Tax technology automates compliance, streamlining tax calculations and reporting to reduce errors and ensure regulatory adherence. Revenue recognition software systematically tracks and records revenue in accordance with accounting standards like ASC 606 and IFRS 15, enhancing accuracy in financial reporting. Explore the distinct benefits of tax technology and revenue recognition software to optimize your accounting processes.

Why it is important

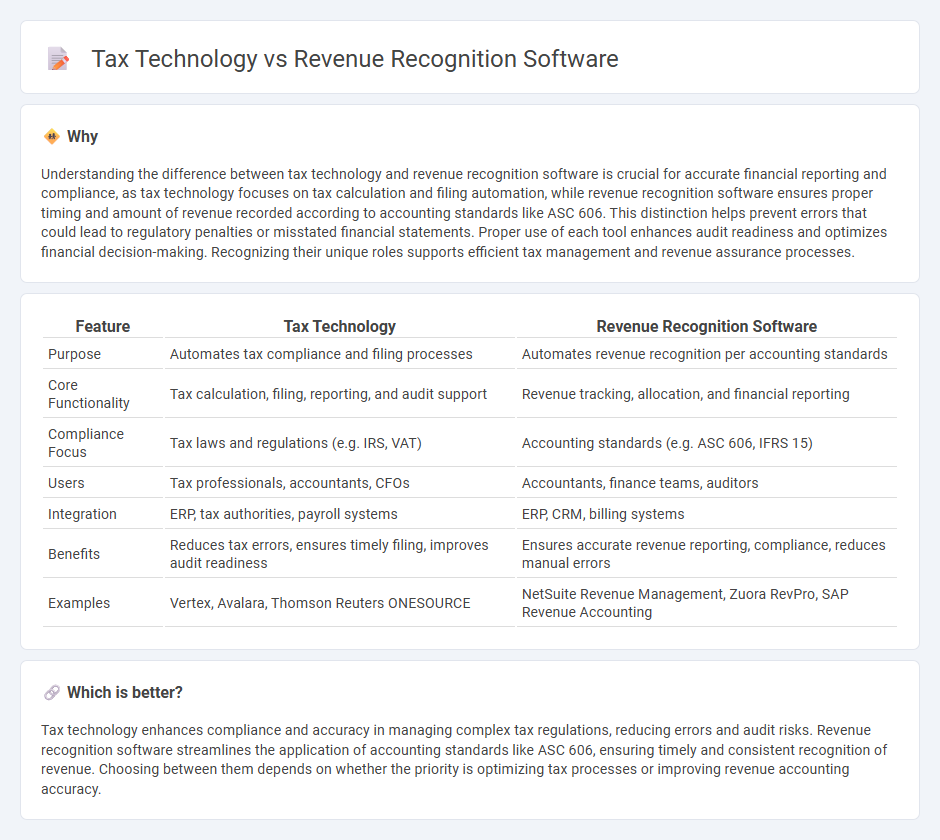

Understanding the difference between tax technology and revenue recognition software is crucial for accurate financial reporting and compliance, as tax technology focuses on tax calculation and filing automation, while revenue recognition software ensures proper timing and amount of revenue recorded according to accounting standards like ASC 606. This distinction helps prevent errors that could lead to regulatory penalties or misstated financial statements. Proper use of each tool enhances audit readiness and optimizes financial decision-making. Recognizing their unique roles supports efficient tax management and revenue assurance processes.

Comparison Table

| Feature | Tax Technology | Revenue Recognition Software |

|---|---|---|

| Purpose | Automates tax compliance and filing processes | Automates revenue recognition per accounting standards |

| Core Functionality | Tax calculation, filing, reporting, and audit support | Revenue tracking, allocation, and financial reporting |

| Compliance Focus | Tax laws and regulations (e.g. IRS, VAT) | Accounting standards (e.g. ASC 606, IFRS 15) |

| Users | Tax professionals, accountants, CFOs | Accountants, finance teams, auditors |

| Integration | ERP, tax authorities, payroll systems | ERP, CRM, billing systems |

| Benefits | Reduces tax errors, ensures timely filing, improves audit readiness | Ensures accurate revenue reporting, compliance, reduces manual errors |

| Examples | Vertex, Avalara, Thomson Reuters ONESOURCE | NetSuite Revenue Management, Zuora RevPro, SAP Revenue Accounting |

Which is better?

Tax technology enhances compliance and accuracy in managing complex tax regulations, reducing errors and audit risks. Revenue recognition software streamlines the application of accounting standards like ASC 606, ensuring timely and consistent recognition of revenue. Choosing between them depends on whether the priority is optimizing tax processes or improving revenue accounting accuracy.

Connection

Tax technology and revenue recognition software are interconnected through their roles in automating financial compliance and reporting processes. Revenue recognition software ensures accurate timing and measurement of income, which directly affects tax calculations and liabilities managed by tax technology systems. Integrating these tools enhances accuracy in financial statements, streamlines audit trails, and ensures adherence to accounting standards like ASC 606 and IFRS 15.

Key Terms

ASC 606 (Revenue Recognition Standard)

Revenue recognition software automates the application of ASC 606 by accurately identifying contract obligations, allocating transaction prices, and ensuring compliance with revenue recognition principles. Tax technology focuses on automating tax calculations, reporting, and compliance but does not specifically address ASC 606's revenue recognition intricacies. Explore our detailed comparison to understand which solution best fits your organization's ASC 606 compliance needs.

Deferred Revenue

Revenue recognition software automates the process of accurately recording deferred revenue in compliance with accounting standards such as ASC 606 and IFRS 15, ensuring timely and precise financial reporting. Tax technology, on the other hand, focuses on managing the tax implications of deferred revenue, optimizing tax liabilities, and ensuring regulatory compliance across jurisdictions. Explore how integrating both solutions can streamline your financial operations and enhance accuracy in revenue and tax management.

Tax Compliance Automation

Tax compliance automation streamlines the accurate calculation and submission of tax liabilities, reducing errors and ensuring adherence to regulatory requirements. While revenue recognition software focuses on proper accounting for income based on standards like ASC 606 or IFRS 15, tax technology targets the end-to-end management of tax processes including filing, reporting, and audits. Explore how integrating dedicated tax compliance automation tools can enhance your organization's efficiency and minimize risks.

Source and External Links

Top 6 Revenue Recognition Software - This article discusses various revenue recognition software options including Synder RevRec, NetSuite, Sage Intacct, Workday Financial Management, SAP Revenue Accounting and Reporting, and Zuora Revenue.

11 Best Revenue Recognition Software Solutions in 2025 - This resource provides an overview of the top revenue recognition software solutions, including Younium, NetSuite, Sage Intacct, SAP, Salesforce Revenue Cloud, and others.

Leading Revenue Recognition Software: ASC 606 & IFRS 15 - Zuora - Zuora offers a fully automated revenue recognition solution designed for subscription-based businesses, supporting complex revenue streams and compliance with accounting standards.

dowidth.com

dowidth.com