Cryptofinance reconciliation involves verifying cryptocurrency transactions and balances to ensure accuracy within digital wallets and blockchain records, reflecting the volatile nature of crypto assets. Fixed asset reconciliation focuses on confirming the existence, condition, and accounting records of physical assets such as machinery or property, matching them with financial statements to prevent discrepancies. Explore the distinct processes and challenges of these reconciliations to enhance financial accuracy.

Why it is important

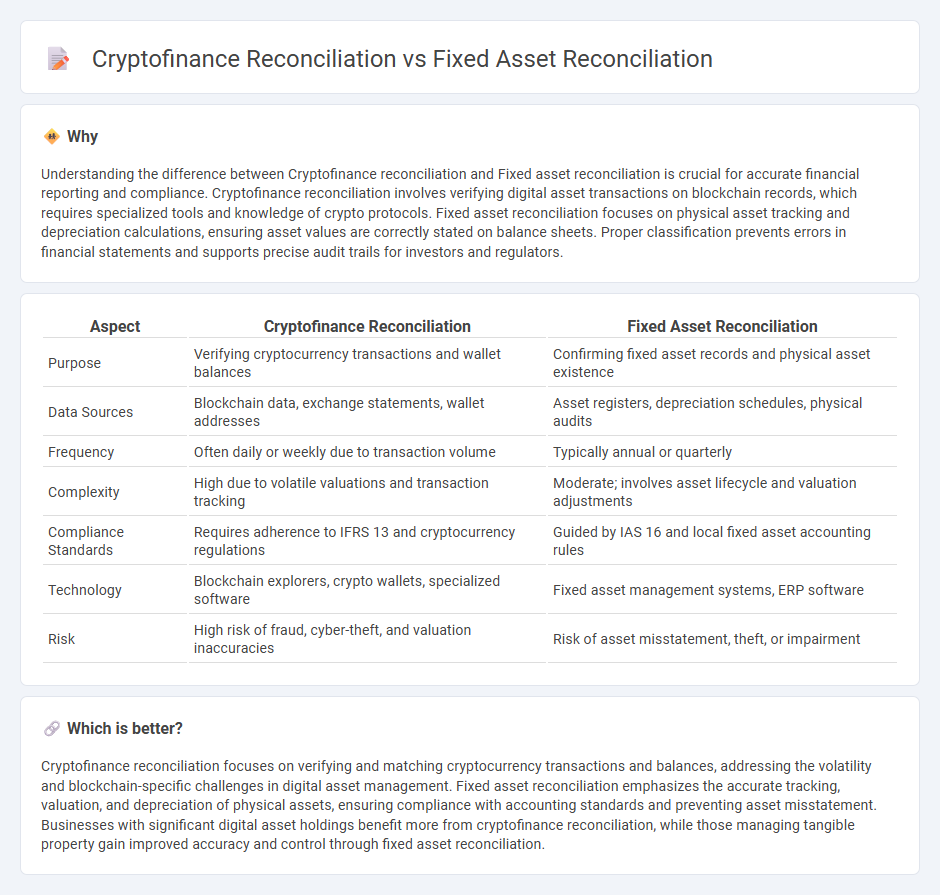

Understanding the difference between Cryptofinance reconciliation and Fixed asset reconciliation is crucial for accurate financial reporting and compliance. Cryptofinance reconciliation involves verifying digital asset transactions on blockchain records, which requires specialized tools and knowledge of crypto protocols. Fixed asset reconciliation focuses on physical asset tracking and depreciation calculations, ensuring asset values are correctly stated on balance sheets. Proper classification prevents errors in financial statements and supports precise audit trails for investors and regulators.

Comparison Table

| Aspect | Cryptofinance Reconciliation | Fixed Asset Reconciliation |

|---|---|---|

| Purpose | Verifying cryptocurrency transactions and wallet balances | Confirming fixed asset records and physical asset existence |

| Data Sources | Blockchain data, exchange statements, wallet addresses | Asset registers, depreciation schedules, physical audits |

| Frequency | Often daily or weekly due to transaction volume | Typically annual or quarterly |

| Complexity | High due to volatile valuations and transaction tracking | Moderate; involves asset lifecycle and valuation adjustments |

| Compliance Standards | Requires adherence to IFRS 13 and cryptocurrency regulations | Guided by IAS 16 and local fixed asset accounting rules |

| Technology | Blockchain explorers, crypto wallets, specialized software | Fixed asset management systems, ERP software |

| Risk | High risk of fraud, cyber-theft, and valuation inaccuracies | Risk of asset misstatement, theft, or impairment |

Which is better?

Cryptofinance reconciliation focuses on verifying and matching cryptocurrency transactions and balances, addressing the volatility and blockchain-specific challenges in digital asset management. Fixed asset reconciliation emphasizes the accurate tracking, valuation, and depreciation of physical assets, ensuring compliance with accounting standards and preventing asset misstatement. Businesses with significant digital asset holdings benefit more from cryptofinance reconciliation, while those managing tangible property gain improved accuracy and control through fixed asset reconciliation.

Connection

Cryptofinance reconciliation and fixed asset reconciliation are connected through their role in ensuring accurate financial records by verifying transactions and asset values. Both processes involve matching ledger entries with external data sources, such as blockchain records for cryptofinance and asset management systems for fixed assets. This connection improves financial transparency, reduces discrepancies, and supports regulatory compliance efforts in accounting.

Key Terms

Depreciation schedules

Fixed asset reconciliation involves matching asset records to physical inventories and verifying depreciation schedules to ensure accurate accounting of asset value over time. Cryptofinance reconciliation focuses on digital asset transactions, emphasizing accuracy in transaction histories and valuation without traditional depreciation methods. Explore detailed depreciation schedule management and its implications for both fixed assets and crypto assets to optimize reconciliation processes.

Blockchain verification

Fixed asset reconciliation centers on verifying book records against physical inventory, ensuring accurate asset valuation and prevention of financial discrepancies. Cryptofinance reconciliation employs blockchain verification to track and authenticate digital asset transactions in real-time, leveraging decentralized ledgers for enhanced transparency and fraud detection. Explore the detailed processes and benefits of blockchain-based reconciliation to optimize your financial accuracy.

Asset tagging

Fixed asset reconciliation requires precise asset tagging to track physical items such as machinery and equipment, ensuring accurate valuation and depreciation records. Cryptofinance reconciliation, on the other hand, relies on digital asset identification methods like blockchain addresses and transaction hashes to verify ownership and movement of cryptocurrencies. Explore detailed strategies and technologies behind effective asset tagging in both domains to enhance reconciliation accuracy.

Source and External Links

What is Fixed Asset Reconciliation? - SolveXia - Fixed asset reconciliation is the accounting process of verifying the accuracy and completeness of a company's fixed asset records by comparing the general ledger and fixed asset register, checking for consistency in cost and depreciation, identifying discrepancies, and making necessary adjustments.

How to reconcile fixed assets? - CPCON - To reconcile fixed assets, gather the general ledger and subsidiary ledger balances, compare them for discrepancies, analyze records for accuracy (including asset status and depreciation), make adjustments as needed, and prepare a reconciliation report documenting the process and results.

Fixed Asset Reconciliation: The Complete Guide - The process involves compiling all relevant documents (invoices, receipts, depreciation schedules), cross-referencing trial balances with fixed asset workpapers, ensuring proper amortization and depreciation, and verifying that all asset additions and disposals are accurately recorded.

dowidth.com

dowidth.com