Deferred revenue recognition records income when cash is received before services are performed, ensuring liabilities are matched with future earnings. The percentage of completion method recognizes revenue proportionally as a project progresses, reflecting ongoing work on long-term contracts. Explore how these accounting methods impact financial reporting and compliance.

Why it is important

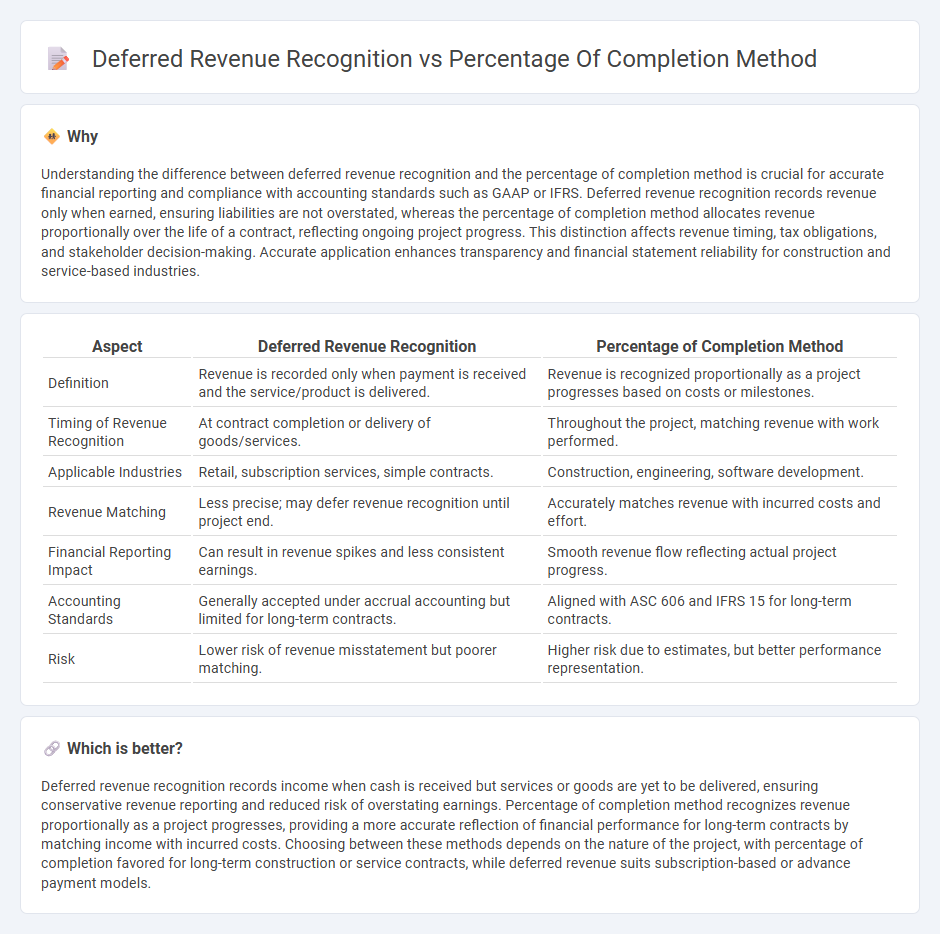

Understanding the difference between deferred revenue recognition and the percentage of completion method is crucial for accurate financial reporting and compliance with accounting standards such as GAAP or IFRS. Deferred revenue recognition records revenue only when earned, ensuring liabilities are not overstated, whereas the percentage of completion method allocates revenue proportionally over the life of a contract, reflecting ongoing project progress. This distinction affects revenue timing, tax obligations, and stakeholder decision-making. Accurate application enhances transparency and financial statement reliability for construction and service-based industries.

Comparison Table

| Aspect | Deferred Revenue Recognition | Percentage of Completion Method |

|---|---|---|

| Definition | Revenue is recorded only when payment is received and the service/product is delivered. | Revenue is recognized proportionally as a project progresses based on costs or milestones. |

| Timing of Revenue Recognition | At contract completion or delivery of goods/services. | Throughout the project, matching revenue with work performed. |

| Applicable Industries | Retail, subscription services, simple contracts. | Construction, engineering, software development. |

| Revenue Matching | Less precise; may defer revenue recognition until project end. | Accurately matches revenue with incurred costs and effort. |

| Financial Reporting Impact | Can result in revenue spikes and less consistent earnings. | Smooth revenue flow reflecting actual project progress. |

| Accounting Standards | Generally accepted under accrual accounting but limited for long-term contracts. | Aligned with ASC 606 and IFRS 15 for long-term contracts. |

| Risk | Lower risk of revenue misstatement but poorer matching. | Higher risk due to estimates, but better performance representation. |

Which is better?

Deferred revenue recognition records income when cash is received but services or goods are yet to be delivered, ensuring conservative revenue reporting and reduced risk of overstating earnings. Percentage of completion method recognizes revenue proportionally as a project progresses, providing a more accurate reflection of financial performance for long-term contracts by matching income with incurred costs. Choosing between these methods depends on the nature of the project, with percentage of completion favored for long-term construction or service contracts, while deferred revenue suits subscription-based or advance payment models.

Connection

Deferred revenue recognition and the percentage of completion method are connected through their focus on matching revenue recognition to the progress of long-term contracts. The percentage of completion method calculates revenue based on the work completed, allowing companies to recognize deferred revenue proportionally as project milestones are achieved. This approach ensures accurate financial reporting by aligning revenue with incurred costs and contract performance.

Key Terms

Revenue Recognition

The percentage of completion method recognizes revenue proportionally as a project progresses, matching income with incurred costs and efforts, which is critical for long-term contracts. Deferred revenue recognition, on the other hand, records income only upon delivery of goods or services, deferring revenue until performance obligations are fulfilled. Explore detailed comparisons to understand how each impacts financial reporting and compliance with accounting standards.

Progress Billing

The percentage of completion method recognizes revenue based on the project's progress, matching earnings with costs incurred, whereas deferred revenue recognition records income only when cash is received, often leading to liabilities on the balance sheet. Progress billing is integral to the percentage of completion method as it triggers revenue recognition proportional to work completed, reducing deferred revenue and reflecting a more accurate financial position. Explore detailed comparisons and practical applications of these methods for improved project accounting insights.

Unearned Revenue

The percentage of completion method recognizes revenue proportionally based on project progress, reducing unearned revenue by matching income with performance milestones. Deferred revenue recognition records payments as unearned revenue until services or goods are fully delivered, keeping liabilities higher during the project tenure. Explore detailed accounting treatments to optimize revenue management and compliance.

Source and External Links

Percentage of Completion Method Defined With Examples - This webpage provides an overview of the percentage of completion method, including its application and calculation methods such as cost-to-cost, efforts expended, and units of delivery.

Types of Revenue Recognition: Contract Length, Percent Complete - This article discusses types of revenue recognition, focusing on the percent completion method, its use in industries like construction, and its advantages and disadvantages.

The Percentage of Completion Method Explained - This resource explains the percentage of completion method, highlighting its application in long-term projects, particularly in construction, and how it differs from other methods like the completed contract method.

dowidth.com

dowidth.com