Collaborative audit trails leverage digital platforms to record and track financial transactions in real-time, enhancing accuracy and transparency compared to manual paper-based audits, which rely on physical documents and are prone to errors and delays. This approach improves compliance by enabling seamless data sharing among stakeholders and automating audit processes, significantly reducing the risk of fraud and discrepancies. Discover how transitioning to collaborative audit trails can optimize your accounting practices and audit efficiency.

Why it is important

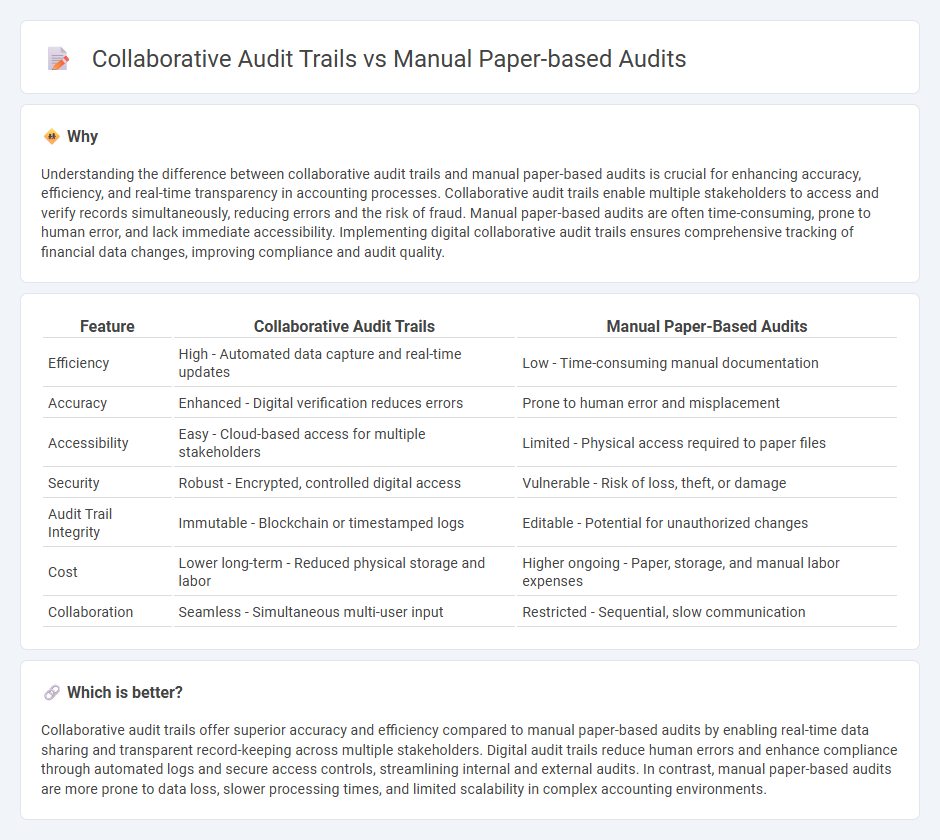

Understanding the difference between collaborative audit trails and manual paper-based audits is crucial for enhancing accuracy, efficiency, and real-time transparency in accounting processes. Collaborative audit trails enable multiple stakeholders to access and verify records simultaneously, reducing errors and the risk of fraud. Manual paper-based audits are often time-consuming, prone to human error, and lack immediate accessibility. Implementing digital collaborative audit trails ensures comprehensive tracking of financial data changes, improving compliance and audit quality.

Comparison Table

| Feature | Collaborative Audit Trails | Manual Paper-Based Audits |

|---|---|---|

| Efficiency | High - Automated data capture and real-time updates | Low - Time-consuming manual documentation |

| Accuracy | Enhanced - Digital verification reduces errors | Prone to human error and misplacement |

| Accessibility | Easy - Cloud-based access for multiple stakeholders | Limited - Physical access required to paper files |

| Security | Robust - Encrypted, controlled digital access | Vulnerable - Risk of loss, theft, or damage |

| Audit Trail Integrity | Immutable - Blockchain or timestamped logs | Editable - Potential for unauthorized changes |

| Cost | Lower long-term - Reduced physical storage and labor | Higher ongoing - Paper, storage, and manual labor expenses |

| Collaboration | Seamless - Simultaneous multi-user input | Restricted - Sequential, slow communication |

Which is better?

Collaborative audit trails offer superior accuracy and efficiency compared to manual paper-based audits by enabling real-time data sharing and transparent record-keeping across multiple stakeholders. Digital audit trails reduce human errors and enhance compliance through automated logs and secure access controls, streamlining internal and external audits. In contrast, manual paper-based audits are more prone to data loss, slower processing times, and limited scalability in complex accounting environments.

Connection

Collaborative audit trails enhance transparency and accuracy by digitally recording every transaction and modification, reducing the reliance on manual paper-based audits prone to errors and omissions. Manual paper-based audits depend heavily on physical documentation, making it challenging to track changes and verify data integrity during financial reviews. Integrating collaborative audit trails into accounting processes streamlines audit verification, offering a reliable, real-time record that complements or replaces traditional manual audit practices.

Key Terms

Documentation

Manual paper-based audits rely heavily on physical documentation, often resulting in increased risks of errors, misplacement, and difficulty in tracking changes over time. Collaborative audit trails utilize digital platforms to ensure real-time documentation updates, enhanced transparency, and secure data integrity through version control and authenticated user access. Explore how transitioning to collaborative audit trails can revolutionize your documentation processes and improve compliance.

Version Control

Manual paper-based audits often suffer from delayed access to historical changes, leading to version control challenges and potential misinterpretation of data. Collaborative audit trails leverage digital platforms to provide real-time tracking, seamless version updates, and transparent change histories that enhance accuracy and accountability. Discover how adopting collaborative audit tools can revolutionize version control in your auditing processes.

Real-time Access

Manual paper-based audits limit real-time access due to their reliance on physical documents and slower data retrieval processes. Collaborative audit trails enable instant updates and shared access through digital platforms, enhancing transparency and decision-making speed in audit environments. Explore how real-time access can transform your auditing efficiency and accuracy.

Source and External Links

The Evolution of Auditing Technology: From Paper to AI - Manual paper-based audits involve auditors reviewing physical documents, recording transactions, and compiling financial statements by hand, a labor-intensive process prone to human error and risks such as data loss or damage, which has since evolved to digital and AI tools for greater efficiency and accuracy.

5 Ways Paper-Based Audit Programs Block Quality Improvements - Paper-based audit programs typically require manual data entry from checklists collected in the field, causing delays, disjointed data management, and limited audit frequency, which undermines sustainable quality improvements and increases costs.

The Evolution of Audit: From Manual Processes to Integrated Digital Solutions - Initial manual paper-based audits were time-consuming and error-prone, relying on physical ledger examination and mental calculations, but these have been replaced by digital tools like CAATs and integrated software enabling automated data collection, real-time analysis, and continuous auditing.

dowidth.com

dowidth.com