Embedded lease accounting integrates lease obligations directly into a company's financial statements, enhancing transparency and compliance with IFRS 16 and ASC 842 standards. Off-balance sheet lease accounting, often utilized to keep leases and related liabilities separate from the balance sheet, can obscure a company's true financial commitments and risk exposure. Explore the detailed differences and implications of these lease accounting methods to optimize your financial reporting strategy.

Why it is important

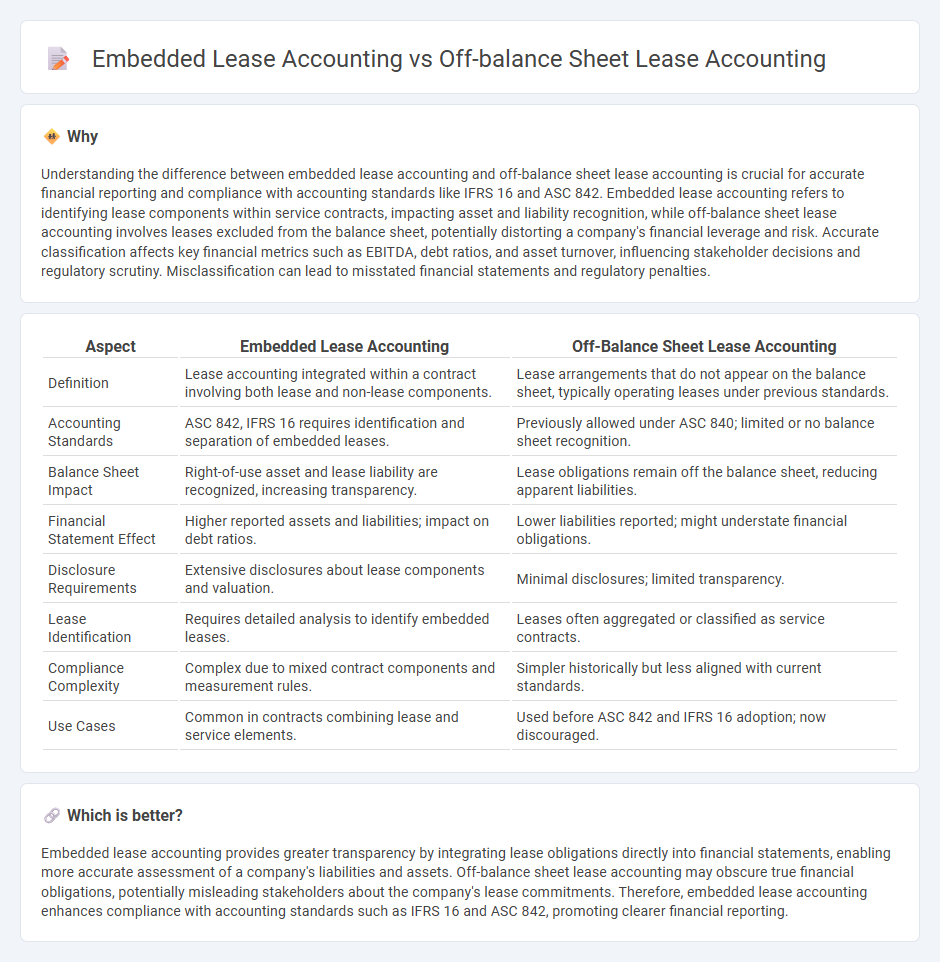

Understanding the difference between embedded lease accounting and off-balance sheet lease accounting is crucial for accurate financial reporting and compliance with accounting standards like IFRS 16 and ASC 842. Embedded lease accounting refers to identifying lease components within service contracts, impacting asset and liability recognition, while off-balance sheet lease accounting involves leases excluded from the balance sheet, potentially distorting a company's financial leverage and risk. Accurate classification affects key financial metrics such as EBITDA, debt ratios, and asset turnover, influencing stakeholder decisions and regulatory scrutiny. Misclassification can lead to misstated financial statements and regulatory penalties.

