Smart contracts accounting automates transaction recording through programmable blockchain agreements, enhancing transparency and reducing manual errors compared to traditional GAAP compliance methods. GAAP accounting relies on standardized principles to ensure financial statements accurately reflect an entity's financial position, emphasizing consistency and regulatory adherence. Explore how integrating smart contracts can transform GAAP compliance for more efficient and reliable financial reporting.

Why it is important

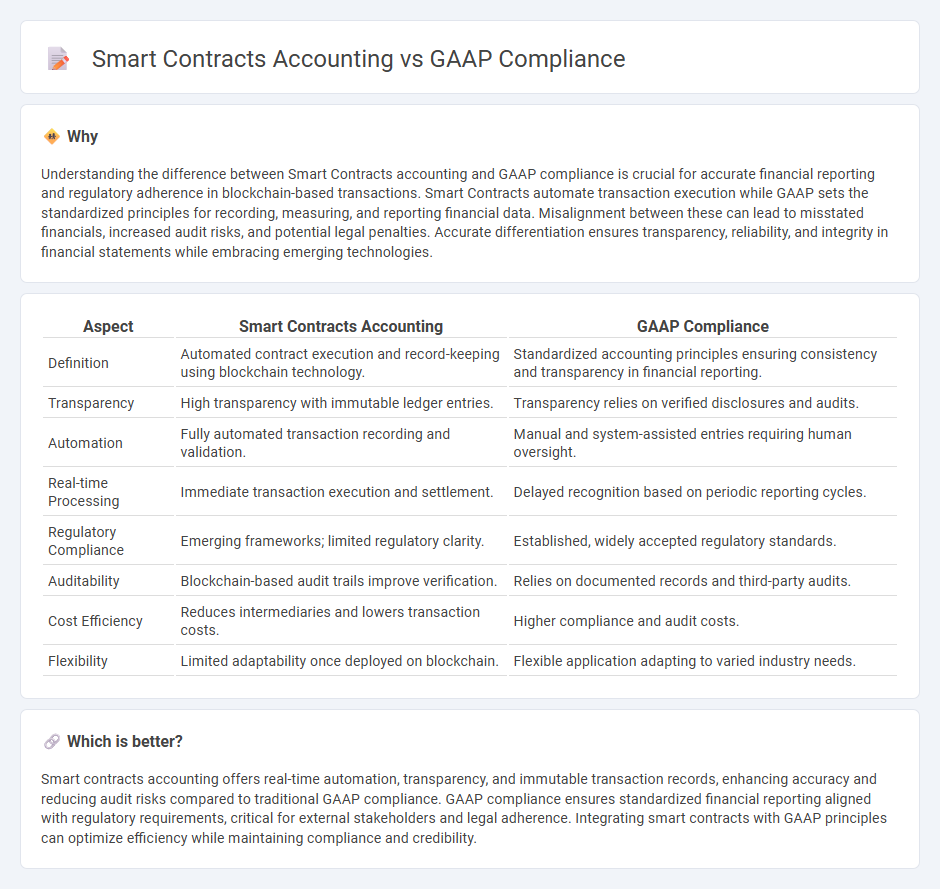

Understanding the difference between Smart Contracts accounting and GAAP compliance is crucial for accurate financial reporting and regulatory adherence in blockchain-based transactions. Smart Contracts automate transaction execution while GAAP sets the standardized principles for recording, measuring, and reporting financial data. Misalignment between these can lead to misstated financials, increased audit risks, and potential legal penalties. Accurate differentiation ensures transparency, reliability, and integrity in financial statements while embracing emerging technologies.

Comparison Table

| Aspect | Smart Contracts Accounting | GAAP Compliance |

|---|---|---|

| Definition | Automated contract execution and record-keeping using blockchain technology. | Standardized accounting principles ensuring consistency and transparency in financial reporting. |

| Transparency | High transparency with immutable ledger entries. | Transparency relies on verified disclosures and audits. |

| Automation | Fully automated transaction recording and validation. | Manual and system-assisted entries requiring human oversight. |

| Real-time Processing | Immediate transaction execution and settlement. | Delayed recognition based on periodic reporting cycles. |

| Regulatory Compliance | Emerging frameworks; limited regulatory clarity. | Established, widely accepted regulatory standards. |

| Auditability | Blockchain-based audit trails improve verification. | Relies on documented records and third-party audits. |

| Cost Efficiency | Reduces intermediaries and lowers transaction costs. | Higher compliance and audit costs. |

| Flexibility | Limited adaptability once deployed on blockchain. | Flexible application adapting to varied industry needs. |

Which is better?

Smart contracts accounting offers real-time automation, transparency, and immutable transaction records, enhancing accuracy and reducing audit risks compared to traditional GAAP compliance. GAAP compliance ensures standardized financial reporting aligned with regulatory requirements, critical for external stakeholders and legal adherence. Integrating smart contracts with GAAP principles can optimize efficiency while maintaining compliance and credibility.

Connection

Smart contracts automate financial transactions by embedding accounting rules directly into blockchain code, ensuring real-time accuracy and transparency in financial records. This automation supports GAAP compliance by enforcing standardized recognition, measurement, and disclosure principles embedded within contract logic. Integrating smart contracts with GAAP frameworks enhances auditability and reduces errors, bridging the gap between decentralized ledger technology and traditional accounting standards.

Key Terms

Standardization

GAAP compliance ensures standardized financial reporting through established principles and regulations that promote consistency and transparency across organizations. Smart contracts accounting leverages blockchain technology to automate and record transactions with real-time accuracy, yet it faces challenges in achieving universal standardization due to varying protocols and legal frameworks. Explore the evolving landscape of accounting standardization by delving deeper into GAAP and smart contract integration.

Automation

GAAP compliance requires rigorous documentation and manual reconciliation to ensure accuracy in financial reporting, often leading to time-consuming processes. Smart contracts accounting leverages blockchain technology to automate transaction validation and enforce contract terms through self-executing code, reducing errors and increasing efficiency. Explore how automation in smart contracts can transform traditional GAAP accounting practices.

Transparency

GAAP compliance requires standardized financial reporting to ensure transparency and comparability across organizations, emphasizing consistent recognition and disclosure of financial transactions. Smart contracts accounting leverages blockchain technology to provide real-time, immutable records, enhancing transparency by automating transaction verification and reducing the potential for human error or manipulation. Explore how integrating these systems can revolutionize transparent financial practices in your organization.

Source and External Links

What are Generally Accepted Accounting Principles (GAAP) - GAAP compliance ensures a company's financial statements are consistent, transparent, and comparable, with required adherence for public companies and strong recommendation for private companies, especially focusing on accurate revenue recognition, proper expense matching, and standardized financial statement formats.

Best Practices to Ensure Compliance with US GAAP - Ensuring GAAP compliance involves robust internal controls, documentation, segregation of duties, regular audits, and strict adherence to revenue recognition standards such as the ASC 606 5-Step Model, all to prevent fraud and provide audit-ready financial records.

GAAP Accounting Explained: Principles, Compliance - GAAP compliance means following FASB-maintained rules to produce financial statements that are accurate, reliable, and consistent, which is essential for building investor and creditor trust and is mandated for all publicly-traded companies in the US.

dowidth.com

dowidth.com