Real-time expense reconciliation automates transaction matching instantly using software integrated with bank feeds, reducing errors and speeding up financial closing processes. Manual expense reconciliation relies on physical receipts and spreadsheets, which is time-consuming and prone to human error. Explore how adopting real-time reconciliation can revolutionize your accounting efficiency and accuracy.

Why it is important

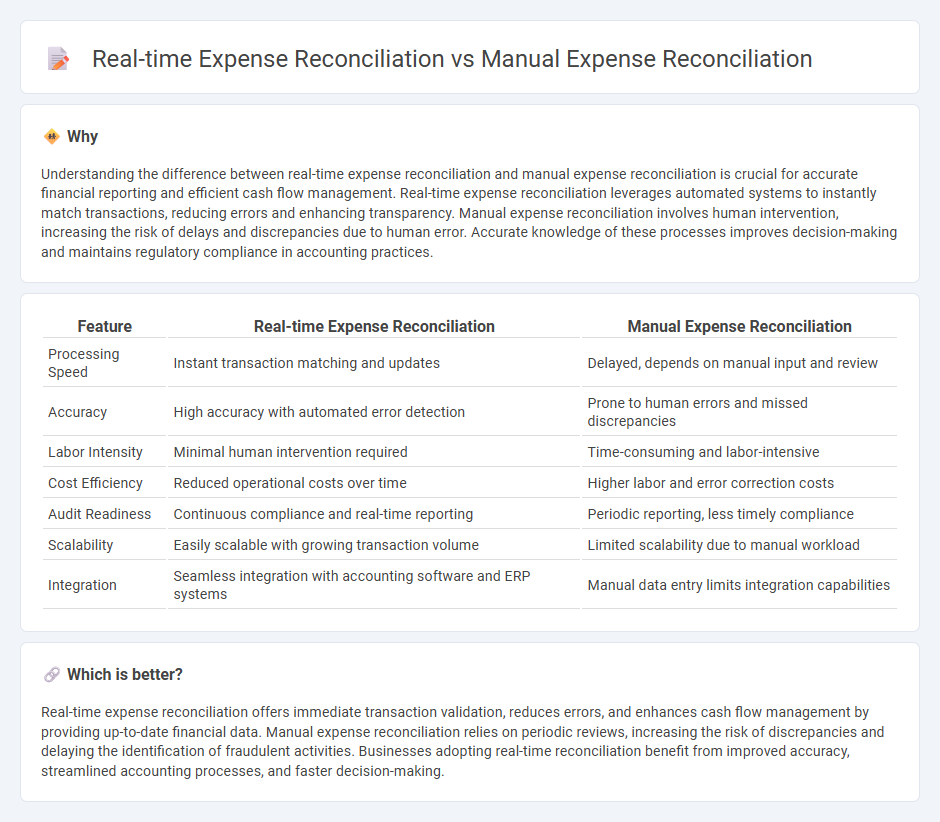

Understanding the difference between real-time expense reconciliation and manual expense reconciliation is crucial for accurate financial reporting and efficient cash flow management. Real-time expense reconciliation leverages automated systems to instantly match transactions, reducing errors and enhancing transparency. Manual expense reconciliation involves human intervention, increasing the risk of delays and discrepancies due to human error. Accurate knowledge of these processes improves decision-making and maintains regulatory compliance in accounting practices.

Comparison Table

| Feature | Real-time Expense Reconciliation | Manual Expense Reconciliation |

|---|---|---|

| Processing Speed | Instant transaction matching and updates | Delayed, depends on manual input and review |

| Accuracy | High accuracy with automated error detection | Prone to human errors and missed discrepancies |

| Labor Intensity | Minimal human intervention required | Time-consuming and labor-intensive |

| Cost Efficiency | Reduced operational costs over time | Higher labor and error correction costs |

| Audit Readiness | Continuous compliance and real-time reporting | Periodic reporting, less timely compliance |

| Scalability | Easily scalable with growing transaction volume | Limited scalability due to manual workload |

| Integration | Seamless integration with accounting software and ERP systems | Manual data entry limits integration capabilities |

Which is better?

Real-time expense reconciliation offers immediate transaction validation, reduces errors, and enhances cash flow management by providing up-to-date financial data. Manual expense reconciliation relies on periodic reviews, increasing the risk of discrepancies and delaying the identification of fraudulent activities. Businesses adopting real-time reconciliation benefit from improved accuracy, streamlined accounting processes, and faster decision-making.

Connection

Real-time expense reconciliation integrates automated data capture and instant transaction matching to provide up-to-date financial accuracy, while manual expense reconciliation involves human review and correction of discrepancies. Both processes aim to ensure precise expense tracking, with real-time systems reducing errors that manual checks traditionally address. Together, they create a comprehensive approach to validate and verify company expenses, enhancing overall accounting integrity.

Key Terms

Data Entry

Manual expense reconciliation relies on time-consuming data entry processes prone to human error and delays, impacting financial accuracy. Real-time expense reconciliation utilizes automated data capture and integration, enhancing accuracy and efficiency by minimizing manual input. Explore the benefits of real-time systems to optimize your expense management workflow.

Accuracy

Manual expense reconciliation often leads to frequent human errors, delayed financial insights, and increased compliance risks due to reliance on manual data entry and cross-checking. Real-time expense reconciliation enhances accuracy by automatically capturing and validating transaction data instantly, reducing discrepancies and enabling proactive error correction. Explore how real-time expense reconciliation can transform your financial accuracy and operational efficiency.

Timeliness

Manual expense reconciliation often involves delays due to the need for data entry, verification, and cross-checking, leading to slower financial closing processes. Real-time expense reconciliation leverages automated systems and integration with expense management software, enabling immediate updates and enhanced timeliness in financial reporting. Explore how transitioning to real-time reconciliation can optimize your financial operations and improve decision-making speed.

Source and External Links

Expense Reconciliation: How to Reconcile Expenses Faster - Ramp - Manual expense reconciliation involves collecting financial documents, sorting them, manually entering transactions into spreadsheets or ledgers, comparing these records for discrepancies, resolving issues, adjusting records, and creating summary statements; it is time-consuming and prone to errors but suitable for small startups before switching to automated methods.

Expense Reconciliation Guide: Implement a Winning Strategy - Tipalti - Manual reconciliation typically uses paper records or Excel spreadsheets to track and compare expenses against receipts and bank statements, but it is vulnerable to human error, loss, and fraud, making it more suitable for small businesses with low transaction volume.

Expense Reconciliation: A Guide to Reconcile Your ... - Happay - Manual expense reconciliation requires finance teams to spend extensive time matching transactions from bank statements to invoices and records by hand, often uncovering discrepancies manually before correcting inaccuracies in payments or bookkeeping.

dowidth.com

dowidth.com