Real-time auditing leverages advanced software and continuous data monitoring to provide immediate insights into financial transactions, enhancing accuracy and compliance within organizations. External auditing involves independent third-party examination of financial statements to ensure the validity and reliability of accounting records. Explore the key differences and benefits of real-time versus external auditing to optimize your financial oversight.

Why it is important

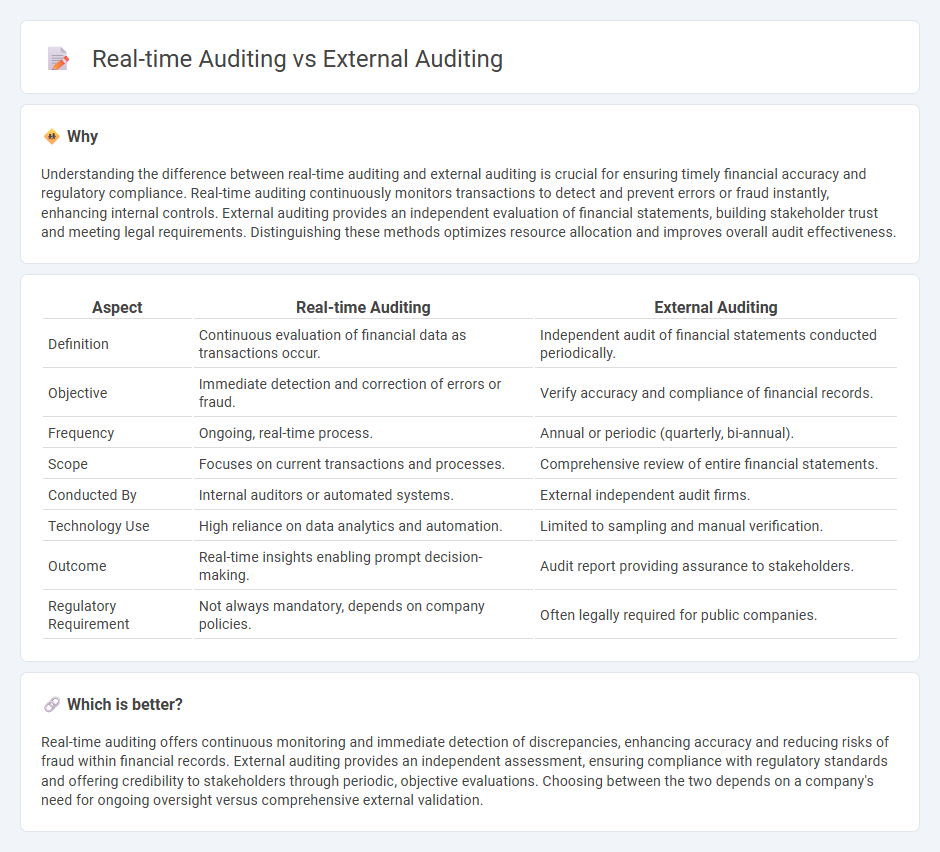

Understanding the difference between real-time auditing and external auditing is crucial for ensuring timely financial accuracy and regulatory compliance. Real-time auditing continuously monitors transactions to detect and prevent errors or fraud instantly, enhancing internal controls. External auditing provides an independent evaluation of financial statements, building stakeholder trust and meeting legal requirements. Distinguishing these methods optimizes resource allocation and improves overall audit effectiveness.

Comparison Table

| Aspect | Real-time Auditing | External Auditing |

|---|---|---|

| Definition | Continuous evaluation of financial data as transactions occur. | Independent audit of financial statements conducted periodically. |

| Objective | Immediate detection and correction of errors or fraud. | Verify accuracy and compliance of financial records. |

| Frequency | Ongoing, real-time process. | Annual or periodic (quarterly, bi-annual). |

| Scope | Focuses on current transactions and processes. | Comprehensive review of entire financial statements. |

| Conducted By | Internal auditors or automated systems. | External independent audit firms. |

| Technology Use | High reliance on data analytics and automation. | Limited to sampling and manual verification. |

| Outcome | Real-time insights enabling prompt decision-making. | Audit report providing assurance to stakeholders. |

| Regulatory Requirement | Not always mandatory, depends on company policies. | Often legally required for public companies. |

Which is better?

Real-time auditing offers continuous monitoring and immediate detection of discrepancies, enhancing accuracy and reducing risks of fraud within financial records. External auditing provides an independent assessment, ensuring compliance with regulatory standards and offering credibility to stakeholders through periodic, objective evaluations. Choosing between the two depends on a company's need for ongoing oversight versus comprehensive external validation.

Connection

Real-time auditing enhances external auditing by providing continuous access to up-to-date financial information, improving accuracy and timeliness in the audit process. External auditors leverage real-time data analytics to identify discrepancies early and reduce risks associated with outdated or incomplete records. Integrating real-time auditing technologies streamlines external audit procedures, ensuring more reliable financial reporting and regulatory compliance.

Key Terms

Independence

External auditing ensures independence by involving third-party auditors who evaluate financial statements without internal influence, maintaining objectivity and credibility. Real-time auditing leverages continuous monitoring technologies within the organization, which may challenge independence due to closer operational ties. Discover how these auditing approaches impact corporate governance and financial transparency.

Continuous monitoring

External auditing involves periodic, independent verification of financial statements to ensure accuracy and compliance with regulatory standards, typically occurring annually or quarterly. Real-time auditing leverages continuous monitoring technology to provide immediate insights and detect anomalies as transactions happen, enhancing timely risk management. Explore our detailed analysis to understand how continuous monitoring is transforming audit processes and improving organizational transparency.

Assurance

External auditing provides independent validation of financial statements, ensuring compliance with regulatory standards and enhancing investor confidence through periodic, retrospective examination. Real-time auditing offers continuous assurance by leveraging advanced technologies to monitor transactions and controls as they occur, enabling immediate detection of anomalies and risks. Explore the key differences and benefits of both auditing approaches to determine the best fit for your organization's assurance needs.

Source and External Links

Understanding the Purpose and Benefits of External Audits - Concur - External auditing provides independent verification of financial statements, evaluates internal controls, and enables organizations to improve compliance, reduce risks, and enhance decision-making by delivering an unbiased audit report with findings and recommendations.

External Audit vs. Internal Audit: What's the Difference? - External auditors are independent CPAs who review financial records and internal controls to assure stakeholders about the accuracy and fairness of financial statements, producing an objective report critical for investors, regulators, and company management.

External Audit: 5 Proven Strategies - Centraleyes - External audits, conducted by independent parties, evaluate organizational security and compliance from an outsider's perspective, identifying vulnerabilities and ensuring regulatory adherence while enhancing credibility and supply chain security.

dowidth.com

dowidth.com