Real-time expense recognition immediately records costs at the moment they incur, providing accurate and up-to-date financial statements. Deferred expense accounting postpones cost recognition until the associated benefit is realized, enhancing matching expenses with revenues over time. Explore the detailed advantages and applications of these accounting methods to optimize your financial management.

Why it is important

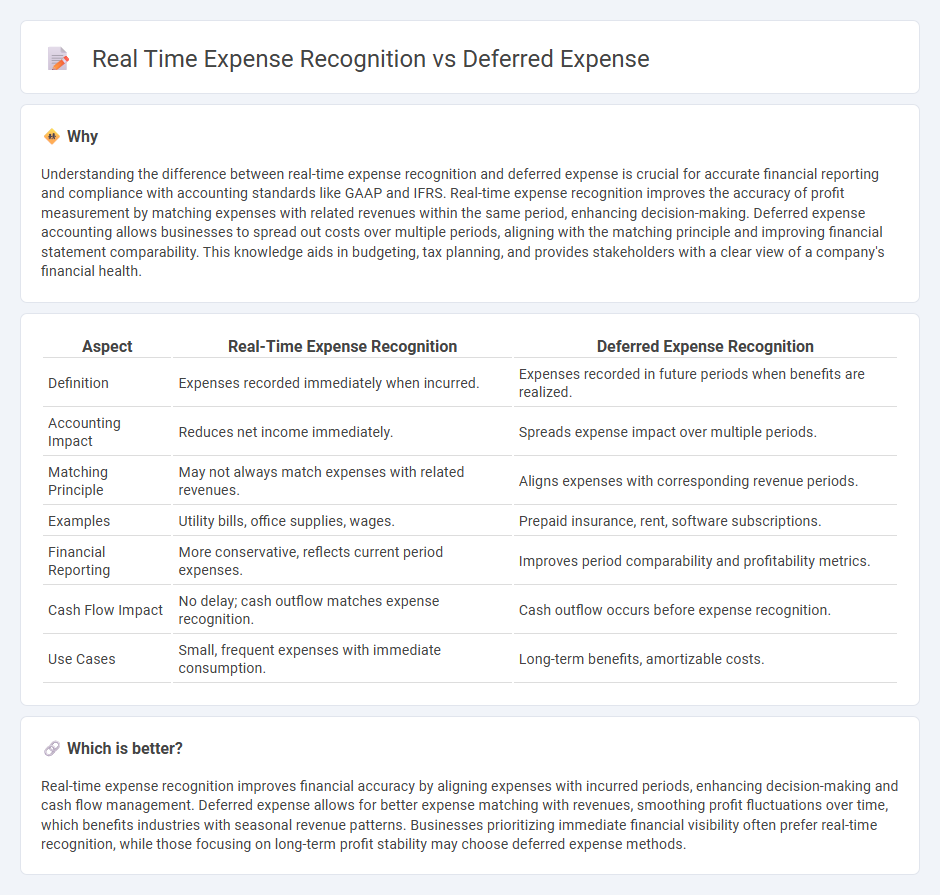

Understanding the difference between real-time expense recognition and deferred expense is crucial for accurate financial reporting and compliance with accounting standards like GAAP and IFRS. Real-time expense recognition improves the accuracy of profit measurement by matching expenses with related revenues within the same period, enhancing decision-making. Deferred expense accounting allows businesses to spread out costs over multiple periods, aligning with the matching principle and improving financial statement comparability. This knowledge aids in budgeting, tax planning, and provides stakeholders with a clear view of a company's financial health.

Comparison Table

| Aspect | Real-Time Expense Recognition | Deferred Expense Recognition |

|---|---|---|

| Definition | Expenses recorded immediately when incurred. | Expenses recorded in future periods when benefits are realized. |

| Accounting Impact | Reduces net income immediately. | Spreads expense impact over multiple periods. |

| Matching Principle | May not always match expenses with related revenues. | Aligns expenses with corresponding revenue periods. |

| Examples | Utility bills, office supplies, wages. | Prepaid insurance, rent, software subscriptions. |

| Financial Reporting | More conservative, reflects current period expenses. | Improves period comparability and profitability metrics. |

| Cash Flow Impact | No delay; cash outflow matches expense recognition. | Cash outflow occurs before expense recognition. |

| Use Cases | Small, frequent expenses with immediate consumption. | Long-term benefits, amortizable costs. |

Which is better?

Real-time expense recognition improves financial accuracy by aligning expenses with incurred periods, enhancing decision-making and cash flow management. Deferred expense allows for better expense matching with revenues, smoothing profit fluctuations over time, which benefits industries with seasonal revenue patterns. Businesses prioritizing immediate financial visibility often prefer real-time recognition, while those focusing on long-term profit stability may choose deferred expense methods.

Connection

Real-time expense recognition ensures accurate financial reporting by recording expenses as they occur, directly impacting cash flow management. Deferred expenses, recorded as assets initially, transition to expenses over time through systematic allocation methods like amortization. This connection helps maintain matching principles in accounting, aligning expenses with the corresponding revenue periods for precise profitability analysis.

Key Terms

Accrual Basis

Deferred expenses under the accrual basis accounting recognize costs by matching them with revenues in the period they benefit, ensuring accurate financial reporting over time. Real-time expense recognition records costs immediately when incurred, providing instant financial impact but potentially distorting long-term profitability. Explore further to understand how accrual accounting balances timing and accuracy in expense recognition.

Matching Principle

Deferred expenses align with the Matching Principle by recording costs as assets and recognizing them over the period they benefit, ensuring expenses match related revenues accurately. Real-time expense recognition records expenses immediately when incurred, which may cause mismatches between costs and revenues in the same accounting period. Explore detailed examples and accounting treatments to fully grasp the implications of both approaches.

Prepaid Expenses

Prepaid expenses involve payments made in advance for goods or services, leading to deferred expense recognition as costs are allocated over the appropriate accounting periods. Real-time expense recognition records costs immediately when incurred, providing a more accurate reflection of current financial activity but not applicable to prepaid scenarios. Explore how businesses balance deferred and real-time recognition to optimize financial reporting and cash flow insights.

Source and External Links

What is a deferred expense? | AccountingCoach - A deferred expense is a cost that has occurred but will be reported as an expense in future accounting periods, initially recorded as an asset on the balance sheet and then amortized systematically over the periods benefiting from the expense, such as prepaid insurance or bond issuance costs.

Accrual vs. Deferral in Accounting-What's the Difference? - Tipalti - Deferred expenses are payments made in advance for goods or services to be consumed in later periods, recorded initially as assets and expensed progressively over time as usage occurs, like prepaid property insurance.

Deferred Expense - Documentation for Frappe Apps - Deferred expenses are costs already incurred but not yet consumed, recorded as current assets on the balance sheet until the associated goods or services are used, at which point they are moved to expense, examples include prepaid rent, advanced insurance, and capitalized interest.

dowidth.com

dowidth.com