Comparison Table

| Aspect | Embedded Lease Accounting | Off-Balance Sheet Lease Accounting |

|---|---|---|

| Definition | Lease accounting integrated within a contract involving both lease and non-lease components. | Lease arrangements that do not appear on the balance sheet, typically operating leases under previous standards. |

| Accounting Standards | ASC 842, IFRS 16 requires identification and separation of embedded leases. | Previously allowed under ASC 840; limited or no balance sheet recognition. |

| Balance Sheet Impact | Right-of-use asset and lease liability are recognized, increasing transparency. | Lease obligations remain off the balance sheet, reducing apparent liabilities. |

| Financial Statement Effect | Higher reported assets and liabilities; impact on debt ratios. | Lower liabilities reported; might understate financial obligations. |

| Disclosure Requirements | Extensive disclosures about lease components and valuation. | Minimal disclosures; limited transparency. |

| Lease Identification | Requires detailed analysis to identify embedded leases. | Leases often aggregated or classified as service contracts. |

| Compliance Complexity | Complex due to mixed contract components and measurement rules. | Simpler historically but less aligned with current standards. |

| Use Cases | Common in contracts combining lease and service elements. | Used before ASC 842 and IFRS 16 adoption; now discouraged. |

Which is better?

Embedded lease accounting provides greater transparency by integrating lease obligations directly into financial statements, enabling more accurate assessment of a company's liabilities and assets. Off-balance sheet lease accounting may obscure true financial obligations, potentially misleading stakeholders about the company's lease commitments. Therefore, embedded lease accounting enhances compliance with accounting standards such as IFRS 16 and ASC 842, promoting clearer financial reporting.

Connection

Embedded lease accounting identifies lease components within larger service contracts, enabling accurate recognition of lease liabilities and right-of-use assets on the balance sheet. Off-balance sheet lease accounting occurs when leases are structured to avoid recognition, often through service agreements without explicit lease terms. The connection lies in embedded lease accounting's role in uncovering such hidden leases, ensuring compliance with accounting standards like IFRS 16 and ASC 842 and preventing off-balance sheet treatment.

Key Terms

Right-of-Use Asset

Off-balance sheet lease accounting excludes the Right-of-Use (ROU) asset and lease liabilities from the balance sheet, often used to keep debt ratios low, whereas embedded lease accounting requires recognition of the ROU asset and corresponding lease liability, enhancing transparency and compliance with IFRS 16 and ASC 842 standards. The ROU asset represents the lessee's right to use an underlying asset for the lease term, reflecting both lease payments and lease modifications in embedded leases. Explore how these approaches impact financial reporting and decision-making in lease management.

Lease Liability

Off-balance sheet lease accounting excludes lease liabilities from the balance sheet, keeping obligations hidden and potentially understating financial risk. Embedded lease accounting identifies lease components within service contracts, recognizing lease liabilities on the balance sheet and providing greater transparency. Discover more about how these accounting approaches impact lease liability reporting and financial analysis.

Embedded Lease Evaluation

Embedded lease accounting requires identification of lease components within a broader contract, emphasizing accurate evaluation to ensure compliance with IFRS 16 and ASC 842 standards, contrasting with off-balance sheet lease accounting that often omits such detailed recognition. The embedded lease evaluation process involves analyzing contract terms to distinguish lease and non-lease components, facilitating precise asset and liability recognition on the balance sheet. Explore our comprehensive guide on embedded lease evaluation to optimize lease accounting accuracy and regulatory adherence.

Source and External Links

Understanding Off-Balance Sheet Financing | Visual Lease - Off-balance sheet lease accounting historically allowed operating leases to be excluded from liabilities on balance sheets, but under ASC 842, both operating and finance leases must now be recorded on the balance sheet to improve transparency and financial reporting accuracy.

Ensure Compliance With the New Lease Accounting Standards - The new lease accounting standards require lessees to recognize a lease liability and a right-of-use asset on their balance sheet for leases over 12 months, substantially eliminating off-balance sheet reporting of operating leases while maintaining that these lease liabilities are not classified as debt.

OFF-BALANCE-SHEET FINANCING AND TRUSTS - Off-balance-sheet lease accounting can involve structures like synthetic leases or ground leases that allow companies to control assets while keeping obligations off the balance sheet, although regulatory changes have reduced the prevalence of such arrangements.

dowidth.com

dowidth.com