Real-time expense reconciliation enables immediate tracking and verification of expenses as transactions occur, reducing errors and improving financial accuracy. Integrated expense management combines various expense-related processes into a unified system, streamlining approvals, reporting, and compliance. Explore how these approaches enhance financial control and operational efficiency.

Why it is important

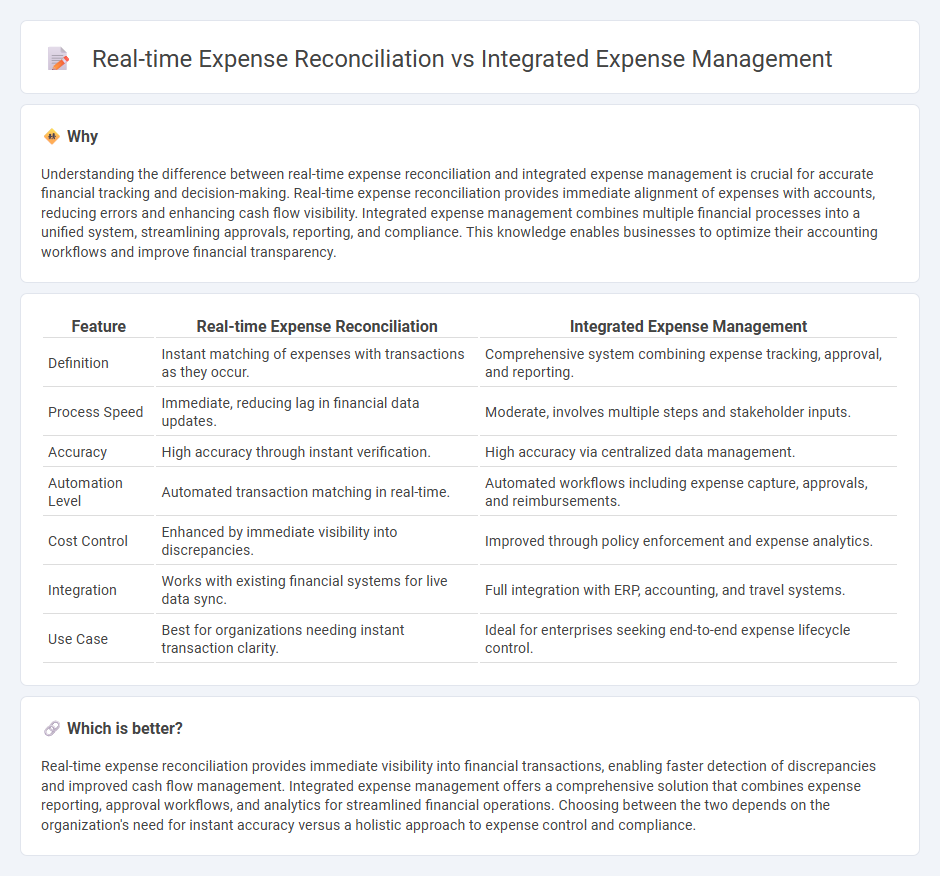

Understanding the difference between real-time expense reconciliation and integrated expense management is crucial for accurate financial tracking and decision-making. Real-time expense reconciliation provides immediate alignment of expenses with accounts, reducing errors and enhancing cash flow visibility. Integrated expense management combines multiple financial processes into a unified system, streamlining approvals, reporting, and compliance. This knowledge enables businesses to optimize their accounting workflows and improve financial transparency.

Comparison Table

| Feature | Real-time Expense Reconciliation | Integrated Expense Management |

|---|---|---|

| Definition | Instant matching of expenses with transactions as they occur. | Comprehensive system combining expense tracking, approval, and reporting. |

| Process Speed | Immediate, reducing lag in financial data updates. | Moderate, involves multiple steps and stakeholder inputs. |

| Accuracy | High accuracy through instant verification. | High accuracy via centralized data management. |

| Automation Level | Automated transaction matching in real-time. | Automated workflows including expense capture, approvals, and reimbursements. |

| Cost Control | Enhanced by immediate visibility into discrepancies. | Improved through policy enforcement and expense analytics. |

| Integration | Works with existing financial systems for live data sync. | Full integration with ERP, accounting, and travel systems. |

| Use Case | Best for organizations needing instant transaction clarity. | Ideal for enterprises seeking end-to-end expense lifecycle control. |

Which is better?

Real-time expense reconciliation provides immediate visibility into financial transactions, enabling faster detection of discrepancies and improved cash flow management. Integrated expense management offers a comprehensive solution that combines expense reporting, approval workflows, and analytics for streamlined financial operations. Choosing between the two depends on the organization's need for instant accuracy versus a holistic approach to expense control and compliance.

Connection

Real-time expense reconciliation enhances integrated expense management by continuously updating and verifying transactions, ensuring data accuracy across financial systems. This seamless synchronization enables organizations to monitor cash flow instantly and enforce budgeting controls more effectively. Efficient integration reduces manual errors and accelerates financial closing processes, optimizing overall accounting workflows.

Key Terms

Expense Automation

Integrated expense management streamlines financial workflows by consolidating expense reporting, approval, and reimbursement within a single platform, enhancing accuracy and reducing manual errors. Real-time expense reconciliation automates the matching of transactions with receipts and corporate policies, ensuring immediate compliance and faster financial reporting. Explore how combined expense automation solutions can drive efficiency and control across your organization's financial processes.

Data Synchronization

Integrated expense management systems streamline data synchronization by automatically consolidating expense reports, receipts, and financial data into a unified platform, reducing manual entry errors and improving accuracy. Real-time expense reconciliation enhances this process by instantly updating transactions across accounting and expense management software, ensuring up-to-date financial visibility and faster decision-making. Discover how advanced synchronization techniques can transform your expense workflow by exploring in-depth solutions and best practices.

Compliance Monitoring

Integrated expense management systems centralize financial data to enhance accuracy and streamline compliance monitoring by automatically validating expenses against regulatory standards. Real-time expense reconciliation enables immediate detection of discrepancies and potential compliance breaches by continuously matching transactions with established policies. Discover how these solutions improve regulatory adherence and operational efficiency in your organization.

Source and External Links

What is Integrated travel and expense management? - Integrated expense management is a unified system that combines travel arrangements and expense tracking to reduce complexities, increase operational efficiency, and improve visibility and accuracy of business expenses.

Business Expense Management Software and Automation - SAP Concur offers automated expense management software that integrates with finance systems to speed up processing, improve budgeting, and provide a total spend management solution.

Integrated Expense Management and Reporting - Zact Expense Management automates expense reporting, integrates with accounting systems, provides real-time insights, enforces credit limits aligned with budgets, and reduces administrative costs.

dowidth.com

dowidth.com