Zero trust accounting emphasizes stringent access controls and continuous verification to protect financial data from internal and external threats. Project accounting focuses on tracking and managing financials related to specific projects, ensuring accurate cost allocation and budget adherence. Explore the key differences and benefits of zero trust and project accounting for optimized financial management.

Why it is important

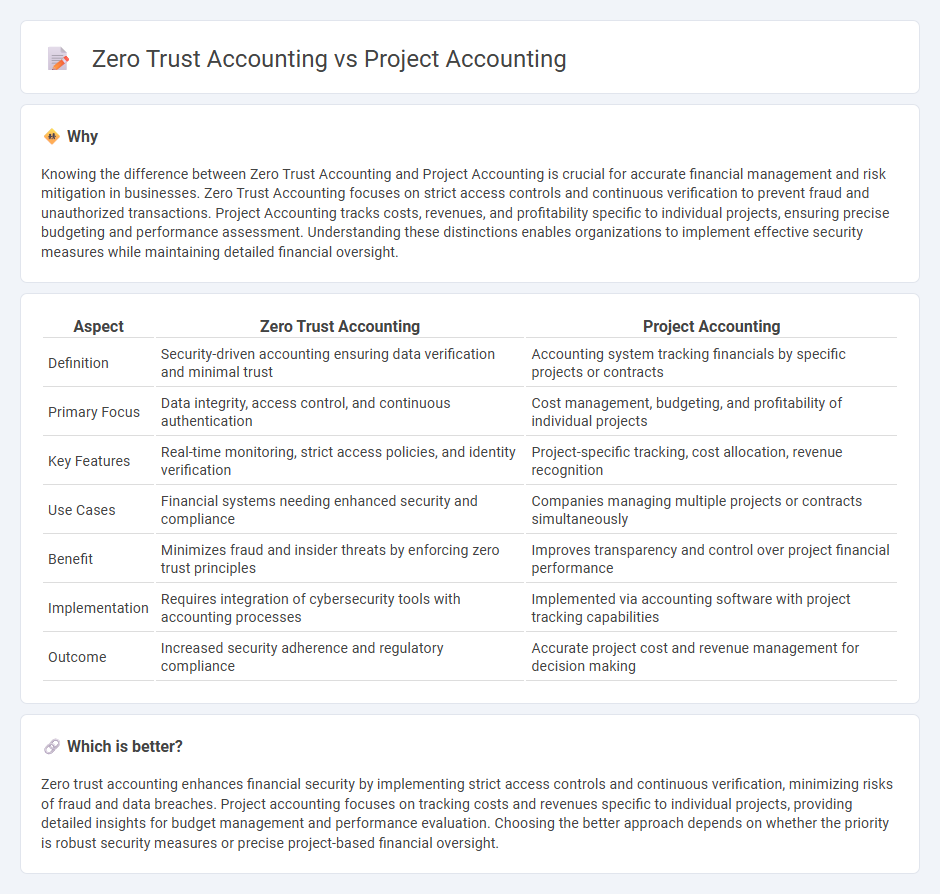

Knowing the difference between Zero Trust Accounting and Project Accounting is crucial for accurate financial management and risk mitigation in businesses. Zero Trust Accounting focuses on strict access controls and continuous verification to prevent fraud and unauthorized transactions. Project Accounting tracks costs, revenues, and profitability specific to individual projects, ensuring precise budgeting and performance assessment. Understanding these distinctions enables organizations to implement effective security measures while maintaining detailed financial oversight.

Comparison Table

| Aspect | Zero Trust Accounting | Project Accounting |

|---|---|---|

| Definition | Security-driven accounting ensuring data verification and minimal trust | Accounting system tracking financials by specific projects or contracts |

| Primary Focus | Data integrity, access control, and continuous authentication | Cost management, budgeting, and profitability of individual projects |

| Key Features | Real-time monitoring, strict access policies, and identity verification | Project-specific tracking, cost allocation, revenue recognition |

| Use Cases | Financial systems needing enhanced security and compliance | Companies managing multiple projects or contracts simultaneously |

| Benefit | Minimizes fraud and insider threats by enforcing zero trust principles | Improves transparency and control over project financial performance |

| Implementation | Requires integration of cybersecurity tools with accounting processes | Implemented via accounting software with project tracking capabilities |

| Outcome | Increased security adherence and regulatory compliance | Accurate project cost and revenue management for decision making |

Which is better?

Zero trust accounting enhances financial security by implementing strict access controls and continuous verification, minimizing risks of fraud and data breaches. Project accounting focuses on tracking costs and revenues specific to individual projects, providing detailed insights for budget management and performance evaluation. Choosing the better approach depends on whether the priority is robust security measures or precise project-based financial oversight.

Connection

Zero trust accounting enhances data security by continuously verifying user identities and access permissions in financial systems, which is crucial for project accounting where multiple stakeholders manage budgets and resources. Project accounting relies on accurate, real-time financial data to monitor costs and performance, making zero trust protocols essential to prevent unauthorized access and data breaches. Integrating zero trust principles ensures that project accounting processes maintain integrity and compliance, safeguarding sensitive financial information throughout the project lifecycle.

Key Terms

**Project accounting:**

Project accounting centers on tracking financials specific to individual projects, including budgets, costs, revenues, and resource allocation, ensuring precise financial management and accountability throughout the project lifecycle. It enables organizations to monitor project profitability, control expenses, and align spending with project goals by using detailed reports and cost centers. Explore more to understand how project accounting drives financial precision and strategic decision-making.

Job costing

Project accounting emphasizes detailed job costing by tracking expenses and revenues for specific tasks or projects, enabling precise financial analysis and resource allocation. Zero trust accounting enhances this process by incorporating strict identity verification and continuous monitoring to safeguard financial data and prevent unauthorized access. Explore how integrating zero trust principles can revolutionize your job costing accuracy and security.

Budget tracking

Project accounting emphasizes detailed budget tracking by monitoring project expenses, resource allocation, and financial performance to ensure project goals are met within budget constraints. Zero trust accounting, however, centers on security by continuously verifying transactions and access controls to prevent fraud and unauthorized budget alterations. Explore the nuances of budget tracking in both methodologies to optimize financial control and security.

Source and External Links

What Is Project Accounting? Get Started With This Guide - This guide explains project accounting as a specialized form of accounting focused on managing the financial aspects of individual projects within a company.

Project Accounting: Guide to Mastering Project Finances - This guide covers the main steps of project accounting, including setting budgets, tracking costs, and managing project billing, to help agencies optimize their finances.

What Is Project Accounting? Principles, Methods & More - This article discusses how project accounting works by creating detailed plans for project costs and managing them throughout execution to ensure staying on budget.

dowidth.com

dowidth.com