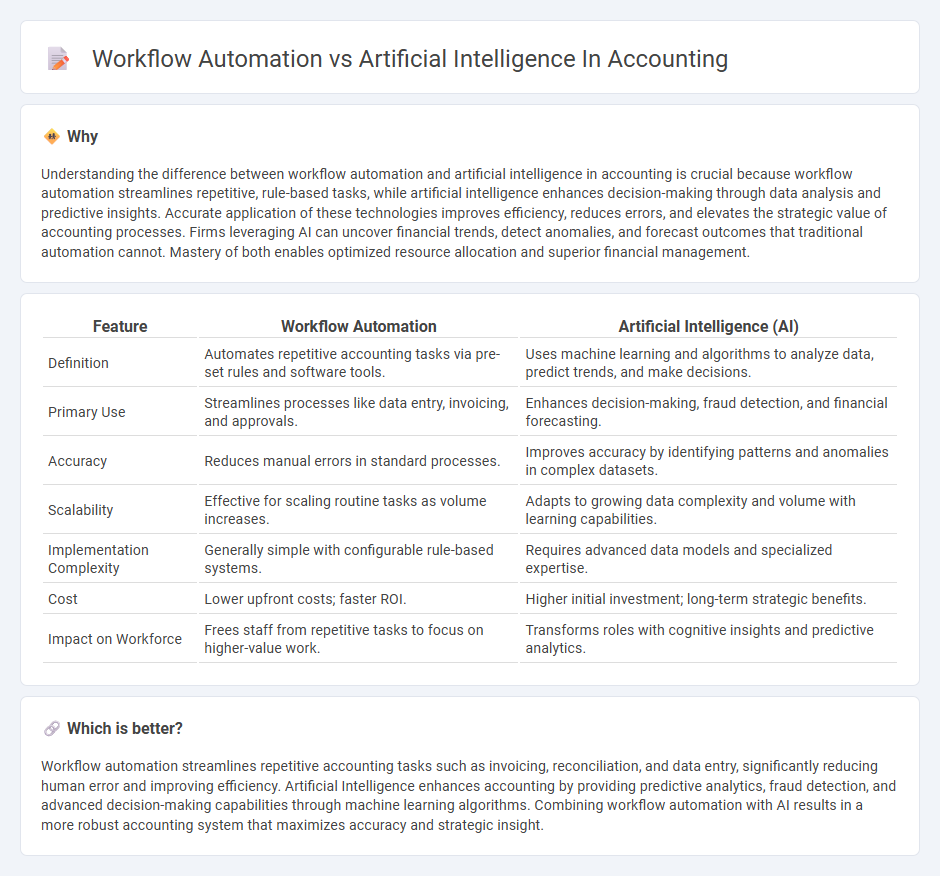

Understanding the difference between workflow automation and artificial intelligence in accounting is crucial because workflow automation streamlines repetitive, rule-based tasks, while artificial intelligence enhances decision-making through data analysis and predictive insights. Accurate application of these technologies improves efficiency, reduces errors, and elevates the strategic value of accounting processes. Firms leveraging AI can uncover financial trends, detect anomalies, and forecast outcomes that traditional automation cannot. Mastery of both enables optimized resource allocation and superior financial management.

Comparison Table

| Feature | Workflow Automation | Artificial Intelligence (AI) |

|---|---|---|

| Definition | Automates repetitive accounting tasks via pre-set rules and software tools. | Uses machine learning and algorithms to analyze data, predict trends, and make decisions. |

| Primary Use | Streamlines processes like data entry, invoicing, and approvals. | Enhances decision-making, fraud detection, and financial forecasting. |

| Accuracy | Reduces manual errors in standard processes. | Improves accuracy by identifying patterns and anomalies in complex datasets. |

| Scalability | Effective for scaling routine tasks as volume increases. | Adapts to growing data complexity and volume with learning capabilities. |

| Implementation Complexity | Generally simple with configurable rule-based systems. | Requires advanced data models and specialized expertise. |

| Cost | Lower upfront costs; faster ROI. | Higher initial investment; long-term strategic benefits. |

| Impact on Workforce | Frees staff from repetitive tasks to focus on higher-value work. | Transforms roles with cognitive insights and predictive analytics. |

Which is better?

Workflow automation streamlines repetitive accounting tasks such as invoicing, reconciliation, and data entry, significantly reducing human error and improving efficiency. Artificial Intelligence enhances accounting by providing predictive analytics, fraud detection, and advanced decision-making capabilities through machine learning algorithms. Combining workflow automation with AI results in a more robust accounting system that maximizes accuracy and strategic insight.

Connection

Workflow automation and Artificial Intelligence (AI) in accounting are interconnected by streamlining data entry, invoice processing, and financial reporting through AI-powered algorithms that reduce errors and increase efficiency. AI enhances automated workflows by enabling predictive analytics and real-time anomaly detection, optimizing decision-making and risk management in accounting processes. Integration of AI-driven automation tools boosts productivity, accuracy, and compliance, transforming traditional accounting into a more strategic function.

Key Terms

Machine Learning (AI in accounting)

Artificial Intelligence in accounting leverages Machine Learning algorithms to analyze vast datasets, detect anomalies, and predict financial trends with high accuracy, enhancing decision-making and reducing human error. Workflow automation streamlines repetitive tasks such as invoice processing and expense tracking, improving efficiency but without the adaptive learning capabilities inherent in AI systems. Discover how integrating Machine Learning in accounting transforms financial operations beyond basic automation.

Robotic Process Automation (Workflow automation)

Artificial Intelligence in accounting enhances decision-making by leveraging machine learning algorithms to analyze complex financial data and predict trends, while Workflow Automation, particularly Robotic Process Automation (RPA), streamlines repetitive tasks such as invoicing and reconciliation by mimicking human actions within software systems. RPA increases efficiency and accuracy by automating rule-based processes without altering existing IT infrastructure, making it ideal for standardizing operations in accounting departments. Explore the distinct benefits and applications of AI and RPA in finance to optimize your accounting workflows effectively.

Predictive Analytics (AI in accounting)

Artificial Intelligence in accounting leverages predictive analytics to forecast financial trends, detect anomalies, and enhance decision-making accuracy by analyzing vast datasets with machine learning algorithms. Workflow automation streamlines repetitive accounting tasks, such as data entry and invoice processing, but lacks the advanced predictive capabilities found in AI-enhanced accounting systems. Explore how predictive analytics transforms accounting accuracy and strategic planning for deeper insights.

Source and External Links

AI in Accounting: A Guide Written by Artificial Intelligence - This guide explores how AI in accounting can improve accuracy, efficiency, and decision-making by automating tasks and providing financial insights.

AI in Accounting: A Transformation - Discusses AI's transformation of accounting processes through automation, data analysis, and trend prediction, enhancing team productivity and business decision-making.

The Transformative Impact of AI on Accounting - Highlights AI's potential to streamline accounting processes, increase accuracy, and enable data-driven decision-making, with significant investments being made in AI integration.

dowidth.com

dowidth.com