Data lake auditing involves analyzing massive volumes of financial data stored in centralized repositories to detect irregularities and ensure compliance, leveraging advanced analytics and machine learning. Forensic accounting focuses on investigating financial discrepancies and fraud through detailed examination and evidence gathering for legal proceedings. Explore the key differences and applications of these approaches to enhance financial integrity.

Why it is important

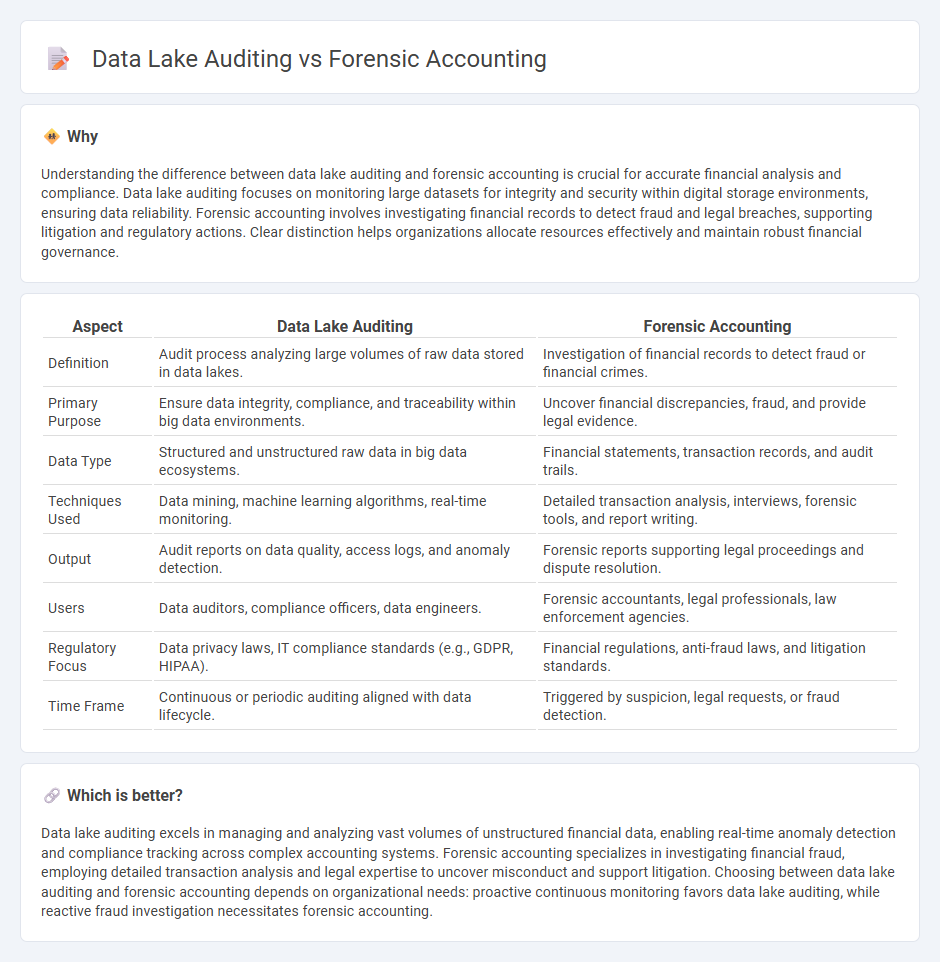

Understanding the difference between data lake auditing and forensic accounting is crucial for accurate financial analysis and compliance. Data lake auditing focuses on monitoring large datasets for integrity and security within digital storage environments, ensuring data reliability. Forensic accounting involves investigating financial records to detect fraud and legal breaches, supporting litigation and regulatory actions. Clear distinction helps organizations allocate resources effectively and maintain robust financial governance.

Comparison Table

| Aspect | Data Lake Auditing | Forensic Accounting |

|---|---|---|

| Definition | Audit process analyzing large volumes of raw data stored in data lakes. | Investigation of financial records to detect fraud or financial crimes. |

| Primary Purpose | Ensure data integrity, compliance, and traceability within big data environments. | Uncover financial discrepancies, fraud, and provide legal evidence. |

| Data Type | Structured and unstructured raw data in big data ecosystems. | Financial statements, transaction records, and audit trails. |

| Techniques Used | Data mining, machine learning algorithms, real-time monitoring. | Detailed transaction analysis, interviews, forensic tools, and report writing. |

| Output | Audit reports on data quality, access logs, and anomaly detection. | Forensic reports supporting legal proceedings and dispute resolution. |

| Users | Data auditors, compliance officers, data engineers. | Forensic accountants, legal professionals, law enforcement agencies. |

| Regulatory Focus | Data privacy laws, IT compliance standards (e.g., GDPR, HIPAA). | Financial regulations, anti-fraud laws, and litigation standards. |

| Time Frame | Continuous or periodic auditing aligned with data lifecycle. | Triggered by suspicion, legal requests, or fraud detection. |

Which is better?

Data lake auditing excels in managing and analyzing vast volumes of unstructured financial data, enabling real-time anomaly detection and compliance tracking across complex accounting systems. Forensic accounting specializes in investigating financial fraud, employing detailed transaction analysis and legal expertise to uncover misconduct and support litigation. Choosing between data lake auditing and forensic accounting depends on organizational needs: proactive continuous monitoring favors data lake auditing, while reactive fraud investigation necessitates forensic accounting.

Connection

Data lake auditing enhances forensic accounting by providing comprehensive, unstructured, and structured data storage, enabling detailed transaction analysis and anomaly detection. Forensic accountants leverage data lake audit trails to trace financial discrepancies, support fraud investigations, and ensure regulatory compliance. Integration of data lake auditing with forensic accounting improves accuracy in identifying irregularities within vast financial datasets.

Key Terms

Fraud Detection

Forensic accounting uses detailed financial analysis and investigative techniques to identify fraudulent transactions and uncover financial discrepancies. Data lake auditing leverages large-scale, unstructured data repositories to detect patterns and anomalies indicative of fraud through advanced analytics and machine learning algorithms. Explore the evolving strategies behind forensic accounting and data lake auditing for enhanced fraud detection capabilities.

Data Integrity

Forensic accounting focuses on tracing financial discrepancies through detailed examination of accounting records to ensure data integrity within financial statements. Data lake auditing emphasizes continuous monitoring, validation, and control of large-scale unstructured and structured data repositories to maintain accuracy and reliability. Explore comprehensive strategies to enhance data integrity in both forensic accounting and data lake auditing.

Digital Evidence

Forensic accounting meticulously examines financial records and transactions to uncover fraud, relying heavily on digital evidence such as transaction logs and metadata stored within audit trails. Data lake auditing involves analyzing vast, unstructured datasets from multiple sources in a centralized repository, ensuring integrity and traceability of digital evidence like raw logs, sensor data, and user activity records. Explore the nuances and techniques used in both fields to enhance your understanding of digital evidence management and investigation.

Source and External Links

What Is Forensic Accounting? - MVNU - Forensic accounting applies accounting skills to investigate financial crimes, involving tasks such as tracing funds, preparing expert witness reports, and assisting with fraud claims and criminal investigations.

Forensic accounting - Wikipedia - Forensic accounting is a specialty practice that investigates financial crimes using techniques distinct from internal auditing, often involving legal risk and requiring skills in translating complex financial data for legal proceedings.

What Is Forensic Accounting? - Purdue Global - Forensic accounting combines accounting and investigative methods to discover financial crimes like money laundering and embezzlement, requiring knowledge of GAAP and investigative techniques for evidence gathering and litigation support.

dowidth.com

dowidth.com