Supply chain finance enhances cash flow by optimizing payment terms between buyers and suppliers, often leveraging technology platforms for real-time financing solutions. Receivables securitization involves pooling accounts receivable and selling them to investors to improve liquidity and reduce credit risk. Explore the key differences and benefits of these financial strategies to optimize your business operations.

Why it is important

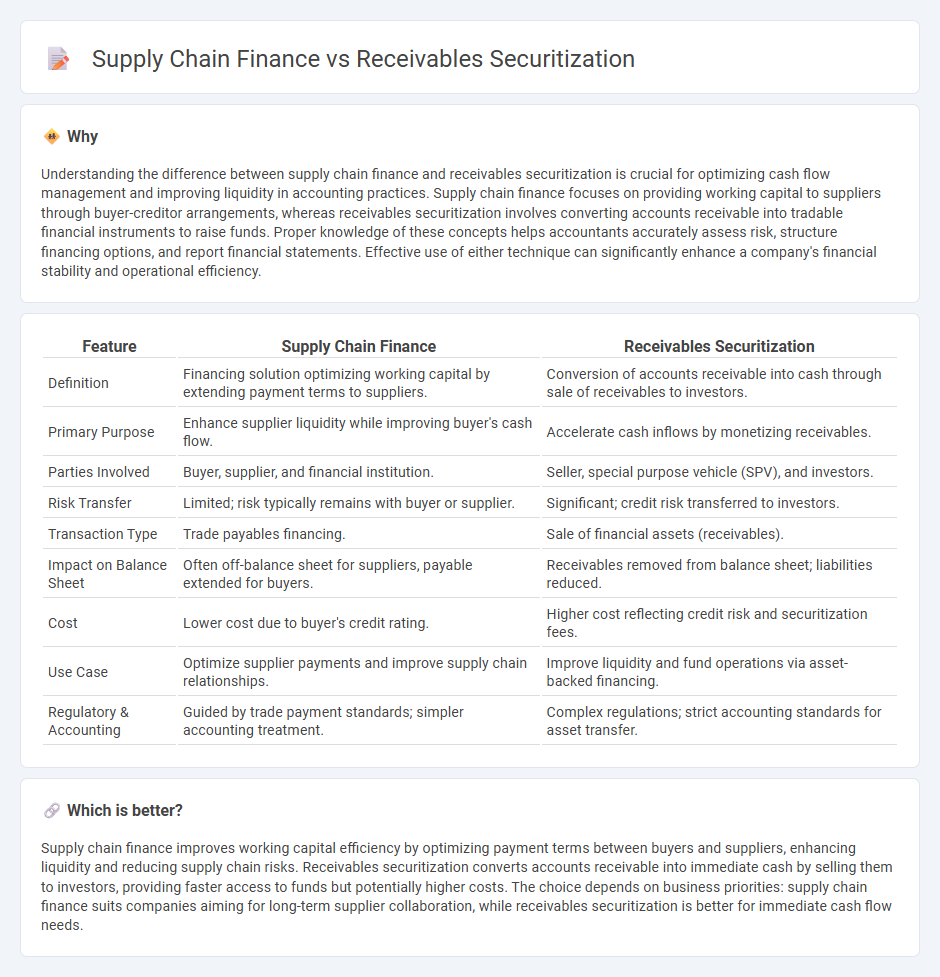

Understanding the difference between supply chain finance and receivables securitization is crucial for optimizing cash flow management and improving liquidity in accounting practices. Supply chain finance focuses on providing working capital to suppliers through buyer-creditor arrangements, whereas receivables securitization involves converting accounts receivable into tradable financial instruments to raise funds. Proper knowledge of these concepts helps accountants accurately assess risk, structure financing options, and report financial statements. Effective use of either technique can significantly enhance a company's financial stability and operational efficiency.

