Forensic data analytics applies advanced analytical techniques to examine financial records and detect fraud or anomalies, playing a critical role in ensuring accuracy and transparency in accounting practices. Corporate governance establishes the framework of policies, controls, and ethical standards that guide organizational financial reporting and risk management. Explore how these disciplines intersect to strengthen financial integrity and accountability.

Why it is important

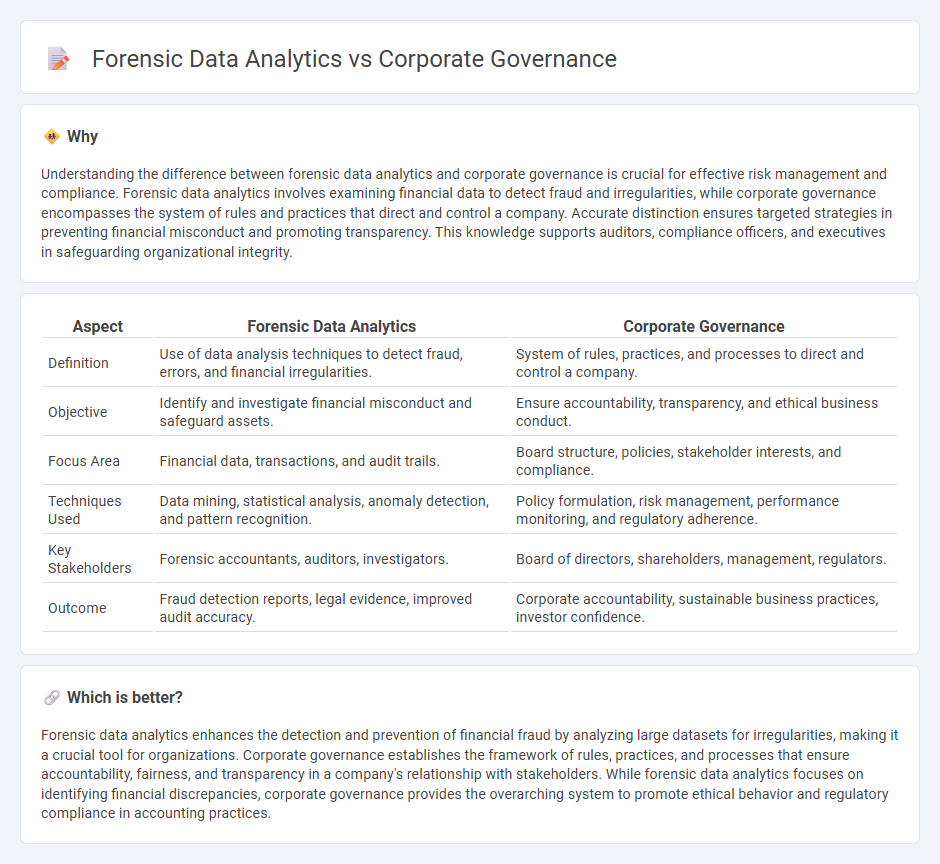

Understanding the difference between forensic data analytics and corporate governance is crucial for effective risk management and compliance. Forensic data analytics involves examining financial data to detect fraud and irregularities, while corporate governance encompasses the system of rules and practices that direct and control a company. Accurate distinction ensures targeted strategies in preventing financial misconduct and promoting transparency. This knowledge supports auditors, compliance officers, and executives in safeguarding organizational integrity.

Comparison Table

| Aspect | Forensic Data Analytics | Corporate Governance |

|---|---|---|

| Definition | Use of data analysis techniques to detect fraud, errors, and financial irregularities. | System of rules, practices, and processes to direct and control a company. |

| Objective | Identify and investigate financial misconduct and safeguard assets. | Ensure accountability, transparency, and ethical business conduct. |

| Focus Area | Financial data, transactions, and audit trails. | Board structure, policies, stakeholder interests, and compliance. |

| Techniques Used | Data mining, statistical analysis, anomaly detection, and pattern recognition. | Policy formulation, risk management, performance monitoring, and regulatory adherence. |

| Key Stakeholders | Forensic accountants, auditors, investigators. | Board of directors, shareholders, management, regulators. |

| Outcome | Fraud detection reports, legal evidence, improved audit accuracy. | Corporate accountability, sustainable business practices, investor confidence. |

Which is better?

Forensic data analytics enhances the detection and prevention of financial fraud by analyzing large datasets for irregularities, making it a crucial tool for organizations. Corporate governance establishes the framework of rules, practices, and processes that ensure accountability, fairness, and transparency in a company's relationship with stakeholders. While forensic data analytics focuses on identifying financial discrepancies, corporate governance provides the overarching system to promote ethical behavior and regulatory compliance in accounting practices.

Connection

Forensic data analytics plays a crucial role in corporate governance by detecting financial fraud and ensuring compliance with regulatory standards. Implementing advanced forensic techniques enhances transparency and accountability in financial reporting, which strengthens internal controls. Effective corporate governance frameworks rely on forensic data analytics to identify risks early and protect stakeholder interests.

Key Terms

Internal Controls

Corporate governance ensures effective internal controls through established policies and oversight mechanisms that manage risks and safeguard assets. Forensic data analytics enhances internal controls by detecting anomalies and irregularities within financial data, enabling timely identification of fraud and compliance breaches. Explore how integrating forensic data analytics strengthens corporate governance frameworks to ensure robust internal controls.

Fraud Detection

Corporate governance establishes the framework of policies and controls that guide an organization's ethical conduct and compliance, serving as a preventative measure against fraud. Forensic data analytics employs advanced algorithms and statistical techniques to scrutinize transactional data and identify irregularities indicative of fraudulent activities. Discover how integrating governance principles with forensic analytics enhances fraud detection effectiveness in modern enterprises.

Audit Trail

Corporate governance emphasizes transparency and accountability through robust audit trails to monitor compliance and detect irregularities. Forensic data analytics leverages advanced techniques to analyze audit trails, identifying patterns indicative of fraud or misconduct. Explore how integrating forensic analytics strengthens governance frameworks and enhances audit trail efficacy.

Source and External Links

Corporate governance - Diligent - Corporate governance is a system of accountability that ensures businesses follow ethical codes and includes key aspects such as accountability, transparency, fairness, responsibility, risk management, and upholding shareholder rights.

What is corporate governance? | Overview - ICAEW - Corporate governance is the system by which companies are directed and controlled, with the board of directors responsible for setting strategic aims, supervising management, and reporting to shareholders.

Understanding Corporate Governance: The 2025 Guideline - Corporate governance involves principles like fairness, transparency, responsibility, and accountability to ensure ethical, responsible, and sustainable board leadership and decision-making.

dowidth.com

dowidth.com