Real-time expense reconciliation provides immediate verification of transactions as they occur, enhancing accuracy and reducing financial discrepancies. Automated expense reconciliation leverages software algorithms to systematically match and validate expenses, improving efficiency and minimizing manual errors. Explore the key differences and benefits to determine the best solution for your accounting needs.

Why it is important

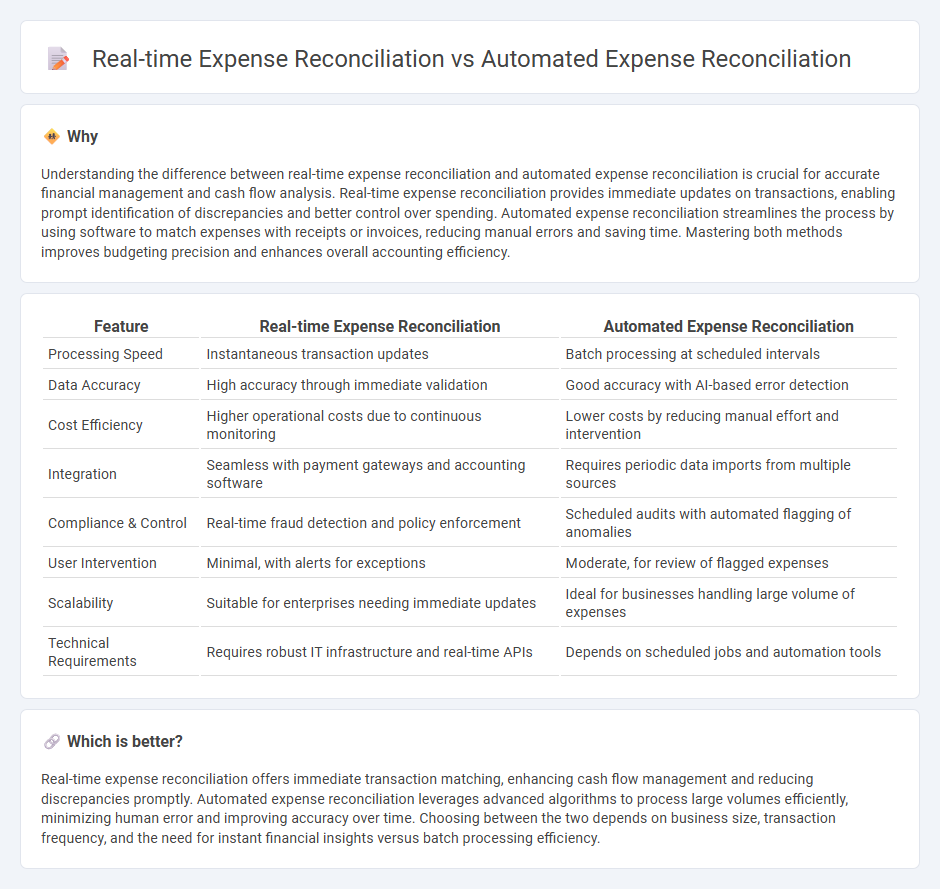

Understanding the difference between real-time expense reconciliation and automated expense reconciliation is crucial for accurate financial management and cash flow analysis. Real-time expense reconciliation provides immediate updates on transactions, enabling prompt identification of discrepancies and better control over spending. Automated expense reconciliation streamlines the process by using software to match expenses with receipts or invoices, reducing manual errors and saving time. Mastering both methods improves budgeting precision and enhances overall accounting efficiency.

Comparison Table

| Feature | Real-time Expense Reconciliation | Automated Expense Reconciliation |

|---|---|---|

| Processing Speed | Instantaneous transaction updates | Batch processing at scheduled intervals |

| Data Accuracy | High accuracy through immediate validation | Good accuracy with AI-based error detection |

| Cost Efficiency | Higher operational costs due to continuous monitoring | Lower costs by reducing manual effort and intervention |

| Integration | Seamless with payment gateways and accounting software | Requires periodic data imports from multiple sources |

| Compliance & Control | Real-time fraud detection and policy enforcement | Scheduled audits with automated flagging of anomalies |

| User Intervention | Minimal, with alerts for exceptions | Moderate, for review of flagged expenses |

| Scalability | Suitable for enterprises needing immediate updates | Ideal for businesses handling large volume of expenses |

| Technical Requirements | Requires robust IT infrastructure and real-time APIs | Depends on scheduled jobs and automation tools |

Which is better?

Real-time expense reconciliation offers immediate transaction matching, enhancing cash flow management and reducing discrepancies promptly. Automated expense reconciliation leverages advanced algorithms to process large volumes efficiently, minimizing human error and improving accuracy over time. Choosing between the two depends on business size, transaction frequency, and the need for instant financial insights versus batch processing efficiency.

Connection

Real-time expense reconciliation and automated expense reconciliation both streamline financial management by ensuring immediate matching of transactions with accounting records, reducing manual errors and enhancing accuracy. These processes utilize advanced software algorithms and artificial intelligence to continuously monitor and validate expenses, enabling businesses to maintain up-to-date financial statements. Integration of automated systems with real-time data feeds allows for faster detection of discrepancies, improving cash flow management and compliance with accounting standards.

Key Terms

Workflow Automation

Automated expense reconciliation streamlines the matching of transactions with receipts using pre-defined rules, reducing manual input and errors. Real-time expense reconciliation integrates continuous data processing and instant validation within workflow automation, enabling immediate identification of discrepancies and faster financial close cycles. Explore how these advanced automation workflows can transform your organization's financial accuracy and efficiency.

Data Synchronization

Automated expense reconciliation streamlines data synchronization by batch processing transactions at scheduled intervals, often leading to periodic updates and potential delays in reflecting current expenditure status. Real-time expense reconciliation leverages continuous data integration from multiple financial sources, ensuring up-to-the-minute accuracy in expense tracking and immediate identification of discrepancies. Explore the key differences in synchronization methods to optimize your financial management system effectively.

Accuracy

Automated expense reconciliation leverages algorithms to match transactions with expense reports, improving efficiency but occasionally encountering mismatches due to delayed data updates. Real-time expense reconciliation enhances accuracy by instantly validating expenses as they occur, reducing errors and enabling immediate issue resolution. Discover more about how these approaches impact financial accuracy and operational workflows.

Source and External Links

Ramp | Expense Reconciliation: How to Reconcile Expenses Faster - Ramp's automated platform streamlines expense reconciliation by syncing transactions directly into your accounting system, using OCR and AI-powered categorization to match receipts and categorize expenses instantly.

Yokoy | Expense Reconciliation: Enhancing Efficiency with Automation Software - Yokoy's AI-driven expense management solution automates the end-to-end reconciliation process, reducing errors and fraud while accelerating reimbursement cycles.

Coast | Expense Reconciliation: Best Practices, Common Pitfalls - Coast highlights how automation transforms expense reconciliation from a slow, manual task into a fast, accurate process by automatically categorizing transactions and collecting receipts in real time.

dowidth.com

dowidth.com