Comparison Table

| Feature | Supply Chain Finance | Receivables Securitization |

|---|---|---|

| Definition | Financing solution optimizing working capital by extending payment terms to suppliers. | Conversion of accounts receivable into cash through sale of receivables to investors. |

| Primary Purpose | Enhance supplier liquidity while improving buyer's cash flow. | Accelerate cash inflows by monetizing receivables. |

| Parties Involved | Buyer, supplier, and financial institution. | Seller, special purpose vehicle (SPV), and investors. |

| Risk Transfer | Limited; risk typically remains with buyer or supplier. | Significant; credit risk transferred to investors. |

| Transaction Type | Trade payables financing. | Sale of financial assets (receivables). |

| Impact on Balance Sheet | Often off-balance sheet for suppliers, payable extended for buyers. | Receivables removed from balance sheet; liabilities reduced. |

| Cost | Lower cost due to buyer's credit rating. | Higher cost reflecting credit risk and securitization fees. |

| Use Case | Optimize supplier payments and improve supply chain relationships. | Improve liquidity and fund operations via asset-backed financing. |

| Regulatory & Accounting | Guided by trade payment standards; simpler accounting treatment. | Complex regulations; strict accounting standards for asset transfer. |

Which is better?

Supply chain finance improves working capital efficiency by optimizing payment terms between buyers and suppliers, enhancing liquidity and reducing supply chain risks. Receivables securitization converts accounts receivable into immediate cash by selling them to investors, providing faster access to funds but potentially higher costs. The choice depends on business priorities: supply chain finance suits companies aiming for long-term supplier collaboration, while receivables securitization is better for immediate cash flow needs.

Connection

Supply chain finance enhances liquidity by allowing businesses to optimize working capital through early payment options based on approved invoices, which closely ties to receivables securitization where these invoices are bundled and sold as securities to investors. This connection facilitates improved cash flow management and risk distribution, enabling companies to access lower-cost financing by leveraging their accounts receivable assets. Both mechanisms rely on the valuation and quality of receivables, making their integration critical for efficient financial operations within supply chains.

Key Terms

Asset-backed Securities

Receivables securitization involves pooling receivables to create asset-backed securities (ABS) that investors can purchase, providing companies with upfront capital and risk transfer. Supply chain finance optimizes working capital by enabling suppliers to receive early payments based on buyer credit, without converting receivables into tradable securities. Explore how asset-backed securities differentiate these financing methods and impact corporate liquidity solutions.

Factoring

Receivables securitization and supply chain finance are vital tools in enhancing liquidity through different mechanisms, with factoring playing a central role in supply chain finance by allowing businesses to sell their invoices to third parties at a discount. Factoring improves cash flow by converting accounts receivable into immediate working capital, unlike receivables securitization that pools and sells future receivables as securities to investors. Explore the detailed benefits of factoring within supply chain finance to optimize your company's financial strategy.

Reverse Factoring

Receivables securitization involves converting accounts receivable into tradeable securities to improve liquidity and access capital, while supply chain finance, particularly reverse factoring, allows suppliers to receive early payments through a financial intermediary based on the buyer's credit profile. Reverse factoring enhances cash flow for suppliers by accelerating payment cycles without impacting the buyer's balance sheet, commonly used in industries with extensive supplier networks. Explore the benefits and implementation strategies of reverse factoring to optimize supply chain finance solutions.

Source and External Links

Accounts Receivable Securitization - It is a financial process where a company creates a special purpose entity (SPE) to transfer and pool accounts receivable, then sells securities backed by these receivables to investors, providing immediate cash and potentially lower interest rates for large organizations.

What is an Accounts Receivable Securitization? - This financing technique converts outstanding invoices into marketable securities through a special purpose vehicle (SPV), allowing the company to improve cash flow by quickly raising funds from investors who receive payment from customers' invoice payments.

Receivables Securitization and Capital Structure - Receivables securitization packages trade receivables into asset-backed securities that provide liquidity and reduce financial risk by diversifying funding sources and lowering volatility in funding costs, though it may reduce available credit from traditional credit facilities.

dowidth.com

dowidth.com