Blockchain bookkeeping offers a decentralized and tamper-resistant ledger that enhances transparency and security compared to traditional double-entry bookkeeping, which relies on centralized record-keeping and reconciliation processes. Double-entry bookkeeping remains a widely accepted accounting method, ensuring accuracy through balanced debits and credits in financial statements. Explore the differences and benefits of both systems to understand their impact on modern accounting practices.

Why it is important

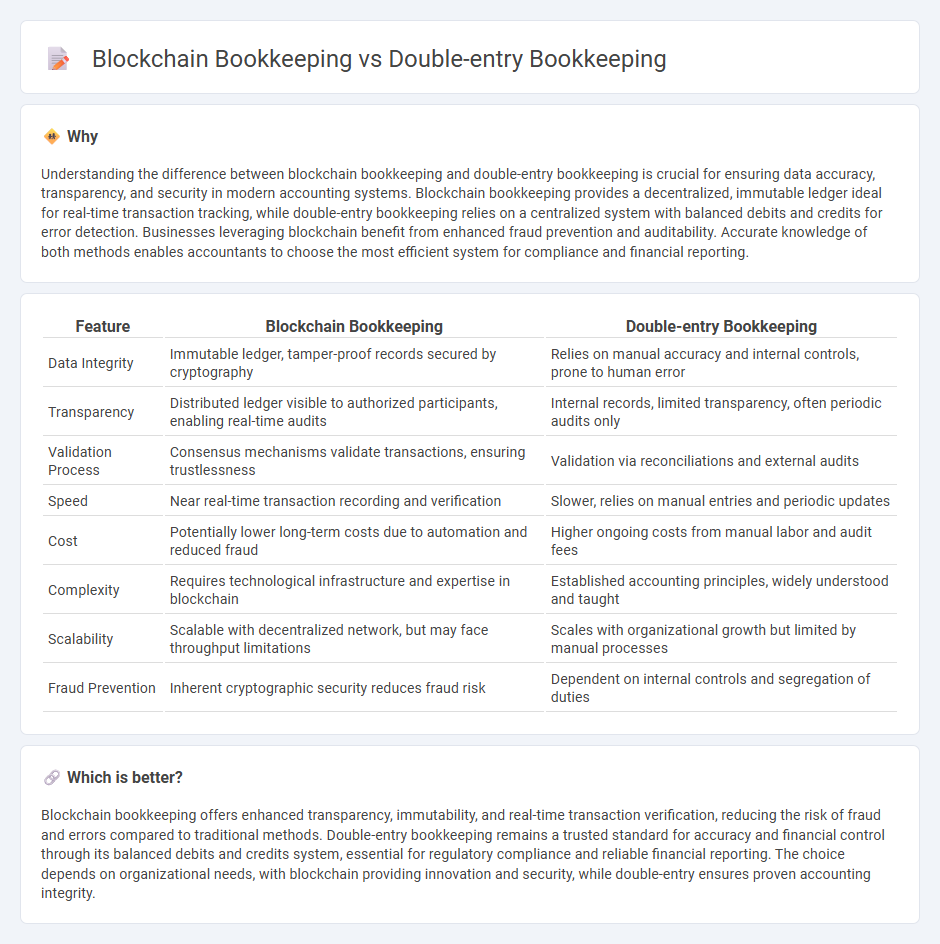

Understanding the difference between blockchain bookkeeping and double-entry bookkeeping is crucial for ensuring data accuracy, transparency, and security in modern accounting systems. Blockchain bookkeeping provides a decentralized, immutable ledger ideal for real-time transaction tracking, while double-entry bookkeeping relies on a centralized system with balanced debits and credits for error detection. Businesses leveraging blockchain benefit from enhanced fraud prevention and auditability. Accurate knowledge of both methods enables accountants to choose the most efficient system for compliance and financial reporting.

Comparison Table

| Feature | Blockchain Bookkeeping | Double-entry Bookkeeping |

|---|---|---|

| Data Integrity | Immutable ledger, tamper-proof records secured by cryptography | Relies on manual accuracy and internal controls, prone to human error |

| Transparency | Distributed ledger visible to authorized participants, enabling real-time audits | Internal records, limited transparency, often periodic audits only |

| Validation Process | Consensus mechanisms validate transactions, ensuring trustlessness | Validation via reconciliations and external audits |

| Speed | Near real-time transaction recording and verification | Slower, relies on manual entries and periodic updates |

| Cost | Potentially lower long-term costs due to automation and reduced fraud | Higher ongoing costs from manual labor and audit fees |

| Complexity | Requires technological infrastructure and expertise in blockchain | Established accounting principles, widely understood and taught |

| Scalability | Scalable with decentralized network, but may face throughput limitations | Scales with organizational growth but limited by manual processes |

| Fraud Prevention | Inherent cryptographic security reduces fraud risk | Dependent on internal controls and segregation of duties |

Which is better?

Blockchain bookkeeping offers enhanced transparency, immutability, and real-time transaction verification, reducing the risk of fraud and errors compared to traditional methods. Double-entry bookkeeping remains a trusted standard for accuracy and financial control through its balanced debits and credits system, essential for regulatory compliance and reliable financial reporting. The choice depends on organizational needs, with blockchain providing innovation and security, while double-entry ensures proven accounting integrity.

Connection

Blockchain bookkeeping enhances traditional double-entry bookkeeping by creating an immutable, decentralized ledger that records every transaction with cryptographic verification. This integration ensures accuracy, transparency, and real-time auditability of financial records, reducing errors and fraud risk. Accounting systems leveraging blockchain benefit from the secure, automated reconciliation of debit and credit entries inherent in double-entry bookkeeping principles.

Key Terms

Ledger

Double-entry bookkeeping records financial transactions through balanced debits and credits, ensuring accuracy within a centralized ledger managed by accountants. Blockchain bookkeeping employs a decentralized ledger where transactions are securely recorded across multiple nodes, enhancing transparency and reducing fraud risk. Discover how these distinct ledger systems impact financial management and data integrity.

Transaction

Double-entry bookkeeping records each transaction as equal debits and credits across two accounts, ensuring balanced financial statements and error detection. Blockchain bookkeeping stores transactions as immutable, time-stamped blocks linked cryptographically, providing enhanced transparency and security through decentralization. Explore the differences in transaction handling to understand how these systems impact accuracy and trust.

Immutability

Double-entry bookkeeping ensures accuracy and error prevention by recording each transaction in two accounts, yet it relies on centralized control, making data susceptible to tampering. Blockchain bookkeeping offers unparalleled immutability through decentralized ledger technology, where transactions are cryptographically secured and transparently verified by multiple participants. Explore the detailed mechanisms behind blockchain's immutable records and their impact on financial integrity.

Source and External Links

The Basics of Double-Entry Bookkeeping - Explains how double-entry bookkeeping works by recording transactions twice, using debits and credits, to ensure balance in accounts.

Double Entry - Overview, History, How It Works, Example - Provides an overview of double-entry bookkeeping, its history, and how it maintains balance through debits and credits in financial transactions.

What Is Double-Entry Bookkeeping? A Simple Guide for ... - Offers a simple guide on double-entry bookkeeping, explaining its key components and how it applies to financial transactions in businesses.

dowidth.com

dowidth.com