Cryptofinance reconciliation involves matching cryptocurrency transaction records with blockchain data to ensure accuracy and prevent discrepancies in digital asset balances. Customer reconciliation focuses on aligning customer account statements with internal financial records to verify payment accuracy and resolve any inconsistencies. Discover how mastering both reconciliation methods can enhance financial transparency and operational efficiency.

Why it is important

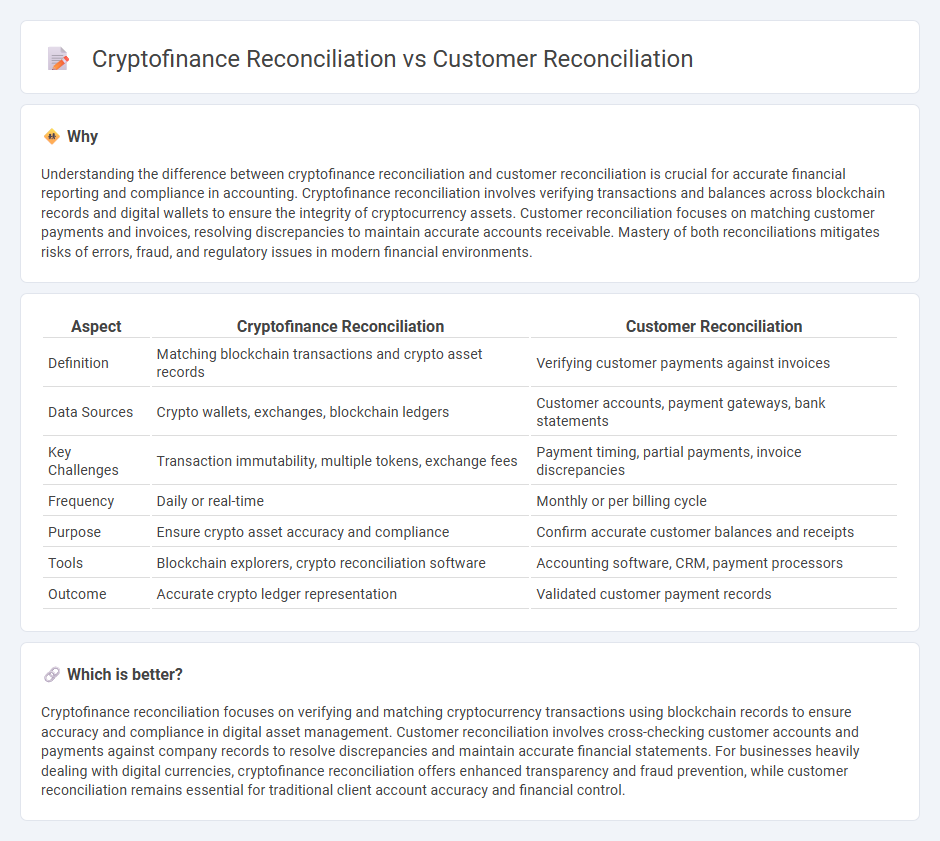

Understanding the difference between cryptofinance reconciliation and customer reconciliation is crucial for accurate financial reporting and compliance in accounting. Cryptofinance reconciliation involves verifying transactions and balances across blockchain records and digital wallets to ensure the integrity of cryptocurrency assets. Customer reconciliation focuses on matching customer payments and invoices, resolving discrepancies to maintain accurate accounts receivable. Mastery of both reconciliations mitigates risks of errors, fraud, and regulatory issues in modern financial environments.

Comparison Table

| Aspect | Cryptofinance Reconciliation | Customer Reconciliation |

|---|---|---|

| Definition | Matching blockchain transactions and crypto asset records | Verifying customer payments against invoices |

| Data Sources | Crypto wallets, exchanges, blockchain ledgers | Customer accounts, payment gateways, bank statements |

| Key Challenges | Transaction immutability, multiple tokens, exchange fees | Payment timing, partial payments, invoice discrepancies |

| Frequency | Daily or real-time | Monthly or per billing cycle |

| Purpose | Ensure crypto asset accuracy and compliance | Confirm accurate customer balances and receipts |

| Tools | Blockchain explorers, crypto reconciliation software | Accounting software, CRM, payment processors |

| Outcome | Accurate crypto ledger representation | Validated customer payment records |

Which is better?

Cryptofinance reconciliation focuses on verifying and matching cryptocurrency transactions using blockchain records to ensure accuracy and compliance in digital asset management. Customer reconciliation involves cross-checking customer accounts and payments against company records to resolve discrepancies and maintain accurate financial statements. For businesses heavily dealing with digital currencies, cryptofinance reconciliation offers enhanced transparency and fraud prevention, while customer reconciliation remains essential for traditional client account accuracy and financial control.

Connection

Cryptofinance reconciliation and customer reconciliation are interconnected processes essential for accurate financial management in accounting, ensuring consistency between cryptocurrency transactions and customer account records. Both reconciliations involve verifying transaction details, matching ledger entries, and resolving discrepancies to maintain accurate financial statements and customer balances. Integrating cryptofinance reconciliation with customer reconciliation improves transparency and reduces errors in financial reporting and customer billing.

Key Terms

Accounts Receivable (Customer reconciliation)

Customer reconciliation in Accounts Receivable ensures accurate matching of customer payments with outstanding invoices, reducing errors and improving cash flow management. Cryptofinance reconciliation involves verifying transactions recorded on blockchain networks against internal records, addressing challenges like decentralized ledgers and volatile asset values. Explore further to understand how these reconciliation processes optimize financial accuracy in traditional and digital asset environments.

Wallet Balances (Cryptofinance reconciliation)

Customer reconciliation involves verifying and matching customer transactions and account balances to ensure accuracy in traditional financial records. Cryptofinance reconciliation specifically focuses on wallet balances, tracking cryptocurrency transactions and ensuring that digital asset holdings align with blockchain records. Explore more to understand how advanced tools streamline wallet balance verification in cryptofinance reconciliation.

Transaction Matching

Customer reconciliation involves matching payment transactions with customer accounts to ensure accurate balances and identify discrepancies in invoicing or payments. Cryptofinance reconciliation requires specialized transaction matching processes due to the complexity of blockchain records, multiple wallets, and fluctuating asset values. Explore further to understand advanced techniques in transaction matching for enhanced accuracy across financial ecosystems.

Source and External Links

What Is Account Reconciliation - Datarails - Customer reconciliation involves comparing invoices sent to customers with the accounts receivable ledger to spot discrepancies and is usually done at month-end as part of financial closing.

Step by Step Process for Reconciliation of Accounts Receivable - Customer reconciliation ensures the accuracy of accounts receivable by gathering documents, cross-checking invoices and payments, and investigating any mismatches to maintain financial integrity and cash flow.

What is Account Reconciliation? Meaning and Steps | Versapay - Customer reconciliation compares outstanding customer balances to the general ledger accounts receivable to identify any irregularities before monthly financial reporting.

dowidth.com

dowidth.com