Fractional CFOs provide part-time, strategic financial leadership tailored to a company's specific needs, often integrating deeply with internal teams. Outsourced CFOs offer external, on-demand financial management services that focus on oversight and compliance without becoming embedded in daily operations. Explore the key differences and benefits of each to determine the optimal financial solution for your business.

Why it is important

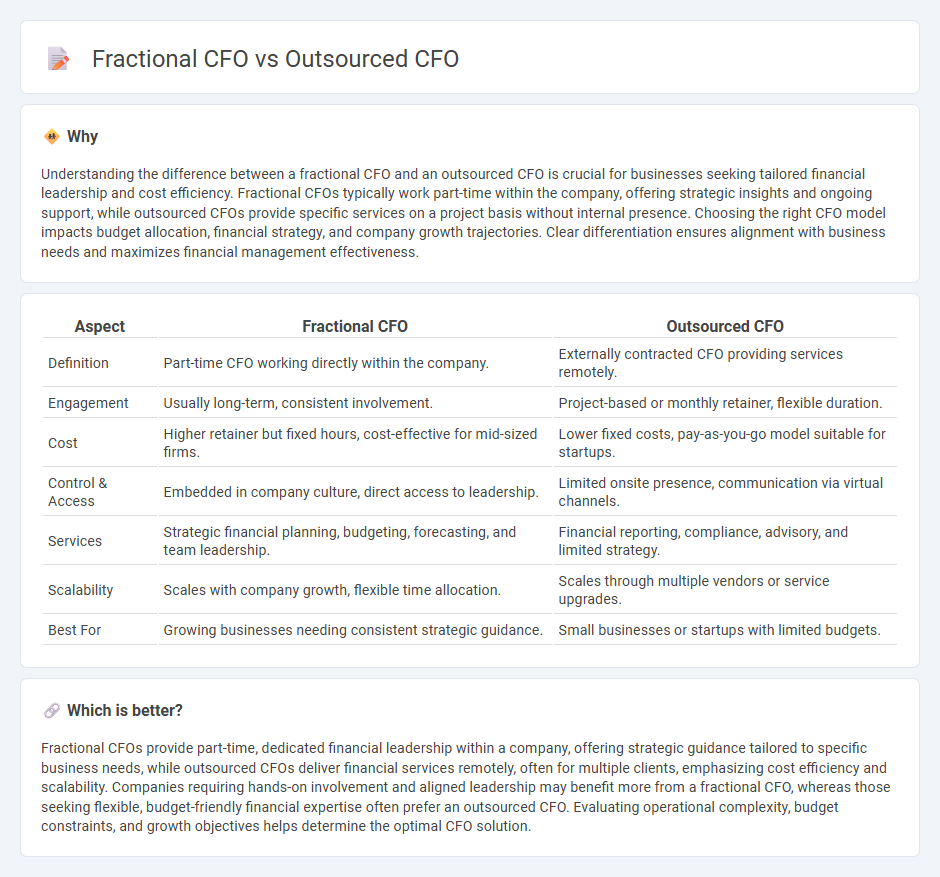

Understanding the difference between a fractional CFO and an outsourced CFO is crucial for businesses seeking tailored financial leadership and cost efficiency. Fractional CFOs typically work part-time within the company, offering strategic insights and ongoing support, while outsourced CFOs provide specific services on a project basis without internal presence. Choosing the right CFO model impacts budget allocation, financial strategy, and company growth trajectories. Clear differentiation ensures alignment with business needs and maximizes financial management effectiveness.

Comparison Table

| Aspect | Fractional CFO | Outsourced CFO |

|---|---|---|

| Definition | Part-time CFO working directly within the company. | Externally contracted CFO providing services remotely. |

| Engagement | Usually long-term, consistent involvement. | Project-based or monthly retainer, flexible duration. |

| Cost | Higher retainer but fixed hours, cost-effective for mid-sized firms. | Lower fixed costs, pay-as-you-go model suitable for startups. |

| Control & Access | Embedded in company culture, direct access to leadership. | Limited onsite presence, communication via virtual channels. |

| Services | Strategic financial planning, budgeting, forecasting, and team leadership. | Financial reporting, compliance, advisory, and limited strategy. |

| Scalability | Scales with company growth, flexible time allocation. | Scales through multiple vendors or service upgrades. |

| Best For | Growing businesses needing consistent strategic guidance. | Small businesses or startups with limited budgets. |

Which is better?

Fractional CFOs provide part-time, dedicated financial leadership within a company, offering strategic guidance tailored to specific business needs, while outsourced CFOs deliver financial services remotely, often for multiple clients, emphasizing cost efficiency and scalability. Companies requiring hands-on involvement and aligned leadership may benefit more from a fractional CFO, whereas those seeking flexible, budget-friendly financial expertise often prefer an outsourced CFO. Evaluating operational complexity, budget constraints, and growth objectives helps determine the optimal CFO solution.

Connection

Fractional CFOs and outsourced CFOs both provide businesses with high-level financial expertise on a part-time or contract basis, offering cost-effective solutions compared to full-time CFOs. They help companies manage financial strategy, budgeting, and reporting, enabling scalable and flexible financial leadership. Many organizations leverage these roles to access specialized accounting skills without the long-term commitment of hiring permanent executives.

Key Terms

Scope of Services

An outsourced CFO typically provides comprehensive financial management services on a project or interim basis, including budgeting, forecasting, and strategic planning. A fractional CFO offers part-time executive-level financial expertise integrated into the company's leadership team, focusing on ongoing financial strategy and operations. Explore further to understand which CFO model aligns best with your business needs and budget.

Commitment Level

An outsourced CFO typically engages with a company on a project-by-project basis or for specific financial tasks, offering flexibility but limited long-term involvement. A fractional CFO provides ongoing, part-time CFO services with a higher commitment level, integrating more deeply into the company's strategic decision-making. Explore more insights on choosing the right CFO model to match your business needs.

Cost Structure

Outsourced CFO services typically involve a fixed monthly fee based on agreed-upon deliverables, offering predictable budgeting and access to a broad financial expertise pool. Fractional CFOs generally charge hourly or retainer fees, providing flexibility for businesses needing part-time, specialized financial leadership without the commitment of a full-time hire. Explore the cost implications and service models to determine which CFO arrangement best aligns with your company's growth strategy.

Source and External Links

Benefits of an Outsourced CFO - This article discusses how an outsourced CFO can provide cost-effective financial expertise to businesses, helping them focus on strategic growth without the burden of a full-time CFO salary.

What do Outsourced CFOs Do? - This resource outlines the common duties and tasks of outsourced CFOs, including financial strategy, forecasting, and addressing financial challenges such as cash flow issues or growth optimization.

What is an Outsourced CFO? - An outsourced CFO is a financial expert who provides high-level financial strategy and operational optimizations on a part-time or project basis, helping businesses manage financial challenges and achieve strategic goals.

dowidth.com

dowidth.com